Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Note:-

- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism.

- Answer completely.

- You will get up vote for sure.

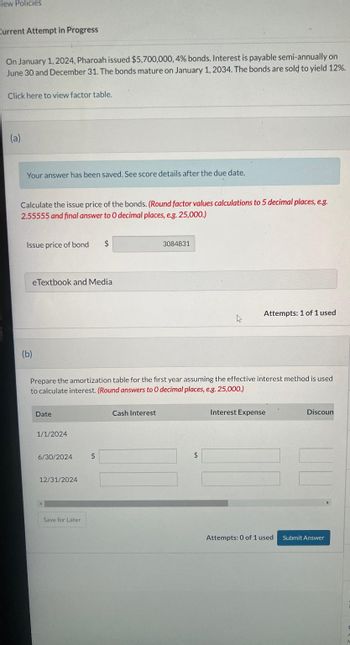

Transcribed Image Text:"iew Policies

Current Attempt in Progress

On January 1, 2024, Pharoah issued $5,700,000, 4% bonds. Interest is payable semi-annually on

June 30 and December 31. The bonds mature on January 1, 2034. The bonds are sold to yield 12%.

Click here to view factor table.

(a)

Your answer has been saved. See score details after the due date.

Calculate the issue price of the bonds. (Round factor values calculations to 5 decimal places, e.g.

2.55555 and final answer to O decimal places, e.g. 25,000.)

Issue price of bond $

eTextbook and Media

(b)

Date

1/1/2024

Prepare the amortization table for the first year assuming the effective interest method is used

to calculate interest. (Round answers to O decimal places, e.g. 25,000.)

6/30/2024

12/31/2024

Save for Later

$

3084831

Cash Interest

4

$

Attempts: 1 of 1 used

Interest Expense

Attempts: 0 of 1 used

Discoun

Submit Answer

F

A

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 4 images

Knowledge Booster

Similar questions

- Tacit or implicit knowledge, is personal, experiential, context-specific, and hard to formalize and communicate. True Falsearrow_forwardDavid Savage asked you to write a memo presenting the issues and the risks associated withconsultants. Further, outline a set of procedures that could be used as a guide in selecting aconsultant.arrow_forwardAssume that you accept the following ethical rule: “Failure to tell the whole truth is wrong.” In the textbook illustration about Santos’s problem with Ellis’s instructions, (a) what would this rule require Santosto do and (b) why is an unalterable rule such as this classified as an element of imperative ethical theory?arrow_forward

- Please do not rely too much on chatgpt, because its answer may be wrong. Please consider it carefully and give your own answer. You can borrow ideas from gpt, but please do not believe its answer.Very very grateful!Please do not rely too much on chatgpt, because its answer may be wrong. Please consider it carefully and give your own answer. You can borrow ideas from gpt, but please do not believe its answer.Very very grateful!arrow_forwarddiscuss how critical thinking skills will make you less likely to be influenced by arguments that are based on fallacies and faulty reasoning.arrow_forwardWhy does scope creep create risk in independence? Select all that apply It can create an unfair advantage in the marketplace. It can decrease costs. It can lead to unintentionally providing a prohibited service to a restricted entity. It can cause non-compliance with KPMG policies on independence.arrow_forward

- Karen finds that many claim forms were rejected because important information was omitted. How might Karen suggest corrections for these omissions?arrow_forwardUrgent Please answer a soon as possible. Answer must be plagirism free What is the role of auditors and explain the importance of the role.arrow_forwardThe phrase “except for the possible effects of the matter described…” appears in an audit report. This could be what type of opinion? a. Qualified Adverse Disclaimer Yes Yes No b. Qualified Adverse Disclaimer Yes No No c. Qualified Adverse Disclaimer No No Yes d. Qualified Adverse Disclaimer No Yes No e. Qualified Adverse Disclaimer Yes Yes Yesarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education