FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

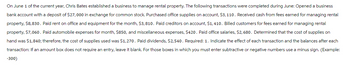

Transcribed Image Text:On June 1 of the current year, Chris Bates established a business to manage rental property. The following transactions were completed during June: Opened a business

bank account with a deposit of $27,000 in exchange for common stock. Purchased office supplies on account, $3,110. Received cash from fees earned for managing rental

property, $8,830. Paid rent on office and equipment for the month, $3,810. Paid creditors on account, $1,410. Billed customers for fees earned for managing rental

property, $7,060. Paid automobile expenses for month, $850, and miscellaneous expenses, $420. Paid office salaries, $2,680. Determined that the cost of supplies on

hand was $1,840; therefore, the cost of supplies used was $1,270. Paid dividends, $2,540. Required: 1. Indicate the effect of each transaction and the balances after each

transaction: If an amount box does not require an entry, leave it blank. For those boxes in which you must enter subtractive or negative numbers use a minus sign. (Example:

-300)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On June 1 of the current year, Chris Bates established a business to manage rental property. The following transactions were completed during June: Opened a business bank account with a deposit of $29,000 in exchange for common stock. Purchased office supplies on account, $3,590. Received cash from fees earned for managing rental property, $9,700. Paid rent on office and equipment for the month, $4,400. Paid creditors on account, $1,630. Billed customers for fees earned for managing rental property, $8,150. Paid automobile expenses for month, $980, and miscellaneous expenses, $490. Paid office salaries, $3,100. Determined that the cost of supplies on hand was $2,120; therefore, the cost of supplies used was $1,470. Paid dividends, $2,930. Required: 1. Indicate the effect of each transaction and the balances after each transaction:If an amount box does not require an entry, leave it blank.For those boxes in which you must enter subtractive or negative numbers use a minus sign.…arrow_forwardOn September 1 of the current year, Joy Tucker established a business to manage rental property. She completed the following transactions during September: Opened a business bank account with a deposit of $36,000 in exchange for common stock. Purchased office supplies on account, $1,800. Received cash from fees earned for managing rental property, $6,750. Paid rent on office and equipment for the month, $5,000. Paid creditors on account, $1,375. Billed customers for fees earned for managing rental property, $9,500. Paid automobile expenses for month, $840, and miscellaneous expenses, $960. Paid office salaries, $3,600. Determined that the cost of supplies on hand was $350; therefore, the cost of supplies used was $1,450. Paid dividends, $3,000. Required: 1. Indicate the effect of each transaction and the balances after each transaction:For those boxes in which no entry is required, leave the box blank.For those boxes in which you must enter subtractive or negative numbers use a…arrow_forwardDuring its first year of operations, a company entered into the following transactions: • Borrowed $5,150 from the bank by signing a promissory note. • Issued stock to owners for $11,500. • Purchased $1,150 of supplies on account. Paid $550 to suppliers as payment on account for the supplies purchased. What is the amount of total assets at the end of the year? Multiple Choice O O $17,250 $17,800 $5,750 $16,650arrow_forward

- On June 30, Year 3, Rundle Company's total current assets were $501,000 and its total current liabilities were $274,000. On July 1, Year 3, Rundle issued a short-term note to a bank for $39,400 cash. Required a. Compute Rundle's working capital before and after issuing the note. b. Compute Rundle's current ratio before and after issuing the note. (Round your answers to 2 decimal places.) Before the After the transaction transaction a. Working capital b. Current ratio MacBook Air 80 DII DD F2 F3 F4 F5 F6 F7 F8 F9 F10 23 2$ & * 3 4 6. 7 E R Y D F G H J K この * COarrow_forwardFinancial Transactions: Journalize the following transactions that occurred during the year: January 1: Received $100,000 cash in exchange for common stock. January 1: Purchased a delivery truck for $36,000 by paying $6,000 in cash and signing a note f remainder. January 15: Purchased $1,200 of supplies on account July 1: Paid $12,000 for an annual insurance policy. December 31: Made sales of $500,000 on the account. The Cost of Goods Sold was $300,000.arrow_forwardJay Crowley established Affordable Realty, which completed the following transactions during the month: Jay Crowley transferred cash from a personal bank account to an account to be used for the business in exchange for common stock, $40,000. Paid rent on office and equipment for the month, $4,800. Purchased supplies on account, $2,150. Paid creditor on account, $1,100. Earned sales commissions, receiving cash, $18,750. Paid automobile expenses (including rental charge) for month, $1,580, and miscellaneous expenses, $800. Paid office salaries, $3,500. Determined that the cost of supplies used was $1,300. Paid dividends, $1,500. Instructions Journalize entries for transactions (a) through (i), using the following account titles: Cash, Supplies, Accounts Payable, Common Stock, Dividends, Sales Commissions, Rent Expense, Office Salaries Expense, Automobile Expense, Supplies Expense, Miscellaneous Expense. Explanations may be omitted. Prepare T accounts,…arrow_forward

- Brian Sipe began operations of his business, Sipe Sons Incorporated, on January 1, Year One. During the year, the company performed services on credit of $192,000. Of that amount, $115,750 was collected in cash during the year. Brian estimates, of the remaining amount due, $5,100 may not be collected. Prepare the entries for the events during year one What is the balance in the accounts receivable account? What is the amount of receivables reported on the balance sheet? Why would Brian have a separate allowance account and not reduce the receivable balance for the amount estimated to e uncollectible? What type of account is Allowance for Doubtful Accountsarrow_forwardInner Resources Company started its business on April 1, 2019. The following transactions occurred during the month of April. A. The owners invested $9,000 from their personal account to the business account. B. Paid rent $750 with check #101. C. Initiated a petty cash fund $550 with check #102. D. Received $850 cash for services rendered. E. Purchased office supplies for $180 with check #103. F. Purchased computer equipment $8,500, paid $1,600 with check #104 and will pay the remainder in 30 days. G. Received $1,200 cash for services rendered. H. Paid wages $560, check #105. I. Petty cash reimbursement: Office supplies $200, Maintenance Expense $140, Miscellaneous Expense $65. Cash on Hand $93. Check #106. J. Increased Petty Cash by $100, check #107. Prepare the journal entries. If an amount box does not require an entry, leave it blank. A. В. E. F. G. Н. II II II 1I I II II I II II 1I I1 III II II D.arrow_forwardOn November 1, 20Y9, Lexi Martin established an interior decorating business, Heritage Designs. During the month, Lexi completed the following transactions related to the business: Nov. 1 Lexi transferred cash from a personal bank account to an account to be used for the business in exchange for common stock, $50,000. 1 Paid rent for period of November 1 to end of month, $4,000. 6 Purchased office equipment on account, $15,000. 8 Purchased a truck for $38,500 paying $5,000 cash and giving a note payable for the remainder. 10 Purchased supplies for cash, $1,750. 12 Received cash for job completed, $11,500. 15 Paid annual premiums on property and casualty insurance, $2,400. 23 Recorded jobs completed on account and sent invoices to customers, $22,300. 24 Received an invoice for truck expenses, to be paid in November, $1,250. Enter the following transactions on Page 2 of the two-column journal: Nov. 29 Paid utilities expense, $4,500. 29…arrow_forward

- During its first month of operation, the Quick Tax Corporation, which specializes in tax preparation, completed the following transactions. Began business by making a deposit in a company bank account of $60,000, in exchange for 6,000 shares of $10 par value common stock. July 1 July 3 Paid the current month's rent, $3,500 July 5 Paid the premium on a 1-year insurance policy, $4,200 July 7 Purchased supplies on account from Little Company, $1,000. July 10 Paid employee salaries, $3,500 July 14 Purchased equipment from Lake Company, $10,000. Paid $2,500 down and the balance was placed on account. Payments will be $500.00 per month until the equipment is paid. The first payment is due 8/1. Note: Use accounts payable for the balance due. July 15 Received cash for preparing tax returns for the first half of July, $8,000 July 19 Made payment on account to Lake Company, $500. July 31 Received cash for preparing tax returns for the last half of July, $9,000 July 31 Declared and paid cash…arrow_forwardLes Stanley established an insurance agency on July 1, 20Y5, and completed the following transactions during July: Opened a business bank account in the name of Stanley Insurance Inc., with a deposit of $48,000 in exchange for common stock. Borrowed $25,000 by issuing a note payable. Received cash from fees earned, $28,500. Paid rent on office and equipment for the month, $2,600. Paid automobile expense for the month, $1,800, and miscellaneous expense, $1,000. Paid office salaries, $4,200. Paid interest on the note payable, $90. Purchased land as a future building site, $60,000. Paid dividends, $4,300. Instructions: 1. Indicate the effect of each transaction and the balances after each transaction, using the integrated financial statement framework. If an amount box does not require an entry, leave it blank. Enter account decreases and net cash outflows as negative amounts. 2. Which of the following shows the correct effect on the accounting equation for a utility expense…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education