FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

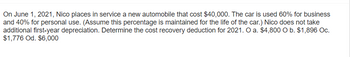

Transcribed Image Text:On June 1, 2021, Nico places in service a new automobile that cost $40,000. The car is used 60% for business

and 40% for personal use. (Assume this percentage is maintained for the life of the car.) Nico does not take

additional first-year depreciation. Determine the cost recovery deduction for 2021. O a. $4,800 O b. $1,896 Oc.

$1,776 Od. $6,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Modified Accelerated Cost Recovery System (MACRS), Listed Property, Limitation on Depreciation of Luxury Automobiles(LO 8.2, 8.4, 8.5) On September 14, 2019, Jay purchased a passenger automobile that is used 75 percent in his accounting business. The automobile has a basis for depreciation purposes of $40,000, and Jay uses the accelerated method under MACRS. Jay does not elect to expense under section 179. Click here to access the depreciation table and click here to access the annual automobile depreciation limitations. TABLE 8.2 Accelerated Depreciation for Personal Property Assuming Half-Year Convention(For Property Placed in Service after December 31, 1986) RecoveryYear 3-Year(200% DB) 5-Year(200% DB) 7-Year(200% DB) 10-Year(200% DB) 15-Year(150% DB) 20-Year(150% DB) 1 33.33 20.00 14.29 10.00 5.00 3.750 2 44.45 32.00 24.49 18.00 9.50 7.219 3 14.81 * 19.20…arrow_forwardIn 2021, Peter Quill had a 5 179 deduction carryover of $40,000. In 2022, Peter elected 5 179 for an asset acquired at a cost of $120,000. Peter's $ 179 business income imitation for 2022 is $130.000. Determine Peter's § 179 deduction for 2022 O a $25,000 Ob $115,000 Oc$130,000 Od $140,000arrow_forwardPincer Company uses the declining balance depreciation method. It buys a machine for $105,600 that has an unknown salvage value and applies a 60% rate. The machine stays in service for 3 full years and is sold for $12,560 on the first day of year 4. Round all answers to the nearest dollar (no cents). Required 1: What depreciation expense will Pincer record in year 2? $ Required 2: What depreciation expense will Pincer record in year 3? $ Required 3: What accumulated depreciation will Pincer Co report at the end of year 2? $ Required 4: What accumulated depreciation will Pincer Co report at the end of year 3? $ Required 5: What is the net book value of the machine that Pincer Co reports at the end of year 2? $ Required 6: What is the net book value of the machine that Pincer Co reports at the end of year 3 provided the selling price is already known? $arrow_forward

- On July 10, 2023, Ariff places in service a new SUV that cost $70,000 and weighed 6,300 pounds. The SUV is used 100% for business. Determine Ariff's maximum deduction for 2023, assuming Ariff's § 179 business income is $110,000. Ariff does not take additional first-year depreciation. A. $14,000 B. $ 28,900 C. $37, 120 D. $70,000 It says that the answer is C but why is that? Please be detailedarrow_forwardHauswirth Corporation sold (or exchanged) a warehouse in year 0. Hauswirth bought the warehouse several years ago for $65,000, and it has claimed $23,000 of depreciation expense against the building. (Loss amounts should be indicated by a minus sign. Leav no answer blank. Enter zero if applicable. Round your final answers to the nearest whole dollar amount.) Required: a. Assuming that Hauswirth receives $50,000 in cash for the warehouse, compute the amount and character of Hauswirth's recognized gain or loss on the sale. b. Assuming that Hauswirth exchanges the warehouse in a like-kind exchange for some land with a fair market value of $50,000, compute Hauswirth's realized gain or loss, recognized gain or loss, deferred gain or loss, and basis in the new land. c. Assuming that Hauswirth receives $20,000 in cash in year O and a $50,000 note receivable that is payable in year 1, compute th amount and character of Hauswirth's gain or loss in year O and in year 1. Complete this question by…arrow_forwardTax Drill - AMT and Depreciation In 2019, Brennen sold a machine used in his business for $180,000. The machine was purchased eight years ago for $340,000. Depreciation up to the date of the sale for regular income tax purposes was $210,000 and $190,000 for AMT purposes. For AMT purposes, Brennen has a negative adjustment of $fill in the blank 2 related to the sale.arrow_forward

- Nonearrow_forwardHhharrow_forwardModified Accelerated Cost Recovery System (MACRS), Election to Expense, Listed Property, Limitation on Depreciation of Luxury Automobiles (LO 8.2, 8.3, 8.4, 8.5) During 2022, William purchases the following capital assets for use in his catering business: New passenger automobile (September 30) Baking equipment (June 30) $66,000 10,000 Assume that William decides to use the election to expense on the baking equipment (and has adequate taxable income to cover the deduction) but not on the automobile, and he also uses the MACRS accelerated method to calculate depreciation but elects out of bonus depreciation. Click here to access the depreciation table and click here to access the annual automobile depreciation limitations. Calculate William's maximum depreciation deduction for 2022, assuming he uses the automobile 100 percent in his business. Xarrow_forward

- 1) Kristine sold one asset on March 20th of 2023. It was a computer with an original basis of $10,000, purchased in May of 2021 and depreciated under the half-year convention. What is Kristine's depreciation deduction for 2023? Note: Round final answer to the nearest whole number. Blank] Blank 1 Add your answerarrow_forwardCarla Vista Products purchased a machine for $66400 on July 1, 2025. The company intends to depreciate it over 8 years using the double-declining balance method. The salvage value is $6700. Depreciation for 2026 to the closest dollar is $8300. O $33200. O $14525. $13200.arrow_forwardces On May 12, 2022, Nelson Incorporated purchased eight passenger automobiles for its business. Nelson did not make a Section 179 election to expense any portion of the cost of the automobiles, which are five-year recovery property subject to the half-year convention. Assume there is no bonus depreciation or Section 179 deduction. Use Table 7-1 and Table 7-2. Use the below table for annual depreciation deduction for year 2022 to 2025: 2022 2023 2024 2025 and subsequent years $ 11, 200 18,000 10,800 6,460 Required: a. Compute Nelson's depreciation deduction with respect to the automobiles for 2022 and 2023 assuming the automobiles were Mini Coopers costing $14,300 each. b. Compute Nelson's depreciation deduction with respect to the automobiles for 2022 and 2023 assuming the automobiles were Cadillacs costing $60,000 each. Complete this question by entering your answers in the tabs below. Required A Required Barrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education