Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

I need help big time with this accounting problem! PLEASE

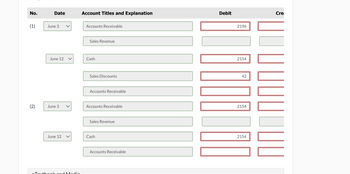

Transcribed Image Text:No.

Date

Account Titles and Explanation

Debit

(1)

June 3

Accounts Receivable

Sales Revenue

June 12 <

Cash

(2)

June 3

Sales Discounts

Accounts Receivable

Accounts Receivable

Sales Revenue

June 12

Cash

eTextbeekend Media

Accounts Receivable

2196

2154

42

2154

2154

Cre

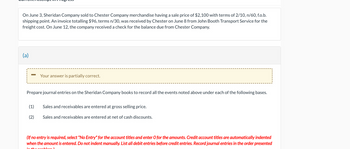

Transcribed Image Text:On June 3, Sheridan Company sold to Chester Company merchandise having a sale price of $2,100 with terms of 2/10, n/60, f.o.b.

shipping point. An invoice totalling $96, terms n/30, was received by Chester on June 8 from John Booth Transport Service for the

freight cost. On June 12, the company received a check for the balance due from Chester Company.

(a)

Your answer is partially correct.

Prepare journal entries on the Sheridan Company books to record all the events noted above under each of the following bases.

(1)

Sales and receivables are entered at gross selling price.

(2)

Sales and receivables are entered at net of cash discounts.

(If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented

when the amount is entered. Do not indent manually. List all debit entries before credit entries. Record journal entries in the order presented

in the problem!

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Review the following transactions and prepare any necessary journal entries for Tolbert Enterprises. A. On April 7, Tolbert Enterprises contracts with a supplier to purchase 300 water bottles for their merchandise inventory, on credit, for $10 each. Credit terms are 2/10, n/60 from the invoice date of April 7. B. On April 15, Tolbert pays the amount due in cash to the supplier.arrow_forwardToby Company had the following sales transactions for March: Mar. 6Sold merchandise on account to Osbourne, Inc., invoice no. 1128, 563.17. 14Sold merchandise on account to Ortiz Company, invoice no. 1129, 823.50. 20Sold merchandise on account to Bailey Corporation, invoice no. 1130, 2,350.98. 24Sold merchandise on account to Shannon Corporation, invoice no. 1131, 1,547.07. Assume that Toby Company had beginning balances on March 1 of 3,569.80 (Sales 411) and 2,450.39 (Accounts Receivable 113). Record the sales of merchandise on account in the sales journal (page 24) and then post to the general ledger.arrow_forwardOn June 3, Sunland Company sold to Chester Company merchandise having a sale price of $5,200 with terms of 4/10, n/60, f.o.b. shipping point. An invoice totalling $98, terms n/30, was received by Chester on June 8 from John Booth Transport Service for the freight cost. On June 12, the company received a check for the balance due from Chester Company.arrow_forward

- On June 3, Concord Company sold to Chester Company merchandise having a sale price of $3,300 with terms of 2/10, n/60, f.o.b. shipping point. An invoice totaling $94, terms n/30, was received by Chester on June 8 from John Booth Transport Service for the freight cost. On June 12, the company received a check for the balance due from Chester Company. Prepare journal entries on the Concord Company books to record all the events noted above under each of the following bases. (1) Sales and receivables are entered at gross selling price. (2) Sales and receivables are entered at net of cash discounts.arrow_forwardon june 3, concord comoany sold to chester merchandise having a sale price of $5,500 with terms 2/10,n/60,F.O.B. shipping point. An invoice totalling $99, terms n/30, was received by chester on june 8 from john booth transportservice for the freight cost. on june 12, the company received a check for the balance due from chester company. prepare journal entries on the concord company books to record all the events noted above under each of the following basis. (1) sales and receivable are entered at gross selling price. (2). sales and receivable are entered at net cash discounts.arrow_forwardOn September 1, Jerry's Lighting purchased merchandise with a list price of $4,100 with credit terms of 3/10, n/60; freight of $200 prepaid and added to the invoice. On September 3, Jerry's returns of $500 of the merchandise. If payment is made within the discount period, the total amount paid by Jerry's Lighting is;arrow_forward

- On February 3, Smart Company sold merchandise in the amount of $2,400 to Truman Company, with credit terms of 1/10, n/30. The cost of the items sold is $1,65O. Smart uses the perpetualinventory system and the gross method. Truman pays the invoice on February 8, and takes the appropriate discount. The journal entry that Smart makes on February 8 is: Multiple Choice Cash 1,650 Accounts receivable 1,650 Cash 2,400 Accounts receivable 2,400 Cash 2,320 Sales discounts pe here to search 5:00 PM 6% 3/7/2022arrow_forwardNieman Company purchased merchandise on account from Springhill Company for $12,100, terms 2/10, n/30. Nieman returned merchandise with an invoice amount of $2,800 and received full credit. a. If Nieman Company pays the invoice within the discount period, what is the amount of cash required for the payment? If required, round the answer to the nearest dollar. b. What account is debited by Nieman Company to record the return?arrow_forwardBarans Company purchased merchandise on account from Springhill Company for $10,600, terms 2/10, n/30. Barans returned merchandise with an invoice amount of $2,200 and received full credit. a. If Barans Company pays the invoice within the discount period, what is the amount of cash required for the payment? If required, round the answer to the nearest dollar. b. What account is debited by Barans Company to record the return?arrow_forward

- On November 1, Al Ain Systems purchases merchandise for $1,500 on credit with terms of 2/5, n/30, FOB shipping point; invoice dated November 1. On November 5, Al Ain Systems pays cash for the November 1 purchase. On November 7, Al Ain Systems discovers and returns $200 of defective merchandise purchased on November 1 for a cash refund. On November 10, Al Ain Systems pays $90 cash for transportation costs with the November 1 purchase. On November 13, Al Ain Systems sells merchandise for $1,600 on credit. The cost of the merchandise is $800. On November 16, the customer returns merchandise from the November 13 transaction. The returned items are priced at $300 and cost $130; the items were not damaged and were returned to inventory. Required: Journalize the above merchandising transactions for Al Ain Systems assuming it uses a perpetual inventory system.arrow_forwardOn December 28, 20Y3, Silverman Enterprises sold $20,000 of merchandise to Beasley Co. with terms n/30. The cost of the goods sold was $12,000. On December 31, 20Y3, Silverman prepared its adjusting entries, yearly financial statements, and closing entries. On January 3, 20Y4, Silverman Enterprises issued Beasley Co. a credit memo for returned merchandise. The invoice amount of the returned merchandise was $4,000 and the merchandise originally cost Silverman Enterprises $2,350. Question Content Area a. Journalize the entries by Silverman Enterprises to record the December 28, 20Y3, sale. If an amount box does not require an entry, leave it blank. b. Journalize the entries by Silverman Enterprises to record the merchandise returned by Beasley Co. on January 3, 20Y4. If an amount box does not require an entry, leave it blank.arrow_forwardOn March 1, Sather Co. sold merchandise to Boone Co. on account, $28,200, terms 2/15, n/30. The cost of the merchandise sold is $17,500. The merchandise was paid for on March 14. Assume all discounts are taken. Required: Journalize the entries for Sather Co. and Boone Co. for the sale, purchase, and payment of amount due. Refer to the appropriate company’s Chart of Accounts for exact wording of account titlesarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub