FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

only

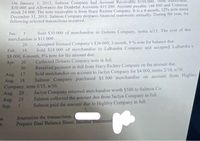

Transcribed Image Text:On January 1, 2012, Salmon Company had Account Receivable S150 000. Note

$30 000 and Allowance for Doubtful Accounts SI5 200, Account payable 140 800 and Common

stock 24 000. The note receivable is from Stacy Richter Company. It is a 4-month, 12% note dated

December 31, 2011. Salmon Company prepares financial statements annually. During the year, the

following selected transactions ocçurred.

ble

Jan.

Sold S30 000 of merchandise to Dolores Company, terms n/15. The cost of this

5

merchandise is $11 000.

Accepted Bernard Company's S30 000, 3-month, 9 % note for balance due.

20

Feb.

Sold $18 000 of merchandise to LaBamba Company and accepted LaBamba's

18

$8 000, 6-month, 9% note for the amount due.

Collected Dolores Company note in full.

Received payment in full from Stacy Richter Company on the amount due.

Sold merchandise on account to Jaclyn Company for $4 000, terms 2/10, n/30.

Salmon Company purchased $1 500 merchandise on account from Highley

20

Apr.

30

Aug.

17

Aug 18

Company, term 5/15, n/30.

Aug. 20

Aug. 25

Sep. 1

Jaclyn Company returned merchandise worth $500 to Salmon Co.

Salmon collected the amount due from Jaclyn Company in full.

Salmon paid the amount due to Highley Company in full

Journalize the transactions.

Prepare final Balance Sheet, Income Statement

a.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Provide the necessary journal entries using the area-of-interest methodarrow_forwardDiamondback Welding & Fabrication Corporation sells and services pipe welding equipment in Illinois. The following selected accounts appear in the ledger of Diamondback Welding & Fabrication at the beginning of the current year: Preferred 2% Stock, $80 par (100,000 shares authorized, 60,000 shares issued) Paid-In Capital in Excess of Par-Preferred Stock Common Stock, $9 par (3,000,000 shares authorized, 1,750,000 shares issued) Paid-In Capital in Excess of Par-Common Stock Retained Earnings During the year, the corporation completed a number of transactions affecting the stockholders' equity. They are summarized as follows: a. Purchased 87,500 shares of treasury common for $8 per share. b. Sold 55,000 shares of treasury common for $11 per share. c. Issued 20,000 shares of preferred 2% stock at $84. d. Issued 400,000 shares of common stock at $13, receiving cash. e. Sold 18,000 shares of treasury common for $7.50 per share. f. Declared cash dividends of $1.60 per share on preferred…arrow_forwardIdentified steps for proving and ruling a journal page. Be specific. Explainarrow_forward

- how to fill in general journalarrow_forwardTrue or false? In a manual system, it is proper to splits journal entry at the bottom page.arrow_forwarda. Assunce tliat perpetual in ventory records are Kept in doller Perpetaal inventory the ending inventoy af fifo is? Lifo? b. If the ending inventoy is onarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education