FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

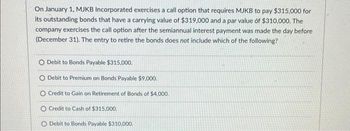

Transcribed Image Text:On January 1, MJKB Incorporated exercises a call option that requires MJKB to pay $315,000 for

its outstanding bonds that have a carrying value of $319,000 and a par value of $310,000. The

company exercises the call option after the semiannual interest payment was made the day before

(December 31). The entry to retire the bonds does not include which of the following?

O Debit to Bonds Payable $315,000.

O Debit to Premium on Bonds Payable $9,000.

O Credit to Gain on Retirement of Bonds of $4,000.

O Credit to Cash of $315,000.

O Debit to Bonds Payable $310,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On July 1, 2021 Concord retired $516,000 of the bonds at 102 plus accrued interest. Concord uses straight-line amortization. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter O for the amounts. Round answers to 0 decimal places, e.g. 5,275.) Account Titles and Explanation Interest Expense Premium on Bonds Payable Cash (To record interest and premium on bonds) Bonds Payable Premium on Bonds Payable Cash Gain on Redemption of Bonds (To record entry for retirement of bonds)) Debit 516000 Creditarrow_forwardNates corporation issued $1,500,000 of 11% of bonds at 97 on Jan 2,2019. Interest is paid semiannually on June 30 and December 31. The bonds had a 10-year life from the date of issue, and the company uses the straight-line method of amortization. On April 30, 2021, Balboa recalls the bonds at the call price of 105 plus accrued interest. Journal entries for 2021 would include:arrow_forwardOso Company purchased a Costco bond for $40,000 on January 1, 2020 at face value with an interest rate of 3% paid and recorded annually on 12/31. Oso Company treats the bond as an available-for-sale investment. 1. On 12/31/20, Oso Company records ALL the entries related to this investment. The fair value of the bond is $45,000. Assume no entries have been recorded to date after the 1/1/20 purchase. Answer the following questions for Oso: a. How much is the investment valued at on Oso's balance sheet? Why is it valued at this amount? b. How much does Oso's net income change by for all entries recorded on 12/31/20 related to this bond? Include the amount and direction. If no change, write no change. 2. On 12/31/21, Oso Company records ALL the entries related to this investment. The fair value of the bond is $42,000. Assume no entries have been recorded since 12/31/20. Answer the following questions for Oso: a. Record the journal entry for any fair value adjustments that are needed. If no…arrow_forward

- On July 1, 2020, West Company purchased for cash, ten $10,000 bonds of North Corporation at a market rate of 6%. The bonds pay 5% interest, payable on a semiannual basis each July 1 and January 1, and mature on July 1, 2023. The bonds are classified as trading securities. The annual reporting period ends December 31. Assume the effective interest method of amortization of any discounts or premiums. Ignore income taxes. a. Prepare a bond amortization schedule for the life of the bonds using the effective interest method. Note: Round each amount entered into the schedule to the nearest whole dollar. Use the rounded amount for later calculations in the schedule. Adjust market interest in the final year of the bond term for any net rounding difference.arrow_forwardOn January 1, 2020 a company purchases bonds as an investment. The company does not have the intent or ability to hold the bonds to maturity and is not in the business of trading investment securities. The bonds have a face value of $150,000, a stated rate of 8.0% and were purchased for $145,000. Interest is payable semiannually on June 30 and December 31 and the bonds mature on December 31, 2024. The company uses the straight line method to amortize any related premium or discount. On December 31, 2020 the bonds have a fair value of $148,000. The bonds are sold on July 1, 2021 for $149,000 (the interest payment received on June 30, 2021 was properly recorded). Required: Provide the journal entries for: acquisition, the first interest payment, the year-end adjustment at 12/31/20, and for the sale on 7/1/21.arrow_forwardOn January 1, 2021, Tiny Tim Industries had outstanding $1,000,000 of 9% bonds with a book value of $965,500. The indenture specified a call price of $982,000. The bonds were issued previously at a price to yield 11% and interest payable semi-annually on July 1 and January 1. Tiny Tim called the bonds (retired them) on July 1, 2021. What is the amount of the loss on early extinguishment?arrow_forward

- BC Corporation sold $55,000,000, 8%, 10-year bonds on January 1, 2022. The bonds apply interest on July 1 and January 1. BC uses the staight-line method to amortize bond premium or discount. Assume no interestaccrued on June 30.Instructions1. Prepare all the necessary journal entries to record the issuance of the bonds and bond interesthappens for 2022, assuming that the bonds sold at 105.2. Prepare journal entries as in part (1) assuming that the bond sold at 98.3. Show statement of financial position presentation for each bond issued at December 31, 2022.arrow_forwardSheridan Corporation retires its $540000 face value bonds at 104 on January 1, following the payment of annual interest. The carrying value of the bonds at the redemption date is $560223. The entry to record the redemption will include a O debit of $1377 to Loss on Bond Redemption. O credit of $21627 to Premium on Bonds Payable. O debit of $21600 to Premium on Bonds Payable. O credit of $1377 to Loss on Bond Redemption.arrow_forwardOn January 1, 2021, the company issued $1,800,000, 6% bonds with a 10-year maturity. The bonds were issued to investors that require an effective interest rate of 9%. The accountant did NOT record the issuance of these bonds. Interest is paid annually and the accountant did NOT record the interest payment transaction. The effective interest method is used to amortize any premium or discount. NOTE – round calculations to nearest dollar. In the Excel spreadsheet, see the tab labelled “Bonds Payable – Series 2” to make any calculations, including an amortization schedule, to support journal entries.arrow_forward

- Please fill pictures out: Tyrell Company Issued callable bonds with a par value of $16,000. The call option requires Tyrell to pay a call premium of $500 plus par (or a total of $16,500) to bondholders to retire the bonds. On July 1, Tyrell exercises the call option. The call option Is exerased after the semannual interest Is paid the day before on June 30. Record the entry to retire the bonds under each separate situation 1. The bonds have a carrying value of $13,500. 2 The bonds have a carrying value of $17,000.arrow_forwardThe Melon Company issues $519,000 of 8%, 10-year bonds at 103 on March 31, Year 1. The bonds pay interest on March 31 and September 30. Assume that the company uses the straight- line method for amortization. Calculate the net balance that will be reported for the bonds on the September 30, Year 1 balance sheet. (Round your intermediate answers to the nearest dollar.) Group of answer choices $533, 791 $535, 349 $519,000 $534, 570arrow_forwardOn April 30, one year before maturity, Middleton Company retired $200,000 of its 9% bonds payable at the current market price of 101 (101% of the bond face amount, or $200,000 × 1.01= $202,000). The bond book value on April 30 is $196,600, reflecting an unamortized discount of $3,400. Bond interest is currently fully paid and recorded up to the date of retirement. What is the gain or loss on retirement of these bonds? Is this gain or loss a real economic gain or loss? Explain.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education