FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

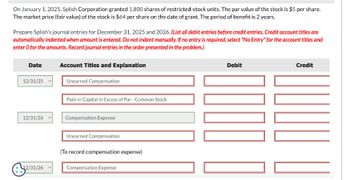

Transcribed Image Text:On January 1, 2025, Splish Corporation granted 1,800 shares of restricted-stock units. The par value of the stock is $5 per share.

The market price (fair value) of the stock is $64 per share on the date of grant. The period of benefit is 2 years.

Prepare Splish's journal entries for December 31, 2025 and 2026. (List all debit entries before credit entries. Credit account titles are

automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and

enter o for the amounts. Record journal entries in the order presented in the problem.)

Date

12/31/25

12/31/26

2/31/26

Account Titles and Explanation

Unearned Compensation

Paid-in Capital in Excess of Par-Common Stock

Compensation Expense

Unearned Compensation

(To record compensation expense)

Compensation Expense

Debit

0000

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Taylor Insurance Company invests $210,000 to acquire $210,000 face value, 5%, five-year corporate bonds on December 31, 2025. The bonds pay interest semiannually on June 30 and December 31 every year until maturity. Assume Taylor Insurance Company uses a calendar year. Based on the information provided, which of the following is the journal entry for the transaction on December 31, 2026? OA. A debit to Cash for $5,250; and a credit to Interest Revenue for $5,250. OB. A debit to Interest Revenue for $5,250; and a credit to Cash for $5,250. OC. A debit to Interest Revenue for $10,500; and a credit to Cash for $10,500. OD. A debit to Cash for $10,500; and a credit to Interest Revenue for $10,500. m 15 tH e THarrow_forwardCan I get the solution for number 2? The Tusquittee company is a retail company that began operating on October 1, 2018, when it incorporated in the state of North Carolina. The Tusquitte Company is authorized to issue 100,000 shares of $1 par value common stock and 50,000 shares of 5 %, $50 par value preferred stock. The Company sells a product that includes a one year warranty and records estimated warranty payable each month. Customers are charged a 6 % state sale tax. The company uses a perpetual inventory system. There are three employees that are paid a monthly salary on the last day of the month. Following is the chart of accounts for The Tusquittee Company. As a new business, all beginning balances are $0arrow_forwardThe Blossom Company issued $310,000 of 10% bonds on January 1, 2020. The bonds are due January 1, 2025, with interest payable each July 1 and January 1. The bonds were issued at 99. Prepare the journal entries for (a) January 1, (b) July 1, and (c) December 31. Assume The Blossom Company records straight-line amortization semiannually. (If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date an. 1, 2020 ly 1, 2020 ec. 31, 2020 - Account Titles and Explanation Debit Credit Parrow_forward

- On January 2, 2018, Sunland Corporation, a small company that follows ASPE, issued $2.6 million of 7% bonds at 98 due on December 31, 2027. Legal and other costs of $260,000 were incurred in connection with the issue. Sunland has a policy of capitalizing and amortizing the legal and other costs incurred by including them with the bond recorded at the date of issuance. Interest on the bonds is payable each December 31. The $260,000 of issuance costs are being deferred and amortized on a straight-line basis over the 10- year term of the bonds. The discount on the bonds is also being amortized on a straight-line basis over the 10 years. (The straight-line method is not materially different in its effect compared with the effective interest method.) The bonds are callable at 105 (that is, at 105% of their face amount), and on January 2, 2023, the company called a face amount of $1,400,000 of the bonds and retired them. (a) Ignoring income taxes, calculate the amount of loss, if any, that…arrow_forwardOn October 31, 2020, the Village of Lexington issued $1,000,000 of 3% general obligation serial bonds. The bonds pay interest on April 30 and October 31. Starting on October 31, 2021, the first of 20 equal annual serial payments of $50,000 was made. At December 31, 2022, what is the amount of accrued but unmatured interest that is not reported by the debt service fund? A. $4,875. B. $5,000. C. $4,500. D. $4,750.arrow_forwardOn June 30, 2020, an interest payment date, $200,000 of Hawk Co. bonds were converted into 5,000 shares of Hawk Co. common stock each having a par value of $38 and a market value of $44. There is $8,000 unamortized premium on the bonds. Using the book value method, Hawk would record the following journal entry at the time of conversion:arrow_forward

- The Blossom Company issued $260,000 of 10% bonds on January 1, 2020. The bonds are due January 1, 2025, with interest payable each July 1 and January 1. The bonds were issued at 98.Prepare the journal entries for (a) January 1, (b) July 1, and (c) December 31. Assume The Blossom Company records straight-line amortization semiannually. (If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually.) No. Date Account Titles and Explanation Debit Credit (a) choose a transaction date Jan. 1, 2020July 1, 2020Dec. 31, 2020 enter an account title enter a debit amount enter a credit amount enter an account title enter a debit amount enter a credit amount enter an account title enter a debit amount enter a credit amount (b) choose a transaction date…arrow_forwardOn January 2, 2018, Crane Corporation, a small company that follows ASPE, issued $1.8 million of 11% bonds at 98 due on December 31, 2027. Legal and other costs of $180,000 were incurred in connection with the issue. Crane has a policy of capitalizing and amortizing the legal and other costs incurred by including them with the bond recorded at the date of issuance. Interest on the bonds is payable each December 31. The $180,000 of issuance costs are being deferred and amortized on a straight-line basis over the 10- year term of the bonds. The discount on the bonds is also being amortized on a straight-line basis over the 10 years. (The straight-line method is not materially different in its effect compared with the effective interest method.) The bonds are callable at 103 (that is, at 103% of their face amount), and on January 2, 2023, the company called a face amount of $1,000,000 of the bonds and retired them. (a) Ignoring income taxes, calculate the amount of loss, if any, that the…arrow_forwardThe Martinez Company issued $230,000 of 12% bonds on January 1, 2020. The bonds are due January 1, 2025, with interest payable each July 1 and January 1. The bonds were issued at 103.Prepare the journal entries for (a) January 1, (b) July 1, and (c) December 31. Assume The Martinez Company records straight-line amortization semiannually.arrow_forward

- A corporation issues $300,000, 10%, 5-year bonds on January 1, 2020, for $287,400. Interest is paid annually on January 1. If the corporation uses the straight-line method of amortization of bond discount, the amount of bond interest expense to be recognized in December 31, 2020’s adjusting entry is Group of answer choices $32,250 $30,000 $27,480 $2,520arrow_forwardPrepare all journal entries and adjusting journal entries necessary to record the information below for 2022: Red Robin holds corporate bonds with a face value of $218,500. It purchased these bonds on January 1 of the prior year (2021). The stated rate of the bonds is 4.85 %, but they were purchased at an effective rate of 7%. The bonds are 5-year bonds and pay interest on December 31 every year. Red Robin correctly classifies this investment as available for sale. This is the only AFS debt investment that Red Robin has ever had. The fair value of the bond on December 31 of the current year is $224,900.arrow_forwardOn the first day of the fiscal year, a company issues a $674,000, 7%, 10-year bond that pays semiannual interest of $23,590 ($674,000 x 7% x 1/2), receiving cash of $707,700. Journalize the entry for the first interest payment and amortization of premium using the straight-line method. If an amount box does not require an entry, leave it blank.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education