Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

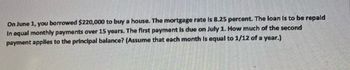

Transcribed Image Text:**Loan Repayment Calculation Example**

On June 1, you borrowed $220,000 to buy a house. The mortgage rate is 8.25 percent. The loan is to be repaid in equal monthly payments over 15 years. The first payment is due on July 1. How much of the second payment applies to the principal balance? (Assume that each month is equal to 1/12 of a year.)

**Explanation:**

To calculate how much of the second payment applies to the principal, you need to first determine the monthly payment using the loan amount, interest rate, and loan term. Then, calculate the interest portion of the second payment and subtract it from the total payment to find the principal portion.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Similar questions

- A person owes $1000 due in two years and $4000 due in 6 years. Using an interest rate of 12% semiannually, what single payment is equivalent to these two debts now?arrow_forwardOn June 1, you borrowed $350,000 to buy a house. The mortgage interest rate is 3.5%. The loan is to be repaid in equal monthly payments over 30 years. What is your monthly payment ? How much equity will you have in the house after 5 years? How much interest have you paid during year 6 only? How much interest will you be paying over the whole course of the loan?arrow_forwardA couple borrows 275000.00 for a mortgage that requires fixed monthly payments over 25 consecutive years. The first monthly payment is due in one month. If the interest rate on the mortgage is 4.00%, which of the following comes closest to the monthly payment?arrow_forward

- The balance on a mortgage was $40,100 and an interest rate of 5.50% compounded semi-annually was charged for the remaining 5-year term. Monthly payments were made to settle the mortgage. a. Calculate the size of the monthly payments. Round up to the next whole number b. If the monthly payments were set at $915, how long would it take to pay off the mortgage? years months Express the answer in years and months, rounded to the next payment period c. If the monthly payments were set at $915, calculate the size of the final payment. Round to the nearest cent Varrow_forwardA mortgage of $38,000 is repaid by making payments of $270 at the end of each month for 13 years. What is the nominal annual rate of interest compounded annually? The nominal annual rate of interest is % compounded annually. (Round to two decimal places as needed.) Varrow_forwardRoss Land has a loan of $8,500 compounded quarterly for four years at 4%. What is the effective interest rate for the loan? Click here to view page 1 of the future value table. Click here to view page 2 of the future value table. The effective interest rate is %. (Round to two decimal places as needed.)arrow_forward

- John received a loan of $40,500, 6 years ago. The interest rate charged on the loan was 4.68% compounded quarterly for the first 6 months, 5.46% compounded semi-annually for the next 2 years, and 5.88% compounded monthly thereafter. a. Calculate the accumulated value of the loan at the end of the first 6 months. Round to the nearest cent b. Calculate the accumulated value of the loan at the end of the next 2 year period. Round to the nearest cent c. Calculate the accumulated value of the loan today. Round to the nearest cent d. Calculate the amount of interest charged on this loan over the past 6 years. jamie wants to double his money in 9 years in an investment fund. What quarterly compounding interest rate do you suggest that he looks for?arrow_forwardA couple borrows $300,000 at an APR of 4.8% compounded monthly on a 30-year mortgage with monthly payments of $1,574. (a) How much of the first payment goes to interest? (b) Find the total interest paid over the life of the loan. (c) After making their 70th payment, they refinance the loan at an APR of 3.6% compounded monthly for 15 years. The refinanced amount includes the unpaid balance from the original loan plus a refinance charge of $2,000. Find the new monthly payment. (d) Find the amount saved by refinancing.arrow_forwardThe balance on a mortgage was $42,600 and an interest rate of 4.25% compounded semi-annually was charged for the remaining 3-year term. Monthly payments were made to settle the mortgage. a. Calculate the size of the monthly payments. Round up to the next whole number b. If the monthly payments were set at $1,412, how long would it take to pay off the mortgage? Express the answer in years and months, rounded to the next payment period (C). If the monthly payments were set at $1,412, calculate the size of the final payment.arrow_forward

- A fully amortizing mortgage loan is made for $100,000 for 15 years. The interest rate is 6 percent per year compounding monthly. Payments are to be made monthly. What is the loan outstanding after one monthly payment? (Round to a dollar) $89,692 $89,380 $99,656 $89,691 $79,725arrow_forwardCalculate Quick Ratio: AKA the Acid Testarrow_forwardJohn obtained a loan of $25,000 at 4.6% compounded monthly. How long (rounded up to the next payment period) would it take to settle the loan with payments of $2,810 at the end of every month? Express the answer in years and months, rounded to the next payment periodarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education