FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

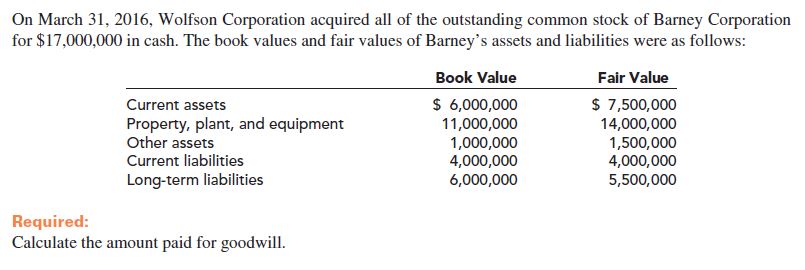

Transcribed Image Text:On March 31, 2016, Wolfson Corporation acquired all of the outstanding common stock of Barney Corporation

for $17,000,000 in cash. The book values and fair values of Barney's assets and liabilities were as follows:

Fair Value

Book Value

$ 6,000,000

$ 7,500,000

Current assets

Property, plant, and equipment

Other assets

Current liabilities

11,000,000

1,000,000

4,000,000

6,000,000

14,000,000

1,500,000

4,000,000

5,500,000

Long-term liabilities

Required:

Calculate the amount paid for goodwill.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- On January 1, 2016, Uncle Company purchased 80 percent of Nephew Company's capital stock for $512,000 in cash and other assets. Nephew had a book value of $626,000 and the 20 percent noncontrolling interest fair value was $128,000 on that date. On January 1, 2015, Nephew had acquired 30 percent of Uncle for $283,000. Uncle's appropriately adjusted book value as of that date was $910,000. Separate operating income figures (not including investment income) for these two companies follow. In addition, Uncle declares and pays $30,000 in dividends to shareholders each year and Nephew distributes $4,000 annually. Any excess fair-value allocations are amortized over a 10-year period. Year UncleCompany NephewCompany 2016 $ 138,000 $ 34,000 2017 203,000 51,800 2018 236,000 52,600 Assume that Uncle applies the equity method to account for this investment in Nephew. What is the subsidiary's income recognized by Uncle in 2018? What is the net income…arrow_forwardOn January 2, 2014, Prunce Company acquired 90% of the outstanding common stock of Sun Company for $180,700 cash. Just before the acquisition, the balance sheets of the two companies were as follows: Prunce Sun Cash $282,130 $ 59,040 Accounts receivable (net) 142,020 24,810 Inventory 118,670 53,230 Plant and equipment (net) 395,640 92,960 Land 62,550 29,220 Total asset $1,001,010 $259,260 Accounts payable $106,440 $ 50,420 Mortgage payable 67,320 37,660 Common stock, $2 par value 421,400 76,960 Other contributed capital 217,440 21,970 Retained earnings 188,410 72,250 Total equities $1,001,010 $259,260 The fair values of Sun Company’s assets and liabilities are equal to their book values with the exception of land. (a) Your answer is correct. Prepare a journal entry to record the purchase of Sun Company’s common stock.…arrow_forwardParent acquires 80% of Sub for $170,000 on December 31, 2014. In 2015 Sub has net income of $140,000 and paid dividends of $70.000. Amortization of excess fair value over book value for the year was $43,750. What is the Investment in Sub account balance as of December 31, 2015.arrow_forward

- On May 1, Burns Corporation acquired 100 percent of the outstanding ownership shares of Quigley Corporation in exchange for $728,000 cash. At the acquisition date, Quigley's book and fair values were as follows: Cash Receivables Inventory Land Building and equipment (net) Patented technology Total assets Accounts payable Long-term liabilities Common stock ($5 par value) Additional paid-in capital Retained earnings Total liabilities and stockholders equity Total assets Assets Book Value $ 112,000 $ 218,000 232,000 $ 177,000 323,000 0 $1,062,000 $ 162,500 $ 638,000 210,000 90,000 (38,500) $1,062,000 Burns directs Quigley to seek additional financing for expansion through a new long-term debt issue. Consequently, Quigley will issue a set of financial statements separate from that of its new parent to support its request for debt and accompanying regulatory filings. Quigley elects to apply pushdown accounting in order to show recent fair valuations for its assets. Prepare a separate…arrow_forwardOn January 1, 2015 P company acquired 80% interest in S Company for P2,000,000 cash. The stockholders' equity of S at the time of acquisition is P 1,875,000. On January 1, 2015, NCI is measured at its implied fair value. The excess of cost over book value of interest acquired is allocated to the following assets: Inventories: 100,000 (sold in 2013) Building: 200,000 (5-year remaining life) During 2015, S company reported total comprehensive income of 500,000 and paid dividends of P 100,000. How much goodwill (gain on bargain purchase) is reported in the consolidated statement of financial position on January 1, 2015? A. 325,000 B. 200,000 C. (325,000) D. (375,000)arrow_forwardOn January 1, 2018, Powers Company acquired 80% of the ordinary share of Scullery Company for $195,000. On this date Scullery had total owners' equity of $200,000 (ordinary share, premium ordinary and retained earnings of $10,000, $90,000, and $100,000 respectively). In that date inventory undervalued $6,250 and equipment undervalued $12,500. The equipment has a remaining life of five years and straight-line depreciation is used. The following transaction occurred during 2018 and 2019: 1) On December 31, 2018, Powers sold equipment to Scullery at a gain of $10,000. During 2019, the equipment was used by Scullery. Depreciation is being computed using the straight-line method, a five-year life, and no salvage value. 2) during 2018scullery sold merchandise inventory 120,000 to powers with gross profit 25% which sold all except 20,000 3) On July 1, 2018 Scullery sold land $100,000 to Powers including 10,000 gain. 4) 1/1/2019 Scullery sold a truck to Powers for 70,000 and book value 50,000…arrow_forward

- On January 1, 2018, Cameron Inc. bought 20% of the outstanding common stock of Lake Construction Companyfor $300 million cash. At the date of acquisition of the stock, Lake’s net assets had a fair value of $900 million.Their book value was $800 million. The difference was attributable to the fair value of Lake’s buildings and itsland exceeding book value, each accounting for one-half of the difference. Lake’s net income for the year endedDecember 31, 2018, was $150 million. During 2018, Lake declared and paid cash dividends of $30 million. Thebuildings have a remaining life of 10 years.Required:1. Prepare all appropriate journal entries related to the investment during 2018, assuming Cameron accounts forthis investment by the equity method.2. Determine the amounts to be reported by Cameron:a. As an investment in Cameron’s 2018 balance sheetarrow_forward2. Cinema Company acquired 75 percent of Movie Corporation's shares on December 31, 2015, at underlying book value of $98,000. At that date, the fair value of the noncontrolling interest was equal to 25 percent of the book value of Movie Corporation. Movie's balance sheet on January 1, 2018, contained the following balances: Cash Accounts Receivable Inventory Buildings and Equipment Less: Accumulated Depreciation Total Assets $50,000 Accounts Payable 35,000 Bonds Payable 40,000 Common Stock 300,000 Additional Paid-In Capital (100,000) Retained Earnings $325,000 Total Liabilities and Equities $40,000 100,000 50,000 Prepare the entries recorded on the books of each company. 75,000 60,000 $325,000 On January 1, 2018, Movie acquired 3,500 of its own $2 par value comm on shares from Nonaffiliated Corporation for $6 per share.arrow_forwardMainline Produce Corporation acquired all the outstanding common stock of Iceberg Lettuce Corporation for $30,000,000 in cash. The book values and fair values of Iceberg's assets and liabilities were as follows: Current assets Property, plant, and equipment Current liabilities Book Value $ 10,200,000 21,000,000 1,800,000 7,200,000 11,800,000 Fair Value $ 13,200,000 Other assets Long-term liabilities Required: 27,000,000 2,800,000 7,200,000 10,800,000 Calculate the amount paid for goodwill. (Enter your answer in millions (i.e. 5,000,000 should be entered as 5).) Amount paid for goodwill millionarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education