FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

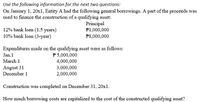

Transcribed Image Text:Use the following information for the next two questions:

On January 1, 20x1, Entity A had the following general borrowings. A part of the proceeds was

used to finance the construction of a qualifying asset:

Principal

P1,000,000

12% bank loan (1.5 years)

10% bank loan (3-year)

P8,000,000

Expenditures made on the qualifying asset were as follows:

Jan.1

P 5,000,000

4,000,000

March 1

August 31

December 1

3,000,000

2,000,000

Construction was completed on December 31, 20x1.

.How much borrowing costs are capitalized to the cost of the constructed qualifying asset?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A company constructs a building for its own use. Construction began on January 1 and ended on December 30. The expenditures for construction were as follows: January 1, $680,000; March 31, $780,000; June 30, $580,000; October 30, $1,140,000. To help finance construction, the company arranged a 9% construction loan on January 1 for $1,060,000. The company's other borrowings, outstanding for the whole year, consisted of a $4 million loan and a $6 million note with interest rates of 10% and 8%, respectively. Assuming the company uses the specific interest method, calculate the amount of interest capitalized for the year. Note: Enter your answers in whole dollars and not in millions. Do not round intermediate calculations. Round your percentage answers to 2 decimal places (i.e. 0.1234 should be entered as 12.34%). Date January 1 March 31 June 30 October 30 Accumulated expenditures Average accumulated expenditures Expenditure Amount X X X Weight Interest Rate % % "1 II = = Average…arrow_forwardThe following information relates to Samson Engineering as at 30 June 2023: RProfit for the year180 000Drawings50 000Property920 000Long-term borrowings510 000Trade receivables380 000Plant and machinery250 000Trade payables180 000Short-term borrowings260 000Fixtures and fittings90 000Inventories420 000Equity at 1 July 20221 175 000Cash45 000Motor vehicles150 000 RequiredCalculate the following:The total non-current assets The total current assetsThe total assetsarrow_forwardInterest During Construction Matrix Inc. borrowed $1,000,000 at 8% to finance the construction of a new building for its own use. Construction began on January 1, 2019, and was completed on October 31, 2019. Expenditures related to this building were: January 1 $252,000 (includes cost of purchasing land of $150,000) May 1 310,000 July 1 420,000 October 31 276,000 In addition, Matrix had additional debt (unrelated to the construction) of $500,000 at 9% and $800,000 at 10%. All debt was outstanding for the entire year. 1. Compute the amount of interest capitalized related to the construction of the building. 2.If the expenditures are assumed to have been incurred evenly throughout the year:a. Compute weighted average accumulated expenditures b. Compute the amount of interest capitalized on the buildingarrow_forward

- sarrow_forwardam.103.arrow_forwardInterest During Construction Dexter Construction Corporation is building a student condominium complex; it started construction on January 1, Year 1. Dexter borrowed $1 million specifically for the project by issuing a 10%, 5-year, $1 million note, which is payable on December 31 of Year 3. Dexter also had a 12%, 5-year, $3 million note payable and a 10%, 10-year, $1.8 million note payable outstanding all year. In Year 1, Dexter incurred costs as follows: January 1 $260,000 March 1 540,000 June 30 1,000,000 November 1 420,000 Calculate Dexter's capitalized interest on the student condominium complex for Year 1. Capitalized interest =arrow_forward

- Isko Company had the following general borrowings during 2021 which were used to finance the construction of the entity's new building. Principal 2,800,000 Borrowing Cost 280,000 10% bank loan 10% short-term note 1,600,000 160,000 2,000,000 6,400,000 The construction began on January 1, 2021 and the building was completed on December 31, 2021. In the first phase of the construction, there were idle funds which the entity invested and earned interest 12% long-term loan 240,000 680,000 income of P62,500. Expenditures on the building were made as follows: January 1 March 31 400,000 1,000,000 June 30 1,200,000 September 30 1,000,000 December 31 400,000 What is the amount of capitalizable borrowing cost? (Use 3 decimal places for capitalization rate.)arrow_forwardam. 85.arrow_forwardOn January 1, 20x1, Lawrence Lenders loaned $9.6 million to Wilkins Food Products, Inc. to purchase a frozen food storage facility. Wilkins signed a three-year, 4% installment note to be paid in three equal payments at the end of each year. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: Prepare the following for Lawrence Lenders: 1. Prepare the journal entry for lending the funds on January 1, 20x1. 2. Prepare an amortization schedule for the three-year term of the installment note. 3. Prepare the journal entry for the first installment payment received on December 31, 20x1. 4. Prepare the journal entry for the third installment payment received on December 31, 20x3. Complete this question by entering your answers in the tabs below. Req 2 Saved Req 1 3 and 4 2021 Prepare an amortization schedule for the three-year term of the installment note. (Enter your answers in whole dollars.) Dec. 31 Cash…arrow_forward

- Horizons plc had the following bank loans outstanding during the whole of 20X8 which form the company’s general borrowings for the year: £m 10% loan repayable 20X9 250 8% loan repayable 20Y2 750 Horizons plc began construction of a qualifying asset on 1 May 20X8 and withdrew funds of £45 million on that date to fund construction. On 1 September 20X8 an additional £60 million was withdrawn for the same purpose. Calculate the borrowing costs which can be capitalised in respect of this project for the year ended 31 December 20X8. Select one: a. £5,000,000 b. £4,250,000 c. £5,418,750 d. £850,000 e. £8,925,000 f. £3,056,250arrow_forwardSubject : Accountingarrow_forwardFrom the following list indicate which of the liabilities that would be classified as current. O a. Deferred revenue on a project that will be completed in 6 months O b. Bank loan payable in 2 years O c. Deferred income taxes O d. Pension liability Oe. The portion of a 10-year bank loan that is due this year O f. Payroll deductions owing to the government Og. A provision for warranty repairs related to a product with a 1-year warranty ype here to search eTextbook and Media 8:arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education