FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

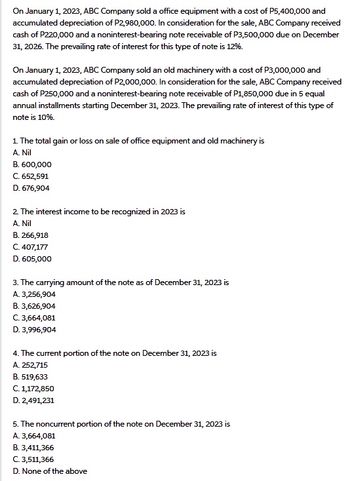

Transcribed Image Text:On January 1, 2023, ABC Company sold a office equipment with a cost of P5,400,000 and

accumulated depreciation of P2,980,000. In consideration for the sale, ABC Company received

cash of P220,000 and a noninterest-bearing note receivable of P3,500,000 due on December

31, 2026. The prevailing rate of interest for this type of note is 12%.

On January 1, 2023, ABC Company sold an old machinery with a cost of P3,000,000 and

accumulated depreciation of P2,000,000. In consideration for the sale, ABC Company received

cash of P250,000 and a noninterest-bearing note receivable of P1,850,000 due in 5 equal

annual installments starting December 31, 2023. The prevailing rate of interest of this type of

note is 10%.

1. The total gain or loss on sale of office equipment and old machinery is

A. Nil

B. 600,000

C. 652,591

D. 676,904

2. The interest income to be recognized in 2023 is

A. Nil

B. 266,918

C. 407,177

D. 605,000

3. The carrying amount of the note as of December 31, 2023 is

A. 3,256,904

B. 3,626,904

C. 3,664,081

D. 3,996,904

4. The current portion of the note on December 31, 2023 is

A. 252,715

B. 519,633

C. 1,172,850

D. 2,491,231

5. The noncurrent portion of the note on December 31, 2023 is

A. 3,664,081

B. 3,411,366

C. 3,511,366

D. None of the above

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step 1: Define note receivable

VIEW Step 2: Compute the total gain or loss on sale of assets

VIEW Step 3: Compute the interest income for 2023

VIEW Step 4: Calculate carrying amount of the note as on 31 December 2023

VIEW Step 5: Compute current portion of the note

VIEW Step 6: Compute the non-current portion of the note on 31 December 2023

VIEW Solution

VIEW Step by stepSolved in 7 steps with 10 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On December 31, 2019, Univ Corporation sold for 50,000 an old machine having an original cost of 90,000 and a book value of 40,000. The terms of the sale were as follows: 10,000 down payment 20,000 payable on December 31 each of the next two years The agreement of sale made no mention of interest; however, 9% would be a fair rate for this type of transaction. What should be the amount of the notes receivable net of the unamortized discount on December 31, 2020 rounded to the nearest dollar? (Round your present value factor to 5 digits).arrow_forwardOn January 1, 2025, Shetland Company loans $252,510 to Durham Corporation in exchange for a $300,000 zero-interest-bearing note payable in 2 years. The market rate of interest for a transaction of this nature for Durham is 9%. The present value of 1, 2 years out at 9% is 0.8417. Shetland Company has a calendar year-end and it uses the effective-interest method. Prepare journal entries on 1/1/25 to recognize the loan for Shetland Companyarrow_forwardOn February 1, 20x1, TSR Co. sold machinery with historical cost of P3,000,000 and accumulated depreciation of P900,000 in exchange for a 3-year, P2,100,000 noninterest-bearing note receivable due in equal semi-annual payments every August 1 and February 1 starting on August 1, 20x1. The prevailing rate of interest for this type of note is 10%. How much is the interest income in 20x2?arrow_forward

- On January 1, 2021, Anna Company sold a piece of equipment to Banana Company with a cost of P3,500,000 and accumulated depreciation of P600,000 in exchange for an annual 10% interest-bearing note, P3,000,000. Banana is required to make four equal annual payments of principal plus interest. What is the interest income for the year 2022?arrow_forwardOn Jan. 1, 2021, Yumi Co. settled a P 1,000,000 loan payable with an unamortized discount of P 20,000 and accrued interest of P 90,000 by transferring to the lender old equipment with cost of P 3,000,000, accumulated depreciation of P 2,200,000 and fair value of P 900,000. How much gain on extinguishment of debt is to be recognized? a. P 270,000b. P 290,000c. P 250,000d. P 150,000arrow_forwardOn January 1, 2018, Apple Company sold delivery equipment costing P1,000,000 with accumulated depreciation of P150,000 in exchange for a 3-year, P1,800,000 noninterest bearing note receivable due on December 31, 2020. The prevailing market rate of interest for this type of note is 12%. How much is the gain or loss on sale of delivery equipment in 2018?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education