FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Determine the amount of

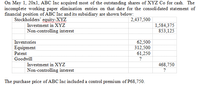

Transcribed Image Text:On May 1, 20x1, ABC Inc acquired most of the outstanding shares of XYZ Co for cash. The

incomplete working paper elimination entries on that date for the consolidated statement of

financial position of ABC Inc and its subsidiary are shown below:

Stockholders' equity-XYZ

2,437,500

1,584,375

853,125

Investment in XYZ

Non-controlling interest

Inventories

62,500

312,500

61,250

Equipment

Patent

Goodwill

Investment in XYZ

468,750

Non-controlling interest

?

The purchase price of ABC Inc included a control premium of P68,750.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The meaning of goodwill in accounting is: Multiple Choice The amount by which a company's value exceeds the value of its individual assets and liabilities. Long term assets held as investment. The support of the board of directors for the operating decisions of management. The cost of developing, maintaining, or enhancing the value of a trademark. Rights granted to an entity to deliver a product or service under specified conditions.arrow_forwardThe consolidated balance of fixed assets will be affected by working paper entries involving all of the following, except: A. Excess of fixed asset FV over BV of the parent at the date of acquisition B. Amortization of the excess of fixed asset FV over BV of the subsidiary at the date of acquisition C. Realized gain or loss on intercompany sale of fixed asset D. Unrealized gain or loss on intercompany sale of fixed assetarrow_forwardWhich of the following is/are true regarding goodwill achieved through acquisition as part of business combination? Where the acquirer was able to purchase the business at a discount, the excess of the market capitalization over the consideration transferred will be recognized in profit or loss. The acquirer shall recognize goodwill as of the acquisition date measured as the excess of the aggregate of the consideration transferred over the net of the fair values of all the assets acquired and the liabilities assumed Group of answer choices Both statements are true. None of these statements are true. 2 only. 1 only.arrow_forward

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education