FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Please don't provide image based answer..thanku

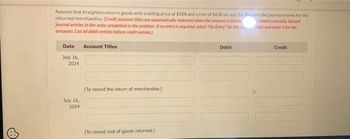

Transcribed Image Text:Assume that Kreighton returns goods with a selling price of $928 and a cost of $630 on July 16. Pare the journal entries for the

returned merchandise. (Credit account titles are automatically indented when the amount is entere

journal entries in the order presented in the problem. If no entry is required, select "No Entry for the

amounts. List all debit entries before credit entries)

indent manually Record

tles and enter O for the

Date Account Titles

July 16,

2024

July 16,

2024

(To record the return of merchandise.)

(To record cost of goods returned.)

Debit

Credit

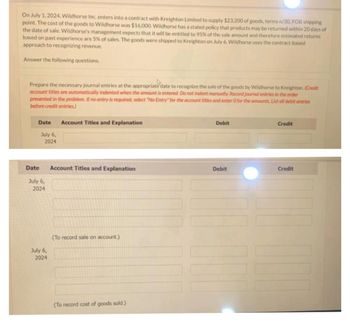

Transcribed Image Text:On July 1, 2024, Wildhorse Inc. enters into a contract with Kreighton Limited to supply $23,200 of goods, terms n/30, FOB shipping

point. The cost of the goods to Wildhorse was $16,000. Wildhorse has a stated policy that products may be returned within 20 days of

the date of sale. Wildhorse's management expects that it will be entitled to 95% of the sale amount and therefore estimated returns

based on past experience are 5% of sales. The goods were shipped to Kreighton on July 6. Wildhorse uses the contract-based

approach to recognizing revenue.

Answer the following questions.

Prepare the necessary journal entries at the appropriate date to recognize the sale of the goods by Wildhorse to Kreighton. (Credit

account titles are automatically indented when the amount is entered. Do not indent manually. Record journal entries in the order

presented in the problem. If no entry is required, select "No Entry" for the account titles and enter O for the amounts List all debit entries

before credit entries)

Date

Date

July 6,

2024

July 6,

2024

July 6,

2024

Account Titles and Explanation

Account Titles and Explanation

(To record sale on account.)

(To record cost of goods sold.)

Debit

Debit

Credit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education