FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

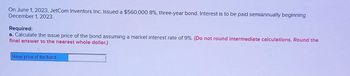

Transcribed Image Text:On June 1, 2023, JetCom Inventors Inc. issued a $560,000 8%, three-year bond. Interest is to be paid semiannually beginning

December 1, 2023.

Required:

a. Calculate the issue price of the bond assuming a market interest rate of 9%. (Do not round intermediate calculations. Round the

final answer to the nearest whole dollar.)

Issue price of the bond

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- On January 1, 2024, Tableau Company issues $20 million of 9% bonds, due in six years, with interest payable semiannually on June 30 and December 31 each year. Use a financial calculator or Excel. Required: 1. If the market rate is 8%, will the bonds issue at face amount, a discount, or a premium? Calculate the issue price. 2. If the market rate is 9%, will the bonds issue at face amount, a discount, or a premium? Calculate the issue price. 3. If the market rate is 10%, will the bonds issue at face amount, a discount, or a premium? Calculate the issue price. Help Save & (Do not round intermediate calculations. Round final answer to the nearest dollar amount. Enter your answer in dollars, not in millions.) 1. The bonds issue at 2. The bonds issue at 3. The bonds issue at and the issue price is and the issue price is and the issue price isarrow_forwardMunabhaiarrow_forwardBonds with a stated interest rate of 9% and a face value totaling $610,000 were issued for $634 400 on January 1.2021 whe market interest rate was 8%. The company uses effective-interest bond amortization Required: Determine the carrying value of the bonds at December 31, 2022. (Round your answer to nearest whole dolar) Carrying Valuearrow_forward

- On July 1, 2019, an investor company owns 20% of the common stock of an Investee and can exercise significant influence over the investee. On July 1, 2019, immedlately preceding the sale of 10% of the investee to an unaffiliated party, the balance of the Equity Investment account was $50,000. The Investor company sold the 106 Interest in the Investee for $30,000. The Investor company determined that after the sale of 10% it could no longer exert significant influence and that the remalning 106 investment has a readily determinable fair value. Immediately after the sale of the 10% interest, what is the carrying amount (I.e., balance) of the Equlty Investment and what method of accounting must the Investor use for the Equity Investment? Select one: a, Balance - $25,000 Method - Equity b. Balance $25,000 Method - Fair value C. Balance $30,000 Method - Fair value d. Balance- $ 30,000 Method Cost-basedarrow_forwardApple issues $5,000,000, 8%, 10-year bonds on January 1, 2020. The bonds pay interest semiannually on June 30 and December 31. The bonds are issued to yield 6%. What are the proceeds from the bond issue? Question 16 options: a) $5,000,000. b) $5,216,494. c) $5,218,809. d) $5,743,894. e) $5,426,490.arrow_forwardMindsetta Music Inc. issued bonds on March 1, 2020, with a par value of $420,000. The bonds mature in 15 years and pay 14.00% annual interest in two semiannual payments. On the issue date, the annual market rate of interest for the bonds turned out to be 16%. (Table attached for reference) 1. What is the semiannual interest payment for these bonds? 2. How many semiannual interest payments will be made on these bonds over their life? 3. Are the bonds issued at discount, premium, or par? 4. Estimate the market value of the binds as the date they were issued 5. Journal entry: Record the sales of bonds at discount on the original issue datearrow_forward

- On September 30, 2024, the Techno Corporation issued 8% stated rate bonds with a face amount of $200 million. The bonds mature on September 30, 2044 (20 years). The market rate of interest for similar bonds was 10%. Interest is paid semiannually on March 31 and September 30. Required: Determine the price of the bonds on September 30, 2024. Note: Use tables, Excel, or a financial calculator. Round your final answers to nearest whole dollar amount, not in millions. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Time values are based on: n= i= Cash Flow Interest Principal Price of bonds S S Amount 40 5% 8,000,000 200,000,000 Present Valuearrow_forwardDomesticarrow_forwardhow to calculate this? thank youarrow_forward

- On January 1, 2020, Blindo Corp. issued ten - year, 12% bonds with a face value of $ 500,000, with interest payable semi-annually on June 30 and December 31. At the time, the market rate was 10%. Required: a) Find PMT and Use your calculator to calculate the issue price of the bonds. Round the answer to the nearest dollar. b) Independent of your solution to part a), assume that the issue price was $ 562, 000. Prepare the amortization table for 2020. Round values to the nearest dollar.arrow_forwardplease step by step solution.arrow_forwardOn December 31, 2024, when the market interest rate is 8%, McMann Realty issues $700,000 of 5.25%, 10-year bonds payable. The bonds pay interest semiannually. Determine the present value of the bonds at issuance. (Round all currency amounts to the nearest whole dollar) (Click the icon to view Present Value of $1 table.) (Click the icon to view Future Value of $1 table.) The present value of the bonds at issuance amounts to (Click the icon to view Present Value of Ordinary Annuity of $1 table.) (Click the icon to view Future Value of Ordinary Annuity of $1 table.) EXEarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education