FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

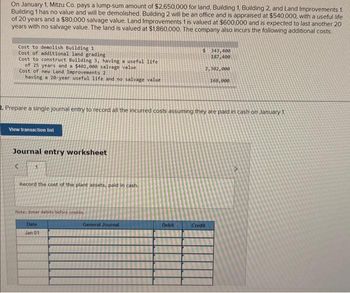

Transcribed Image Text:On January 1, Mitzu Co. pays a lump-sum amount of $2,650,000 for land, Building 1, Building 2, and Land Improvements 1.

Building 1 has no value and will be demolished. Building 2 will be an office and is appraised at $540,000, with a useful life

of 20 years and a $80,000 salvage value. Land Improvements 1 is valued at $600,000 and is expected to last another 20

years with no salvage value. The land is valued at $1,860,000. The company also incurs the following additional costs.

Cost to demolish Building 1

Cost of additional land grading

Cost to construct Building 3, having a useful life

of 25 years and a $402,000 salvage value

Cost of new Land Improvements 2

having a 20-year useful life and no salvage value

View transaction list

Journal entry worksheet

2. Prepare a single journal entry to record all the incurred costs assuming they are paid in cash on January 1

<

Record the cost of the plant assets, paid in cash.

Note: Enter debits before credits.

Date

Jan 01

General Journal

$ 343,400

187,400

Debit

2,302,000

168,000

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On March 1, 2025, Blossom Supply Company acquired real estate, on which it planned to construct a small office buildingby paying $ 80,000 in cashAn old warehouse on the property was demolished at a cost of $8,000; the salvaged materials were sold for $2,000. Additional expenditures before construction began included $1,400 attorney's fee for work concerning the land purchase, $5,400 real estate broker's fee$9,000 architect's fee, and $15,000 to put in driveways and a parking lot.arrow_forwardOn January 1, Mitzu Company pays a lump-sum amount of $2,650,000 for land, Building 1, Building 2, and Land Improvements 1. Building 1 has no value and will be demolished. Building 2 will be an office and is appraised at $750,000, with a useful life of 20 years and a $75,000 salvage value. Land Improvements 1 is valued at $360,000 and is expected to last another 12 years with no salvage value. The land is valued at $1,890,000. The company also incurs the following additional costs. Cost to demolish Building 1 Cost of additional land grading Cost to construct Building 3, having a useful life of 25 years and a $402,000 salvage value Cost of new Land Improvements 2, having a 20-year useful life and no salvage value Required: 1. Allocate the costs incurred by Mitzu to the appropriate columns and total each column. Allocation of Purchase Price Land Building 2 Land Improvements 1 Totals Purchase Price Demolition Land grading New building (Construction cost) New improvements Totals Appraised…arrow_forwardOn March 1, 2027, Crane Company acquired real estate, on which it planned to construct a small office building, by paying $86,500 in cash. An old warehouse on the property was demolished at a cost of $9,500; the salvaged materials were sold for $1,960. Additional expenditures before construction began included $1,460 attorney's fee for work concerning the land purchase, $5,150 real estate broker's fee, $8,960 architect's fee, and $15,300 to put in driveways and a parking lot. (a) Determine the amount to be reported as the cost of the land. Cost of land $ 115950arrow_forward

- 5. On January 1, Mitzu Company pays a lump-sum amount of $2,600,000 for land, Building 1, Building 2, and Land Improvements 1. Building 1 has no value and will be demolished. Building 2 will be an office and is appraised at $793,000, with a useful life of 20 years and a $70,000 salvage value. Land Improvements 1 is valued at $305,000 and is expected to last another 10 years with no salvage value. The land is valued at $1,952,000. The company also incurs the following additional costs. Cost to demolish Building 1 $ 348,400 Cost of additional land grading 187,400 Cost to construct Building 3, having a useful life of 25 years and a $400,000 salvage value 2,202,000 Cost of new Land Improvements 2, having a 20-year useful life and no salvage value 178,000 2. Prepare a single journal entry to record all the incurred costs assuming they are paid in cash on January 1.arrow_forwardPlease help mearrow_forwardOn January 1, Year 1, Lowing Company acquired a patent from Generics Research Corporation for $3 million. The legal life of the patent is 20 years, but Lowing expects to use it for 5 years. Pawson Company has committed to purchase the patent from Lowing for $500,000 at the end of that 5-year period. Lowing uses the straight-line method to amortize intangible assets with finite useful lives. What is the amount of amortization expense each year?arrow_forward

- On July 1, 2024, a company purchased a $550,000 tract of land that is intended to be the site of a new office complex. The company incurred additional costs and realized salvage proceeds during 2024 as follows: Demolition of existing building on site $ 72,000 Legal and other fees to close escrow 12,400 Proceeds from sale of demolition scrap 9,800 What would be the balance in the land account as of December 31, 2024?arrow_forwardBlossom's Drillers erects and places into service an off-shore oil platform on January 1, 2025, at a cost of $8,160,000. Blossom estimates it will cost $1,007,000 to dismantle and remove the platform at the end of its useful life in 10 years, which the company is legally required to do. (The fair value at January 1, 2025, of the dismantle and removal costs is $430,000.) Prepare the entry to record the asset retirement obligation. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List debit entry before credit entry.) Account Titles and Explanation Debit Creditarrow_forwardOn January 1, 2023, Blossom Ltd. acquires a building at a cost of $200,000. The building is expected to have a 20-year life and no residual value. The asset is accounted for under the revaluation model, using the asset adjustment method. Revaluations are carried out every three years. On December 31, 2025, the fair value of the building is appraised at $175,000, and on December 31, 2028, its fair value is $120,000. Blossom applies IFRS. Prepare the journal entries required on December 31, 2025, and the journal entry required on December 31, 2028, to revalue the building, if Blossom uses the proportionate method. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries. Do not round intermediate calculations. Round final answers to O decimal places, e.g. 5,275.) Date ec. 31, 2025 c. 31, 2028 V Account…arrow_forward

- On January 1, Mitzu Company pays a lump-sum amount of $2,600,000 for land, Building 1, Building 2, and Land Improvements 1. Building 1 has no value and will be demolished. Building 2 will be an office and is appraised at $793,000, with a useful life of 20 years and a $75,000 salvage value. Land Improvements 1 is valued at $427,000 and is expected to last another 14 years with no salvage value. The land is valued at $1,830,000. The company also incurs the following additional costs. Cost to demolish Building 1 Cost of additional land grading Cost to construct Building 3, having a useful life of 25 years and a $398,000 salvage value Cost of new Land Improvements 2, having a 20-year useful life and no salvage value Problem 8-3A (Algo) Part 3 3. Using the straight-line method, prepare the December 31 adjusting entries to record depreciation for the first year these assets were in use. View transaction list Journal entry worksheet 2 3 4 Record the year-end adjusting entry for the…arrow_forwardDepletion Expense Prepare the entry to record the cost of the ore mine and year-end adjusting entry. General Journal View transaction list Journal entry worksheet < A B Record the cost of the ore mine in cash. Transaction 1 Note: Enter debits before credits. General Journal Debit Creditarrow_forwardOn January 1, Mitzu Co. pays a lump-sum amount of $2,600,000 for land, Building 1, Building 2, and Land Improvements 1. Building 1 has no value and will be demolished. Building 2 will be an office and is appraised at $644,000, with a useful life of 20 years and a $60,000 salvage value. Land Improvements 1 is valued at $420,000 and is expected to last another 12 years with no salvage value. The land is valued at $1,736,000. The company also incurs the following additional costs. Cost to demolish Building 1 . $ 328,400 Cost of additional land grading. $175,400 Cost to construct Building 3, having a useful life Cost of new Land Improvements 2, having a 20-year of 25 years and a $392,000 salvage value 2,202,000 useful life and no salvage value. 164,000 Required 1. Prepare a table with the following column headings: Land, Building 2, Building 3, Land Improvements 1, and Land Improvements 2. Allocate the costs incurred by Mitzu to the appropriate columns and total each column. 2. Prepare a…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education