FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

please answer coorect and complete with all working

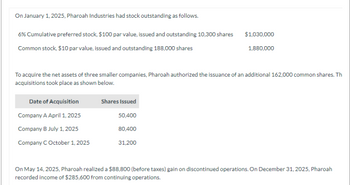

Transcribed Image Text:On January 1, 2025, Pharoah Industries had stock outstanding as follows.

6% Cumulative preferred stock, $100 par value, issued and outstanding 10,300 shares

Common stock, $10 par value, issued and outstanding 188,000 shares

To acquire the net assets of three smaller companies, Pharoah authorized the issuance of an additional 162,000 common shares. Th

acquisitions took place as shown below.

Date of Acquisition

Company A April 1, 2025

Company B July 1, 2025

Company C October 1, 2025

$1,030,000

1,880,000

Shares Issued

50,400

80,400

31,200

On May 14, 2025, Pharoah realized a $88,800 (before taxes) gain on discontinued operations. On December 31, 2025, Pharoah

recorded income of $285,600 from continuing operations.

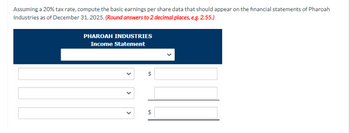

Transcribed Image Text:Assuming a 20% tax rate, compute the basic earnings per share data that should appear on the financial statements of Pharoah

Industries as of December 31, 2025. (Round answers to 2 decimal places, e.g. 2.55.)

PHAROAH INDUSTRIES

Income Statement

10

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The communication process consists of many stages. In which stage of the communication the receiver interprets the message and translates it into meaningful information? O a. Feedback O b. Noise Oc. Encoding O d. Decodingarrow_forwardIn your own words explain the agency theory and give atleast2 personal experience.arrow_forwardCAN I SEE THE MANUAL WORKING OF THE PROBLEMarrow_forward

- When doing activities using an ABC system, what sequence is recommended?arrow_forwardProvide Answer plsarrow_forwardNo single ratio can predict the success or Failure of a company. What different types of Ratios are necessary for financial analysis? How is the Return on Assets (ROA) Ratio Calculated?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education