Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Please do not give solution in image format ? And Fast Answering Please And Explain Proper Step by Step.

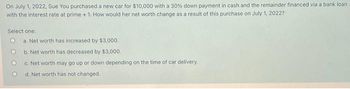

Transcribed Image Text:On July 1, 2022, Sue You purchased a new car for $10,000 with a 30% down payment in cash and the remainder financed via a bank loan

with the interest rate at prime + 1. How would her net worth change as a result of this purchase on July 1, 2022?

Select one:

a. Net worth has increased by $3,000.

b. Net worth has decreased by $3,000.

c. Net worth may go up or down depending on the time of car delivery.

d. Net worth has not changed.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- In the image you can look at the question . Is asking me to choose the correct answer below and fill in the answer box to complete your choice . How can I solve this type of question ?arrow_forwardCan you solve it in an Excel spreadsheet? because something is wrong with the asnwer. tyhank you,arrow_forwardCan you simplify this please.arrow_forward

- Required information [The following information applies to the questions displayed below.] Consider the following narrative describing the process of filling a customer's order at a Starbucks branch: Identify the start and end events and the activities in the following narrative, and then draw the business process model using BPMN: the Starbucks customer entered the drive-through lane and stopped to review the menu. He then ordered a Venti coffee of the day and a blueberry muffin from the barista. The barista recorded the order in the cash register. While the customer drove to the window, the barista filled a Venti cup with coffee, put a lid on it, and retrieved the muffin from the pastry case and placed it in a bag. The barista handed the bag with the muffin and the hot coffee to the customer. The customer has an option to pay with cash, credit card, or Starbucks gift card. The customer paid with a gift card. The barista recorded the payment and returned the card along with the…arrow_forwardPlease correct and incorrect option explain and correct answerarrow_forwardI need this in text not imagesarrow_forward

- Please help me,arrow_forwardPlease don't use chat gpt and other ai other wise I give multiplie downvote Which of the following is sometimes called a currently attainable standard? O a. par b. normal standard O c. theoretical standard d. ideal standardarrow_forwardis there a way to do this question with formulas and a calculator instead of excel? if so please upload the solution this wayarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education