FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

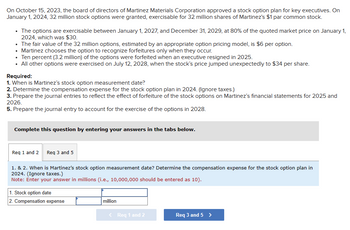

Transcribed Image Text:On October 15, 2023, the board of directors of Martinez Materials Corporation approved a stock option plan for key executives. On

January 1, 2024, 32 million stock options were granted, exercisable for 32 million shares of Martinez's $1 par common stock.

.

• The options are exercisable between January 1, 2027, and December 31, 2029, at 80% of the quoted market price on January 1,

2024, which was $30.

• The fair value of the 32 million options, estimated by an appropriate option pricing model, is $6 per option.

• Martinez chooses the option to recognize forfeitures only when they occur.

• Ten percent (3.2 million) of the options were forfeited when an executive resigned in 2025.

⚫ All other options were exercised on July 12, 2028, when the stock's price jumped unexpectedly to $34 per share.

Required:

1. When is Martinez's stock option measurement date?

2. Determine the compensation expense for the stock option plan in 2024. (Ignore taxes.)

3. Prepare the journal entries to reflect the effect of forfeiture of the stock options on Martinez's financial statements for 2025 and

2026.

5. Prepare the journal entry to account for the exercise of the options in 2028.

Complete this question by entering your answers in the tabs below.

Req 1 and 2 Req 3 and 5

1. & 2. When is Martinez's stock option measurement date? Determine the compensation expense for the stock option plan in

2024. (Ignore taxes.)

Note: Enter your answer in millions (i.e., 10,000,000 should be entered as 10).

1. Stock option date

2. Compensation expense

million

< Req 1 and 2

Req 3 and 5 >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Man of War Company adopted a stock-option plan on April 30, 2019, that provided that 500,000 shares of $10 par value stock be designated as available for the granting of options to officers of the corporation at a price of $26 a share. The market price was $20 a share on April 30, 2019.On January 2, 2020, options to purchase 40,000 shares were granted to president—15,000 for services to be rendered in 2020 and 25,000 for services to be rendered in 2021. Also on that date, options to purchase 26,000 shares were granted to chief financial officer—10,000 for services to be rendered in 2020 and 16,000 for services to be rendered in 2021. The market price of the stock was $23 a share on January 2, 2020. The options were exercisable for a period of one year following the year in which the services were rendered. The fair value of the options on the grant date was $3.20 per option. In 2021, neither the president nor the chief financial officer exercised their options because the market price…arrow_forwardAt December 31, 2019, Hemington Company had 320,000 shares of common stock outstanding. Hemington sold 80,000 shares on October 1, 2020. Net income for 2020 was $1,985,000; the income tax rate was 35%. In addition, Hemington had the following debt and equity securities on its books at December 31, 2019. (a) 30,000 shares of $100 par, 8% cumulative preferred stock (b) 25,000 shares of 10% convertible cumulative preferred stock, par $100, sold at 110. Each share of preferred stock is convertible into three shares of common stock. (c) $1,500,000 face value of 9% bonds sold at par. (d) $2,500,000 face value of 7% convertible bonds sold to yield 8%. Unamortized bond discount is $150,000 at December 31, 2019. Each $1,000 bond is convertible into 22 shares of common stock. Also, options to purchase 20,000 shares of common stock were issued May 1, 2020. Exercise price is $20 per share; market value at date of option was $19; average market value for the year (and for the period…arrow_forwardDuring 2020, Goodfellow has the following transactions involving its common and preferred stock: a. Issued 15,000 shares of $5 par common stock for $15 a share. This brings total shares outstanding to 50,000 shares and 100,000 shares are authorized. b. Issued 5,000 shares of $100 par, 6%, cumulative preferred stock for $121 per share. c. When the market value of the common stock reached $15 a share, Goodfellow declared a 3-for-1 stock split, reducing the par value to $1.67 per share. Required: Prepare a journal entry for each transaction, if required. For grading purposes record the entries on December 31. Prepare a journal entry for each transaction, if required. For grading purposes record the entries on December 31. General Journal Instructions PAGE 1 GENERAL JOURNAL DATE ACCOUNT TITLE POST. REF. DEBIT CREDIT 1 2 3 4 5…arrow_forward

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education