FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

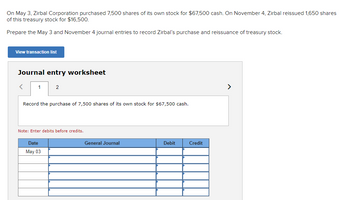

Transcribed Image Text:On May 3, Zirbal Corporation purchased 7,500 shares of its own stock for $67,500 cash. On November 4, Zirbal reissued 1,650 shares

of this treasury stock for $16,500.

Prepare the May 3 and November 4 journal entries to record Zirbal's purchase and reissuance of treasury stock.

View transaction list

Journal entry worksheet

1

2

Record the purchase of 7,500 shares of its own stock for $67,500 cash.

Note: Enter debits before credits.

Date

May 03

General Journal

Debit

Credit

<

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- On April 2 a corporation purchased for cash 6,000 shares of its own $13 par common stock at $27 a share. It sold 4,000 of the treasury shares at $30 a share on June 10. The remaining 2,000 shares were sold on November 10 for $23 a share. a. Journalize the entries to record the purchase (treasury stock is recorded at cost). If an amount box does not require an entry, leave it blank b. Journalize the entries to record the sale of the stock. If an amount box does not require an entry, leave it blank.arrow_forwardOn July 1, Pina Colada Corp. purchases 610 shares of its $5 par value common stock for the treasury at a cash price of $9 per share. On September 1, it sells 230 shares of the treasury stock for cash at $12 per share. Journalize the two treasury stock transactions.arrow_forwardOn April 2 a corporation purchased for cash 6,000 shares of its own $12 par common stock at $27 a share. It sold 4,000 of the treasury shares at $30 a share on June 10. The remaining 2,000 shares were sold on November 10 for $23 a share. a. Journalize the entries to record the purchase (treasury stock is recorded at cost). If an amount box does not require an entry, leave it blank Apr. 2 Treasury Stock Treasury Stock Cash Cash Question Content Area b. Journalize the entries to record the sale of the stock. If an amount box does not require an entry, leave it blank. Jun. 10 - Select - - Select - - Select - - Select - - Select - - Select - Nov. 10 - Select - - Select - - Select - - Select - - Select - - Select -arrow_forward

- Pronghorn Corp purchased 2,100 shares of its $10 par value common stock for $79,800 on August 1. It will hold these in the treasury until resold. Journalize the treasury stock transaction. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Date Account Titles and Explanation Debit Credit Aug. 1arrow_forwardPronghorn Corp began operations on April 1 by issuing 52,200 shares of $4 par value common stock for cash at $15 per share. In addition, Pronghorn issued 2,300 shares of $1 par value preferred stock for $5 per share.Journalize the issuance of the common and preferred shares. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.)arrow_forward25 )arrow_forward

- On May 3, Zirbal Corporation purchased 8,500 shares of its own stock for $93,500 cash. On November 4, Zirbal reissued 1,750 sha of this treasury stock for $21,000. Prepare the May 3 and November 4 journal entries to record Zirbal's purchase and reissuance of treasury stock. View transaction list Journal entry worksheet < 1 2 Record the purchase of 8,500 shares of its own stock for $93,500 cash. Note: Enter debits before credits. Date May 03 Record entry General Journal Clear entry Debit Credit View general journalarrow_forwardsarrow_forwardPronghorn Corporation purchased from its stockholders 5,400 shares of its own previously issued stock for $275,400. It later resold 2,160 shares for $54 per share, then 2,160 more shares for $49 per share, and finally 1,080 shares for $43 per share. Prepare journal entries for the purchase of the treasury stock and the three sales of treasury stock. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Account Titles and Explanation I (To record purchase from stockholders.) (To record sales of shares at $54 per share.) (To record sales of shares at $49 per share.) Debit Creditarrow_forward

- On April 2 a corporation purchased for cash 5,000 shares of its own $15 par common stock at $26 a share. It sold 3,000 of the treasury shares at $29 a share on June 10. The remaining 2,000 shares were sold on November 10 for $22 a share. a. Journalize the entries to record the purchase (treasury stock is recorded at cost). If an amount box does not require an entry, leave it blank Apr. 2 b. Journalize the entries to record the sale of the stock. If an amount box does not require an entry, leave it blank. Jun. 10 Nov. 10 M Y ▼ ♥arrow_forwardElroy Corporation repurchased 3,800 shares of its own stock for $55 per share. The stock has a par of $5 per share. A month later Elroy resold 950 shares of the treasury stock for $63 per share. Required: What is the balance of the Treasury Stock account after these transactions are recognized?arrow_forwardOn December 31, Lowland, Inc., converts its 900,000 par value bonds (carrying value also $900,000) into 90,000 shares of $6 par value common stock. Complete the necessary journal entry.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education