FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

ADDITIONAL INFORMATION:

The partners agree that the inventory is worth P85,000, and the equipment is worth half of its original cost, and the allowance established for doubtful accounts is correct.

REQUIRED: Compute the Bonus received by Jumong.

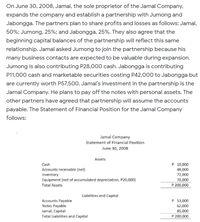

Transcribed Image Text:On June 30, 2008, Jamal, the sole proprietor of the Jamal Company,

expands the company and establisha partnership with Jumong and

Jabongga. The partners plan to share profits and losses as follows: Jamal,

50%; Jumong, 25%; and Jabongga, 25%. They also agree that the

beginning capital balances of the partnership will reflect this same

relationship. Jamal asked Jumong to join the partnership because his

many business contacts are expected to be valuable during expansion.

Jumong is also contributing P28,000 cash. Jabongga is contributing

P11,000 cash and marketable securities costing P42,000 to Jabongga but

are currently worth P57,500. Jamal's investment in the partnership is the

Jamal Company. He plans to pay off the notes with personal assets. The

other partners have agreed that partnership will assume the accounts

payable. The Statement of Financial Position for the Jamal Company

follows:

Jamal Company

Statement of Financial Position

June 30, 2008

Assets

Cash

P 10,000

Accounts receivable (net)

48,000

Inventory

72,000

Equipment (net of accumulated depreciation, P20,000)

70,000

Total Assets

P 200,000

Liabilities and Capital

P 53,000

Accounts Payable

Notes Payable

Jamal, Capital

Total Liabilities and Capital

62,000

85,000

P 200,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Required: (1) Determine whether Grealish will accept the contract. Show calculations of his utility to two decimal places. Also, indicate whether Grealish will work hard or shirk. (include all steps of calculation) (2) Calculate Jack's utility. Jack is risk-neutral and his utility for money is equal to the cash received. (include all steps of calculation) (3)Jack's business has publicly traded shares. Explain whether you would recommend a compensation contract based on both net income and share price performance under the following conditions; a- Net income is calculated based on historical cost. b- Net income is calculated based on fair value accounting.arrow_forward-) Hanse, Incorporated, has the following two mutually exclusive projects available. Year 0 Project R -$ 47,000 Project S -$ 71,000 17,000 1234 17,000 23,000 5 9,000 5,000 18,000 18,000 33,000 29,000 7,000 a. What is the crossover rate for these two projects? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. b. What is the NPV of each project at the crossover rate? Note: Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16. S a. Crossover rate b. Project R Project S %arrow_forwardA, B and C decided to form ABC Partnership. It was agreed that A will contribute an equipment with assessed value of P200,000 with historical cost of P1,600,000 and accumulated depreciation of P1,200,000. B will contribute a land and building with book value of P2,400,000 and fair market value of P3,000,000. The land and building is subject to a mortgage payable amounting to P600,000 to be assumed by the partnership. The partners agreed that B will have 60% capital interest in the partnership. They agreed that C will contribute sufficient cash to the partnership. A day after the partnership formation, the equipment was sold for P 600,000. What is the amount of cash contributed by C?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education