Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

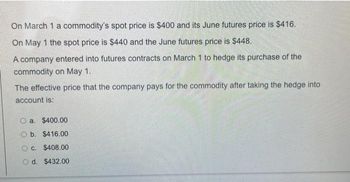

Transcribed Image Text:On March 1 a commodity's spot price is $400 and its June futures price is $416.

On May 1 the spot price is $440 and the June futures price is $448.

A company entered into futures contracts on March 1 to hedge its purchase of the

commodity on May 1.

The effective price that the company pays for the commodity after taking the hedge into

account is:

a. $400.00

Ob. $416.00

O c. $408.00

O d. $432.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- vvk.7arrow_forwardBlossom Inc. entered into a futures contract to sell grain for $1,120 in 30 days. This contract helps the company manage its market risk by locking in the amount it will get when it sells the grain. The contracts trade on an exchange and are net settleable. The broker requires a $220 initial margin (normally a percentage of the market value of the contract or a fixed amount multiplied by the number of contracts). This amount is deposited in cash with the broker. Like the forward, the futures contract would have a zero value up front. This is a non-financial derivative because the underlying is a non-financial commodity (grain). Blossom intends to settle on a net basis. Prepare the related journal entry at the acquisition date. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List debit entry before credit entry.) Account Titles Debit Creditarrow_forwardWe define basis as futures price minus cash price. In general, what is the expected sign of the basis one month prior to expiry for oil sold on the spot market at the futures contract’s delivery location? (i) positive (ii) negative (iii) zeroarrow_forward

- M4arrow_forwardThe following are call option premiums and futures settlement prices for ICE cotton. These prices were quoted on December 16th, 200X. These prices are used in problems 25 through 29 (recopied here for your convenience). Strike Price (cents/lb)_ 48.00 49.00 50.00 51.00 52.00 53.00 Futures close 6 18 12 24 Mar-OX none of the above. 2.56 1.98 1.48 1.09 .78 .55 49.60 May-OX QUESTION - Based on the above price data, there are. represented among both the Mar-OX and May-OX contracts. 6.14 5.33 4.59 3.92 3.31 2.74 53.69 individual options contracts beingarrow_forward1. (7 marks) A stock XYZ is quoted 1015. Two counterparties agree to enter into a forward contract maturing at T = 6 months. Here are the possible values of XYZ, at maturity. XYZ at T=6 months XYZ Forward Long Short 1000 1015 1020 1030 1080 (A) Find the possible values of the payoff for the buyer and for the seller of the forward and sketch a graph of the payoffs. (3.5 marks) (B) We know that spot price at expiration can be duplicated according to Forward + Zero Coupon bond = Spot Price at Maturity. Find the possible values of the zero coupon bond. What can you say about the risk associated with this bond? (3.5 marks)arrow_forward

- B.On October 23, the closing exchange rate of British pounds was $1.70. Calls that would mature the following January with a strike price of $1.75 were traded at $0.10. a. Were the call options in the money, at the money, or out of the money? b. Compute the intrinsic value of the call. c. If the exchange rate of British pounds rises to $1.90 prior to the January option expiration date, what is the percentage return on investment for an investor who purchased a call on October 23?arrow_forwardGive typing answer with explanation and conclusionarrow_forwardCc. 190.arrow_forward

- Sixty futures contracts are used to hedge an exposure to the price of silver. Each futurescontract is on 5,000 ounces of silver. At the time the hedge is closed out, the basis is $0.20per ounce. What is the effect of the basis on the hedger’s financial position if (a) the traderis hedging the purchase of silver and (b) the trader is hedging the sale of silver?arrow_forwardDetermine the cost of carry using a risk-free rate of 2%, calculate the no-arbitrage futures price for a 1-year contract at initiation for an asset with a spot price of $125 and a net cost of carry of $2.arrow_forwardConsider the following prices, volume and open interest for gold futures contracts. Contract size: 100 oz Price units: $/oz (a) Which contract reached the highest price on this trading day? What was its contract value at that price? (b) Why is the high price equal to the low price for the contract expiring in October 2022?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education