FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

On June 30, Collins Management Company purchased land for $560,000 and a building for $520,000, paying $300,000 cash and issuing a 4% note for the balance, secured by a mortgage on the property. The terms of the note provide for 20 semiannual payments of $39,000 on the principal plus the interest accrued from the date of the preceding payment.

| CHART OF ACCOUNTS | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Collins Management Company | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| General Ledger | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Scroll down to access pages 2 through 3 of the journal.

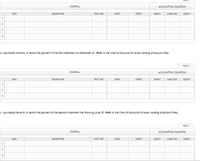

a. Journalize the entry to record the transaction on June 30. Refer to the Chart of Accounts for exact wording of account titles.

Transcribed Image Text:JOURNAL

ACCOUNTING EQUATION

DATE

DESCRIPTION

POST. REF

DEBIT

CREDIT

ASSETS

LIABILITIES

EQUITY

1

b. Joumalize the entry to record the payment of the first instaliment on December 31. Refer to the Chart of Accounts for exact wording of account tiles.

PAGE 2

JOURNAL

ACCOUNTING EQUJATION

DATE

DESCRIPTION

POST. REF.

DEBIT

CREDIT

ASSETS

LIABILITIES

EQUITY

1

C. Journaiize the entry to record the payment of the second instalment the folowing June 30. Refer to the Chart of Accounts for exact wording of account nities.

PAGE 1

JOURNAL

ACCOUNTING EQJATION

DATE

DESCRIPTION

POST. REF.

DEBIT

CREDIT

ASSETS

LIABILITIES

EQUITY

1

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Doyle Company issued $390,000 of 10-year, 8 percent bonds on January 1, Year 2. The bonds were issued at face value. Interest is payable in cash on December 31 of each year. Doyle immediately invested the proceeds from the bond issue in land. The land was leased for an annual $52,500 of cash revenue, which was collected on December 31 of each year, beginning December 31, Year 2. b. Prepare the income statement, balance sheet, and statement of cash flows for Year 2 and Year 3. Complete this question by entering your answers in the tabs below. Req B Income Req B Balance Statement Sheet Req B Statement of Cash Flows Prepare the statement of cash flows for Year 2 and Year 3. Note: Amounts to be deducted and cash outflows should be indicated with minus sign. DOYLE COMPANY Statement of Cash Flows For the Year Ended December 31 Cash flows from operating activities ces Net cash flow from operating activities Cash flows from investing activities Net cash flows from investing activities Cash…arrow_forwardSmiley Corporation wholesales repair products to equipment manufacturers. On April 1, 20Y1, Smiley issued $24,200,000 of five-year, 11% bonds at a market (effective) interest rate of 9%, receiving cash of $26,114,936. Interest is payable semiannually on April 1 and October 1. Required: a. Journalize the entries to record the following. Refer to the Chart of Accounts for exact wording of account titles. 1. Issuance of bonds on April 1, 20Y1. 2. First interest payment on October 1, 20Y1, and amortization of bond premium for six months, using the straight-line method. (Round to the nearest dollar.) b. Explain why the company was able to issue the bonds for $26, 114,936 rather than for the face amount of $24,200,000.arrow_forwardOn January 1, the first day of its fiscal year, Jacinto Company issued $6,500,000 of six-year, 7% bonds to finance its operations of producing and selling home improvement products. Interest is payable semiannually. The bonds were issued at a market (effective) interest rate of 8%, resulting in Jacinto Company receiving cash of $6,194,985. Required: a. Journalize the entries to record the following (refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered.): 1. Issuance of the bonds. 2. First semiannual interest payment. The bond discount amortization, using the straight-line method, is combined with the semiannual interest payment. (Round your answer to the nearest dollar.) 3. Second semiannual interest payment. The bond discount amortization, using…arrow_forward

- On the first day of the fiscal year, a company issues a $883,000, 10%, 10-year bond that pays semiannual interest of $44,150 ($883,000 x 10% x 1/2), receiving cash of $927,200. Journalize the entry to record the first interest payment and amortization of premium using the straight-line method. If an amount box does not require an entry, leave it blank. - Select - - Select - - Select - - Select - - Select - - Select -arrow_forwardOn January 1, Year 1, Platte Corporation issues a 5-year note payable for $5,000. The interest rate is 5% and the annual payment of $1,156, due each December 31, includes both interest and principal. Which of the following correctly shows the effect of the issuance of the note on Platte's financial statements? Assets = Liabilities + n/a n/a (5,000) 5,000 A. 5,000 B. 5,000 C. (5,000) D. 5,000 Multiple Choice O Option A O 0 0 Option B Option D Balance Sheet Option C Stockholders' Equity 5,000 5,000 n/a n/a Revenue 5,000 5,000 n/a n/a Income Statement - Expense n/a n/a n/a n/a = Net Income 5,000 5,000 n/a n/a Statement of Cash Flows. 5,000 FA 5,000 IA (5,000) IA 5,000 FAarrow_forwardOn January 1, a company issues bonds dated January 1 with a par value of $560,000. The bonds mature in 5 years. The contract rate is 8%, and interest is paid semiannually on June 30 and December 31. The market rate is 9% and the bonds are sold for $537,828. The journal entry to record the second interest payment using the effective interest method of amortization is:arrow_forward

- Campbell Inc. produces and sells outdoor equipment. On July 1, 20Y1, Campbell issued $87,000,000 of 10-year, 10% bonds at a market (effective) interest rate of 9%, receiving cash of $92,658,219. Interest on the bonds is payable semiannually on December 31 and June 30. The fiscal year of the company is the calendar year. Required: 1. Journalize the entry to record the amount of cash proceeds from the issuance of the bonds on July 1, 20Y1.* 2. Journalize the entries to record the following:* a. The first semiannual interest payment on December 31, 20Y1, and the amortization of the bond premium, using the straight-line method. (Round to the nearest dollar.) b. The interest payment on June 30, 20Y2, and the amortization of the bond premium, using the straight-line method. (Round to the nearest dollar.) 3. Determine the total interest expense for 20Y1. 4. Will the bond proceeds always be greater than the face amount of the bonds when the contract rate is greater than the market rate of…arrow_forwardPickeril Inc. issues a $600,000, 10%, 10-year mortgage note on December 31, 2010, to obtain financing for a new building. The terms provide for semiannual installment payments of $48,145. The interest amount in first installment payment is $30,000. Prepare the entry to record the mortgage loan on December 31, 2010, and the first installment payment.arrow_forwardKitt Company borrows $800,000 from Neville Capital by issuing an 8-year (96-month), 12% note payable. Interest is due and payable each month based on the outstanding balance at the beginning of the month. Kitt assigns $850,000 of its accounts receivable as collateral for the lending arrangement. Prepare the journal entries to record the financing arrangement on Kitt’s books.arrow_forward

- the following journal entry was made by your predecessor to record the annual payment on a 5%, 10-year installment note. PAGE 22 JOURNAL ACCOUNTING EQUATION DATE DESCRIPTION POST. REF. DEBIT CREDIT ASSETS LIABILITIES EQUITY 1 Oct. 1 Interest Expense 710 203,264.00 ↓ 2 Notes Payable 215 499,298.00 ↓ 3 Cash 110 702,562.00 ↓ Using the information provided, compute the following amounts. 1. What was the carrying amount (book value) of the installment note before the payment on October 1? 2. What portion of next year’s payment will be interest? (Round the amount to the nearest dollar.) can you show me how to work through this problem?arrow_forwardDoyle Company issued $362,000 of 10-year, 5 percent bonds on January 1, Year 1. The bonds were issued at face value. Interest is payable in cash on December 31 of each year. Doyle immediately invested the proceeds from the bond issue in land. The land was leased for an annual $52, 500 of cash revenue, which was collected on December 31 of each year, beginning December 31, Year 1. Journal entry worksheet Note: Enter debits before credits. 4 Date Dec 31 5 ü 6 Record the interest expense for bonds payable for Year 2. General Journal C 7 8 Debit Credit >arrow_forwardSubject : Accountingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education