FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

ssssss

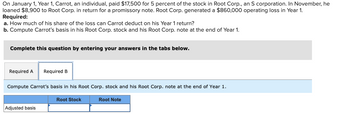

Transcribed Image Text:On January 1, Year 1, Carrot, an individual, paid $17,500 for 5 percent of the stock in Root Corp., an S corporation. In November, he

loaned $8,900 to Root Corp. in return for a promissory note. Root Corp. generated a $860,000 operating loss in Year 1.

Required:

a. How much of his share of the loss can Carrot deduct on his Year 1 return?

b. Compute Carrot's basis in his Root Corp. stock and his Root Corp. note at the end of Year 1.

Complete this question by entering your answers in the tabs below.

Required A Required B

Compute Carrot's basis in his Root Corp. stock and his Root Corp. note at the end of Year 1.

Root Stock

Adjusted basis

Root Note

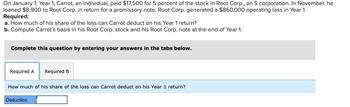

Transcribed Image Text:On January 1, Year 1, Carrot, an individual, paid $17,500 for 5 percent of the stock in Root Corp., an S corporation. In November, he

loaned $8,900 to Root Corp. in return for a promissory note. Root Corp. generated a $860,000 operating loss in Year 1.

Required:

a. How much of his share of the loss can Carrot deduct on his Year 1 return?

b. Compute Carrot's basis in his Root Corp. stock and his Root Corp. note at the end of Year 1.

Complete this question by entering your answers in the tabs below.

Required A Required B

How much of his share of the loss can Carrot deduct on his Year 1 return?

Deduction

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 1 steps

Knowledge Booster

Similar questions

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education