FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

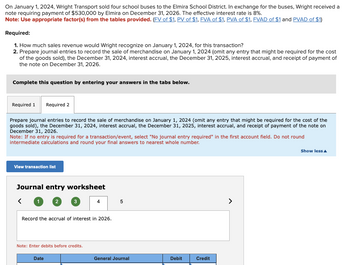

Transcribed Image Text:On January 1, 2024, Wright Transport sold four school buses to the Elmira School District. In exchange for the buses, Wright received a

note requiring payment of $530,000 by Elmira on December 31, 2026. The effective interest rate is 8%.

Note: Use appropriate factor(s) from the tables provided. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1)

Required:

1. How much sales revenue would Wright recognize on January 1, 2024, for this transaction?

2. Prepare journal entries to record the sale of merchandise on January 1, 2024 (omit any entry that might be required for the cost

of the goods sold), the December 31, 2024, interest accrual, the December 31, 2025, interest accrual, and receipt of payment of

the note on December 31, 2026.

Complete this question by entering your answers in the tabs below.

Required 1

Required 2

Prepare journal entries to record the sale of merchandise on January 1, 2024 (omit any entry that might be required for the cost of the

goods sold), the December 31, 2024, interest accrual, the December 31, 2025, interest accrual, and receipt of payment of the note on

December 31, 2026.

Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round

intermediate calculations and round your final answers to nearest whole number.

View transaction list

Journal entry worksheet

>

<

1 2 3

4

5

Record the accrual of interest in 2026.

Note: Enter debits before credits.

Date

General Journal

Debit

Credit

Show less▲

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Pina Co. is building a new hockey arena at a cost of $2,510, 000. It received a downpayment of $490,000 from local businesses to support the project, and now needs to borrow $ 2,020,000 to complete the project. It therefore decides to issue $2,020,000 of 10.0 %, 10- year bonds. These bonds were issued on January 1, 2024, and pay interest annually on each January 1. The bonds yield 9% . Assume that on July 1, 2027, Pina Co. redeems half of the bonds at a cost of $1,079, 300 plus accrued interest. Prepare the journal entry to record this redemption.arrow_forwardMargery Corp. received $100,000 in interest from a bank this year, $80,000 of municipal bond interest. Margery Corp. paid $5,000 of interest expense on loans it secured to purchase the municipal bonds. What is the total, net BTD associated with these investments? Group of answer choices $75,000 favorable, permanent $85,000 favorable, permanent $80,000 favorable, permanent $85,000 favorable, temporaryarrow_forwardOn December 31, 2025, Cullumber Company acquired a computer from Plato Corporation by issuing a $614,000.00 zero-interest- bearing note, payable in full on December 31, 2029. Cullumber Company's credit rating permits it to borrow funds from its several lines of credit at 10%. The computer is expected to have a 5-year life and a $76,000 salvage value. Click here to view factor tables. (a) Prepare the journal entry for the purchase on December 31, 2025. (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and the final answers to 2 decimal places, eg. 58,971.23. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries.) Date Account Titles and Explanation December 31,2025 eTextbook and Media List of Accounts Debit Creditarrow_forward

- please help answerarrow_forwardPittston County has an empty school building with a net book value of $700,000 and a remaining life of 10 years with no expected residual value. The building is leased to the City of Lincoln at the start of the current year for 10 years. Annual payments are set at $103,565 to reflect Pittston’s implicit interest rate of 10 percent per year. This rate is known by both parties. The first payment is made immediately. What revenue and expense does Pittston report in the first year on government wide statements? What expense does Lincoln report in the first year on government wide statements?arrow_forwardOn January 1, 20x1, Lawrence Lenders loaned $9.6 million to Wilkins Food Products, Inc. to purchase a frozen food storage facility. Wilkins signed a three-year, 4% installment note to be paid in three equal payments at the end of each year. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: Prepare the following for Lawrence Lenders: 1. Prepare the journal entry for lending the funds on January 1, 20x1. 2. Prepare an amortization schedule for the three-year term of the installment note. 3. Prepare the journal entry for the first installment payment received on December 31, 20x1. 4. Prepare the journal entry for the third installment payment received on December 31, 20x3. Complete this question by entering your answers in the tabs below. Req 2 Saved Req 1 3 and 4 2021 Prepare an amortization schedule for the three-year term of the installment note. (Enter your answers in whole dollars.) Dec. 31 Cash…arrow_forward

- Riverbed Co. is building a new music arena at a cost of $5,652,000. It received a down payment of $642,000 from local businesses to support the project, and now needs to borrow $5,010,000 to complete the project. It therefore decides to issue $5,010,000 of 7%, 20- year bonds. These bonds were issued on January 1, 2024, and pay interest annually on each January 1. The bonds yield 9%. Prepare the journal entry to record the issuance of the bonds on January 1, 2024. (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and the final answer to O decimal place e.g. 58,971. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries.) Date Account Titles and Explanation January 1,2024 Cash Discount on Bonds Payable Bonds Payable Debit 4095316 914684 Credit 5010000 Prepare a bond amortization…arrow_forwardOn January 1, 2024, Wright Transport sold four school buses to the Elmira School District. In exchange for the buses, Wright received a note requiring payment of $535,000 by Elmira on December 31, 2026. The effective interest rate is 5%. Note: Use appropriate factor(s) from the tables provided. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Required: How much sales revenue would Wright recognize on January 1, 2024, for this transaction? Prepare journal entries to record the sale of merchandise on January 1, 2024 (omit any entry that might be required for the cost of the goods sold), the December 31, 2024, interest accrual, the December 31, 2025, interest accrual, and receipt of payment of the note on December 31, 2026.arrow_forwardOn January 1, 2021, Glanville Company sold goods to Otter Corporation. Otter signed an installment note requiring payment of $21,500 annually for five years. The first payment was made on January 1, 2021. The prevailing rate of interest for this type of note at date of issuance was 10%. Glanville should record sales revenue in January 2021 of: (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Multiple Choice $107,500 $81,502 $89,652 None of these answer choices are correct.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education