FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

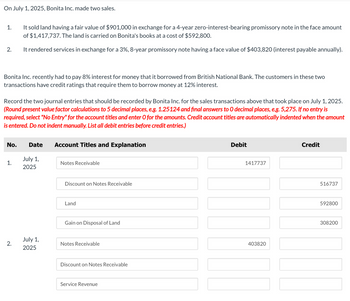

Transcribed Image Text:On July 1, 2025, Bonita Inc. made two sales.

1.

2.

Bonita Inc. recently had to pay 8% interest for money that it borrowed from British National Bank. The customers in these two

transactions have credit ratings that require them to borrow money at 12% interest.

It sold land having a fair value of $901,000 in exchange for a 4-year zero-interest-bearing promissory note in the face amount

of $1,417,737. The land is carried on Bonita's books at a cost of $592,800.

It rendered services in exchange for a 3%, 8-year promissory note having a face value of $403,820 (interest payable annually).

Record the two journal entries that should be recorded by Bonita Inc. for the sales transactions above that took place on July 1, 2025.

(Round present value factor calculations to 5 decimal places, e.g. 1.25124 and final answers to O decimal places, e.g. 5,275. If no entry is

required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when the amount

is entered. Do not indent manually. List all debit entries before credit entries.)

No. Date

1.

2.

July 1,

2025

July 1,

2025

Account Titles and Explanation

Notes Receivable

Discount on Notes Receivable

Land

Gain on Disposal of Land

Notes Receivable

Discount on Notes Receivable

Service Revenue

Debit

1417737

403820

Credit

516737

592800

308200

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Kingbird Corp. sells idle machinery to Enyart Company on July 1, 2020, for $46,000. Kingbird agrees to repurchase this equipment from Enyart on June 30, 2021, for a price of $49,680 (an imputed interest rate of 8%). (a) Prepare the journal entry for Kingbird for the transfer of the asset to Enyart on July 1, 2020. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter O for the amounts.) Account Titles and Explanation Debit Credit eTextbook and Mediaarrow_forwardOn May 1, 2021, AAA and BBB formed a joint operation to acquire and sell a special type of merchandise. The contractual arrangements provide that AAA is to manage the joint operation for a fee and that gain and losses are to be divided equally. On May 1, 2021, BBB invests cash of P52,000, which P50,000 was used to purchase merchandise. AAA incurs expenses amounting to P2,500. On May 20, one half of the merchandise was sold for P36,000 cash. In the books of BBB, the Investment in Joint Operation account on May 30, 2021 would show a balance of:arrow_forwardPresented below are two independent situations: Click here to view factor tables. (a) On January 1, 2025, Splish Inc. purchased land that had an assessed value of $363,000 at the time of purchase. A $561,000, zero- interest-bearing note due January 1, 2028, was given in exchange. There was no established exchange price for the land, nor a ready fair value for the note. The interest rate charged on a note of this type is 12%. Determine at what amount the land should be recorded at January 1, 2025, and the interest expense to be reported in 2025 related to this transaction. (Round intermediate calculation to 5 decimal places, e.g. 0.23451 and final answers to O decimal places, e.g. 38,548.) Land to be recorded at January 1, 2025 $ Interest expense to be reported $arrow_forward

- On January 1, 2025, Sunland Company makes the two following acquisitions. 1. Purchases land having a fair market value of $860,000 by issuing a 5-year, zero-interest-bearing promissory note in the face amount of $1,263,622. 2. Purchases equipment by issuing a 5%, 9-year promissory note having a maturity value of $350,000 (Interest payable annually on January 1). The company has to pay 9% interest for funds from its bank. (a) Record the two journal entries that should be recorded by Sarasota Company for the two purchases on January 1, 2025. (b) Record the interest at the end of the first year on both notes using the effective-interest method.arrow_forwardOn January 1, 2025, Sarasota Corporation sold a building that cost $273,840 and that had accumulated depreciation of $109,280 on the date of sale. Sarasota received as consideration a $263,840 non-interest-bearing note due on January 1, 2028. There was no established exchange price for the building, and the note had no ready market. The prevailing rate of interest for a note of this type on January 1, 2025, was 9%. At what amount should the gain from the sale of the building be reported? (Round factor values to 5 decimal places, e.g. 1.25124 and final answer to 0 decimal places, e.g. 458,581.) The amount of gain should be reported $arrow_forwardIn 2021, TPC Incorporated sold investment land with a $474,000 book and tax basis for $775,000. The purchaser paid $100,000 in cash and gave TPC a note for the $675,000 balance of the price. In 2022, TPC received a $105,500 payment on the note ($67,500 principal + $38,000 interest). Assuming that TPC is using the installment sale method, compute its gain recognized in 2022.arrow_forward

- (a) On January 1, 2025, Skysong Inc. purchased land that had an assessed value of $376,000 at the time of purchase. A $585,000, zero- interest-bearing note due January 1, 2028, was given in exchange. There was no established exchange price for the land, nor a ready fair value for the note. The interest rate charged on a note of this type is 12%. Determine at what amount the land should be recorded at January 1, 2025, and the interest expense to be reported in 2025 related to this transaction. (Round intermediate calculation to 5 decimal places, e.g. 0.23451 and final answers to O decimal places, e.g. 38,548.) Land to be recorded at January 1, 2025 Interest expense to be reported $ $ (b) On January 1, 2025, Concord Furniture borrowed $3,600,000 (face value) from Sinise Co., a major customer, through a zero- interest-bearing note due in 4 years. Because the note was zero-interest-bearing, Concord Furniture agreed to sell furniture to this customer at lower than market price. A 10% rate…arrow_forwardDo not give image formatarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education