FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

devrat

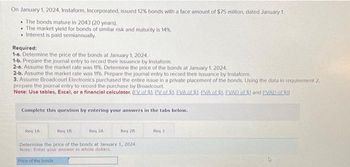

Transcribed Image Text:On January 1, 2024, Instaform, Incorporated, issued 12% bonds with a face amount of $75 million, dated January 1.

The bonds mature in 2043 (20 years).

The market yield for bonds of similar risk and maturity is 14%.

• Interest is paid semiannually.

Required:

1-8. Determine the price of the bonds at January 1, 2024.

1-b. Prepare the journal entry to record their issuance by Instaform.

2-a. Assume the market rate was 11%. Determine the price of the bonds at January 1, 2024.

2-b. Assume the market rate was 11%. Prepare the journal entry to record their issuance by Instaform.

3. Assume Broadcourt Electronics purchased the entire issue in a private placement of the bonds. Using the data in requirement 2,

prepare the journal entry to record the purchase by Broadcourt.

Note: Use tables, Excel, or a financial calculator. (EV of $1. PV of $1. EVA of $1. PVA of SJ. EVAD of 51 and PVAD of S1)

Complete this question by entering your answers in the tabs below.

Req 1A

Req 18

Req 2A

Reg 28

Determine the price of the bonds at January 1, 2024.

Note: Enter your answer in whole dollars.

Price of the bonds

Req 3

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Step 1: Introduction

VIEW Step 2: Computation of the issue price of bonds by Instaform, Incorporated:

VIEW Step 3: Journal entry to record their issuance by Instaform:

VIEW Step 4: Computation of the issue price of bonds by Instaform, Incorporated:

VIEW Step 5: Journal entry to record their issuance by Instaform:

VIEW Solution

VIEW Trending nowThis is a popular solution!

Step by stepSolved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education