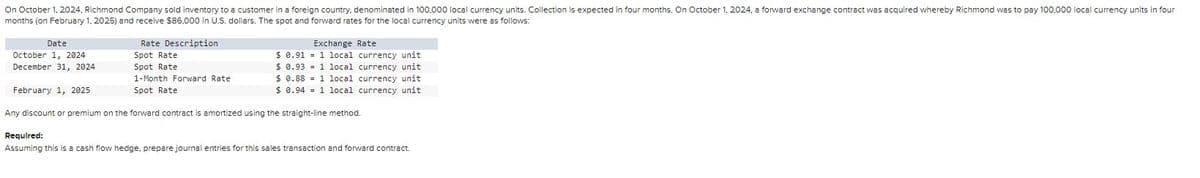

On October 1, 2024, Richmond Company sold inventory to a customer in a foreign country, denominated in 100,000 local currency units. Collection is expected in four months. On October 1, 2024, a forward exchange contract was acquired whereby Richmond was to pay 100,000 local currency units in four months (on February 1, 2025) and receive $86,000 in U.S. dollars. The spot and forward rates for the local currency units were as follows: Date Rate Description Exchange Rate October 1, 2024 Spot Rate $ 0.91 1 local currency unit December 31, 2024 Spot Rate $ 0.93 1 local currency unit February 1, 2025 1-Month Forward Rate Spot Rate $ 0.88 1 local currency unit $ 0.94 1 local currency unit Any discount or premium on the forward contract is amortized using the straight-line method. Required: Assuming this is a cash flow hedge, prepare journal entries for this sales transaction and forward contract.

On October 1, 2024, Richmond Company sold inventory to a customer in a foreign country, denominated in 100,000 local currency units. Collection is expected in four months. On October 1, 2024, a forward exchange contract was acquired whereby Richmond was to pay 100,000 local currency units in four months (on February 1, 2025) and receive $86,000 in U.S. dollars. The spot and forward rates for the local currency units were as follows: Date Rate Description Exchange Rate October 1, 2024 Spot Rate $ 0.91 1 local currency unit December 31, 2024 Spot Rate $ 0.93 1 local currency unit February 1, 2025 1-Month Forward Rate Spot Rate $ 0.88 1 local currency unit $ 0.94 1 local currency unit Any discount or premium on the forward contract is amortized using the straight-line method. Required: Assuming this is a cash flow hedge, prepare journal entries for this sales transaction and forward contract.

Chapter10: Measuring Exposure To Exchange Rate Fluctuations

Section: Chapter Questions

Problem 2ST

Related questions

Question

Transcribed Image Text:On October 1, 2024, Richmond Company sold inventory to a customer in a foreign country, denominated in 100,000 local currency units. Collection is expected in four months. On October 1, 2024, a forward exchange contract was acquired whereby Richmond was to pay 100,000 local currency units in four

months (on February 1, 2025) and receive $86,000 in U.S. dollars. The spot and forward rates for the local currency units were as follows:

Date

Rate Description

Exchange Rate

October 1, 2024

Spot Rate

$ 0.91

1 local currency unit

December 31, 2024

Spot Rate

$ 0.93

1 local currency unit

February 1, 2025

1-Month Forward Rate

Spot Rate

$ 0.88

1 local currency unit

$ 0.94

1 local currency unit

Any discount or premium on the forward contract is amortized using the straight-line method.

Required:

Assuming this is a cash flow hedge, prepare journal entries for this sales transaction and forward contract.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you