FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

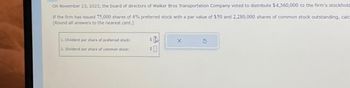

Transcribed Image Text:On November 23, 2023, the board of directors of Walker Bros Transportation Company voted to distribute $4,360,000 to the firm's stockhold

If the firm has issued 75,000 shares of 4% preferred stock with a par value of $50 and 2.280,000 shares of common stock outstanding, calc

(Round all answers to the nearest cent.)

1. Dividend per share of preferred stock:

2. Dividend per share of common stock:

SA

SO

X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- Queenstown Corporation issues 4,000, $4 cumulative preferred shares at $80 each and 12,000 common shares at $18 at the beginning of 2022. Each preferred share is convertible into four common shares. During the years 2022 and 2023, the following transactions affected Queenstown Corporation's shareholders' equity accounts: 2022 Dec. 10 Declared and paid $12,000 of annual dividends to preferred shareholders. 2023 Dec. 10 Dec. 21 Required: a) b) Declared and paid the annual dividend to preferred shareholders and a $4,000 dividend to common shareholders. The preferred shares were converted into common shares. Journalize each of the 2022 and 2023 transactions. After the preferred shares are converted, what is the total number of common shares issued?arrow_forwardOn December 31, 2023, Berclair Incorporated had 480 million shares of common stock and 3 million shares of 9%, $100 par value cumulative preferred stock issued and outstanding. . On March 1, 2024, Berclair purchased 24 million shares of its common stock as treasury stock. • Berclair issued a 5% common stock dividend on July 1, 2024. • Four million treasury shares were sold on October 1. • Net income for the year ended December 31, 2024, was $750 million. . The income tax rate is 25%. • Also outstanding at December 31 were incentive stock options granted to key executives on September 13, 2019. • The options are exercisable as of September 13, 2023, for 30 million common shares at an exercise price of $56 per share. . During 2024, the market price of the common shares averaged $70 per share. • In 2020, $50.0 million of 8% bonds, convertible into 6 million common shares, were issued at face value. Required: Compute Berclair's basic and diluted earnings per share for the year ended…arrow_forwardOn December 31, 2023, Berclair Incorporated had 280 million shares of common stock and 3 million shares of 9%, $100 par value cumulative preferred stock issued and outstanding. • On March 1, 2024, Berclair purchased 56 million shares of its common stock as treasury stock. ● ● Berclair issued a 5% common stock dividend on July 1, 2024. Four million treasury shares were sold on October 1. Net income for the year ended December 31, 2024, was $350 million. Also outstanding at December 31 were 30 million incentive stock options granted to key executives on September 13, 2019. • The options were exercisable as of September 13, 2023, for 30 million common shares at an exercise price of $56 per share. During 2024, the market price of the common shares averaged $70 per share. Required: Compute Berclair's basic and diluted earnings per share for the year ended December 31, 2024. (Shares for stock options and conversion of convertible securities have been adjusted for any stock split or stock…arrow_forward

- Marigold, Inc. has 10500 shares of 4%, $100 par value, noncumulative preferred stock and 105000 shares of $1 par value common stock outstanding at December 31, 2019, and December 31, 2020. The board of directors declared and paid a $49300 dividend in 2019. In 2020, $111000 of dividends are declared and paid, What are the dividends received by the preferred and common shareholders in 2020? Preferred Common $42000 $69000 $0 $111000 $79500 $31500 $55500 $55500 96 5 6 7 darrow_forwardNeed help with attached question, thanks.arrow_forwardWildhorse Appliance Company has 5100 shares of 6%, $50 par value, cumulative preferred stock and 102000 shares of $1 par value common stock outstanding at December 31, 2025, and December 31, 2024. The board of directors declared and paid a $13300 dividend in 2024. In 2025, a total of $60,000 in dividends are declared and paid. What are the dividends received by the preferred stockholders in 2025? O $15300. O $43900. O $30600. O $17300.arrow_forward

- On June 30, 2020, when ABC shares were selling for $ 65 each, the equity accounts had the following balances: Common shares (par value $ 50: 50,000 issued) $ 2,500,000 Capital contributed in excess of par value 600,000 Retained earnings 4,200,000 A 100% share dividend is declared and distributed, the balance of the Common Shares account after recording the dividend will be: a. $2,500,000 b. $7,300,000 c. $3,100,000 d. $5,000,000arrow_forwardOn December 31, 2023, Berclair Incorporated had 600 million shares of common stock and 17 million shares of 9%, $100 par value cumulative preferred stock issued and outstanding. • . On March 1, 2024, Berclair purchased 120 million shares of its common stock as treasury stock. Berclair issued a 6% common stock dividend on July 1, 2024. • Four million treasury shares were sold on October 1. • Net income for the year ended December 31, 2024, was $850 million. Also outstanding at December 31 were 72 million incentive stock options granted to key executives on September 13, 2019. The options were exercisable as of September 13, 2023, for 72 million common shares at an exercise price of $60 per share. During 2024, the market price of the common shares averaged $90 per share. The options were exercised on September 1, 2024. Required: Compute Berclair's basic and diluted earnings per share for the year ended December 31, 2024. (Shares for stock options and conversion of convertible securities…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education