FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

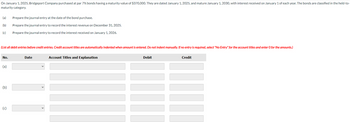

Transcribed Image Text:On January 1, 2025, Bridgeport Company purchased at par 7% bonds having a maturity value of $370,000. They are dated January 1, 2025, and mature January 1, 2030, with interest received on January 1 of each year. The bonds are classified in the held-to-

maturity category.

(a) Prepare the journal entry at the date of the bond purchase.

(b)

Prepare the journal entry to record the interest revenue on December 31, 2025.

(c)

Prepare the journal entry to record the interest received on January 1, 2026.

(List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.)

No.

(a)

(b)

(c)

Date

11

Account Titles and Explanation

Debit

Credit

III

Expert Solution

arrow_forward

Step 1 Introduction

Journal Entry :— It is an act of recording transaction in books of account when transaction occurred.

Bond :— It is one of the type of securities that pays fixed periodic interest and face value of amount at the end of maturity term to their investors.

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On April 1, 2020, Quicke Mart issued $1,000,000, 9% bonds at par plus accrued interest dated January 1, 2020. Interest is payable semi-annually on January 1 and July 1. The bonds mature on January 1, 2027. Required: Prepare journal entries to record the following transactions related to long-term bonds of Quicke Mart: 1. The issuance of the bonds. 2. The first interest payments.arrow_forwardOn January 1, 2020, Ehrlich Corporation issued 7%, 15-year bonds with a face amount of $5,000,000 .InstructionsPrepare the following entries: Round to the nearest dollar when necessary.a. record the issuance of the bonds on 1/1/20, assuming the bonds were issued at 102b. prepare the entry for the interest accrual and amortization on 12/31/20.c. calculate the balance of the unamortized premium and the carrying value of the bond at 12/31/20. Show your calculations.d. record the issuance of the bonds on 1/1/20, assuming the bonds were issued at 100e. prepare the entry for the redemption of the bonds at maturityarrow_forwardCrane Company redeemed $178,000 face value, 17.5% bonds on June 30, 2022, at 98. The carrying value of the bonds at the redemption date was $190,000. The bonds pay annual interest, and the interest payment due on June 30, 2022, has been made and recorded. Prepare the appropriate journal entry for the redemption of the bonds.arrow_forward

- Volunteer Inc. issued bonds with a $650,000 face value, 12% interest rate, and a 4-year term on July 1, 2018 and received $700,000. Interest is payable annually. The premium is amortized using the straight-line method. A. July 1, 2018: entry to record issuing the bonds B. June 30, 2019: entry to record payment of interest to bondholders C. June 30, 2019: entry to record amortization of premium D. June 30, 2020: entry to record payment of interest to bondholders E. June 30, 2020: entry to record amortization of premium Prepare journal entries for the above transactions. If an amount box does not require an entry, leave it blank. A. July 1, 2018 Cash Bonds Payable Premium on Bonds Payable B. June 30, 2019 Interest Expense Cash C. June 30, 2019 Premium on Bonds Payable Interest Expense D. June 30, 2020 Interest Expense Cash E. June 30, 2020 Premium on Bonds Payable Interest Expensearrow_forwardGrocery Corporation received $301,001 for 13.50 percent bonds issued on January 1, 2021, at a market interest rate of 10.50 percent. The bonds had a total face value of $255,000, stated that interest would be paid each December 31, and stated that they mature in 10 years. Assume Grocery Corporation uses the effective-interest method to amortize the bond premium. Required: 1. & 2. Prepare the required journal entries to record the bond issuance and the first interest payment on December 31. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field. Round your answers to the nearest whole dollar.) View transaction list Journal entry worksheet Record the issuance of bonds with a face value of $255,000 for $301,001. Note: Enter debits before credits. Date January 011 Cash General Journal Premium on Bonds Payable Bonds Payable Debit Creditarrow_forwardNovak Corp. redeemed $148,000 face value, 12% bonds on April 30, 2022, at 102. The carrying value of the bonds at the redemption date was $134,500. The bonds pay annual interest, and the interest payment due on April 30, 2022, has been made and recorded. Prepare the appropriate journal entry for the redemption of the bonds.arrow_forward

- Ellis Company issues 6.5%, five-year bonds dated January 1, 2021, with a $250,000 par value. The bonds pay interest on June 30 and December 31 and are issued at a price of $255,333. The annual market rate is 6% on the issue date. Required: 1. Compute the total bond interest expense over the bonds' life. 2. Prepare an effective interest amortization table for the bonds' life. 3. Prepare the journal entries to record the first two interest payments.arrow_forwardOn January 1, 2018, for $17.4 million, Cenotaph Company purchased 8% bonds, dated January 1, 2018, with a face amount of $19.4 million. For bonds of similar risk and maturity, the market yield is 10%. Interest is paid semiannually on June 30 and December 31. Required: 1. Prepare the journal entry to record interest on June 30, 2018, using the effective interest method. 2. Prepare the journal entry to record interest on December 31, 2018, using the effective interest method. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare the journal entry to record interest on June 30, 2018, using the effective interest method. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in whole dollars.) View transaction list Journal entry worksheet 1 > Record the entry to interest on June 30, 2018, using the effective interest method. Note: Enter debits before credits. Date General…arrow_forwardOn May 1, 2024, Green Corporation issued $1,200,000 of 8% bonds, dated January 1, 2024, for $1,104,000 plus accrued interest. The market rate of interest was 9%.The bonds pay interest semiannually on june 30 and december 31,.Green's fiscal year ends on December 31 each year. Determine the amount of accrued interest that was included in the proceeds received from the bond sale. Prepare the journal entry for the issuance of the bonds. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.). Need answer in detail with explanation computation formulas with stepsarrow_forward

- Ellis Company issues 8.5 %, five - year bonds dated January 1, 2021, with a $540,000 par value. The bonds pay interest on June 30 and December 31 and are issued at a price of $550, 969. The annual market rate is 8.0% on the issue date. Required: Compute the total bond interest expense over the bonds' life. Prepare an effective interest amortization table for the bonds' life. Prepare the journal entries to record the first two interest payments.arrow_forwardOn January 1, 2024, Instaform, Incorporated, issued 14% bonds with a face amount of $50 million, dated January 1. The bonds mature in 2043 (20 years). The market yield for bonds of similar risk and maturity is 16%. Interest is paid semiannually. Required: 1-a. Determine the price of the bonds at January 1, 2024. 1-b. Prepare the journal entry to record their issuance by Instaform. 2-a. Assume the market rate was 12%. Determine the price of the bonds at January 1, 2024. 2-b. Assume the market rate was 12%. Prepare the journal entry to record their issuance by Instaform. 3. Assume Broadcourt Electronics purchased the entire issue in a private placement of the bonds. Using the data in requirement 2, prepare the journal entry to record the purchase by Broadcourt.arrow_forwardPrepare journal entries to record the following transactions relating to long-term bonds of Lancaster Inc. Show calculations and round to the nearest dollar. a) On June 1, 2023, Lancaster Inc. issued $400,000, 6% bonds for $391,760, including accrued interest. The bonds were dated February 1, 2023, and interest is payable semi-annually on February 1 and August 1 with the bonds maturing on February 1, 2033. The bonds are callable at 102. b) On August 1, 2023, Lancaster paid the semi-annual interest and recorded the amortization of the discount or premium, using straight-line amortization. c) On February 1, 2025, Lancaster paid the semi-annual interest and recorded amortization of the discount or premium. Assume that a reversing entry was made on January 1, 2025. d) The company then purchased $240,000 of the bonds at the call price Do not give…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education