FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

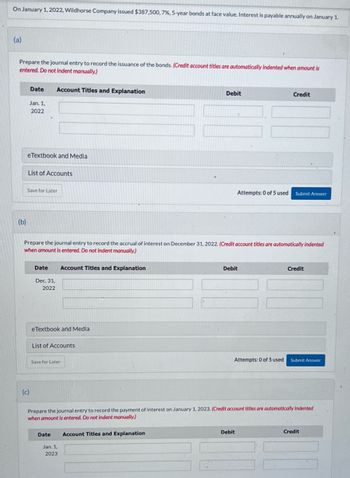

Transcribed Image Text:On January 1, 2022, Wildhorse Company issued $387,500, 7%, 5-year bonds at face value. Interest is payable annually on January 1.

(a)

Prepare the journal entry to record the issuance of the bonds. (Credit account titles are automatically indented when amount is

entered. Do not indent manually.)

(b)

Date

Jan. 1,

2022

eTextbook and Media

List of Accounts

Save for Later

(c)

Account Titles and Explanation

Date

Dec. 31,

2022

Prepare the journal entry to record the accrual of interest on December 31, 2022. (Credit account titles are automatically indented

when amount is entered. Do not indent manually.)

eTextbook and Media

Account Titles and Explanation

List of Accounts

Save for Later

Date

Jan. 1,

2023

Debit

Account Titles and Explanation

Credit

Attempts: 0 of 5 used Submit Answer

Debit

Prepare the journal entry to record the payment of interest on January 1, 2023. (Credit account titles are automatically Indented

when amount is entered. Do not indent manually.)

Debit

Credit

Attempts: 0 of 5 used Submit Answer

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Culver Corporation issued 2,800 9%, 7-year, $1,000 bonds dated January I, 2022, at face value. Interest is paid. each January I. what is the journal entry to record the sale of these bonds on January I, 2022. what is the adjusting journal entry on December 31, 2022, to record interest expense. what is the journal entry on January I, 2023, to record interest paid.arrow_forwardThe following section is taken from Wildhorse's balance sheet at December 31, 2021. Current liabilities Interest payable Long-term liabilities Bonds payable (8%, due January 1, 2025) (a) Interest is payable annually on January 1. The bonds are callable on any annual interest date. $33,000 Date 412,500 Journalize the payment of the bond interest on January 1, 2022. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Jan. 1, 2022 Account Titles and Explanation Debit Creditarrow_forwardKingbird, Inc. issues $4.1 million, 10-year. 9% bonds at 102, with interest payable on January 1. The straight-line method is used to amortize bond premium (a) Your answer is partially correct Prepare the journal entry to record the sale of these bonds on January 1, 2022. (Credit account titles are automatically indented when amount is entered. Do not indent manually) Date Account Tities and Explanation Jan 1 Cash Premium on Bonds Payable Bons Payable Debit 369000 82000 Credit 4100000arrow_forward

- Randle Inc. issues $300,000, 10-year, 8% bonds at 98. Prepare the journal entry to record the sale of these bonds on March 1, 2020. what is the account title or explanation ? what is debit or credited?arrow_forwardDate Account Titles and Explanation Debit Credit 1/1/20 7/1/20 12/31/20arrow_forwardPlease answer question completely. This is one question with multiple parts please answer each part correctly and completelyarrow_forward

- On August 1, 2022, Martinez Corp. issued $489,600, 6%, 10-year bonds at face value. Interest is payable annually on August 1. Martinez’s year-end is December 31. Prepare the journal entry to record the issuance of the bonds. Date Account Titles and Explanation Debit Credit Aug. 1 enter an account title to record the issuance of the bonds on August 1enter an account title to record the issuance of the bonds on August 1arrow_forwardBlossom Company issues $360,000, 20-year, 10% bonds at 101. Prepare the journal entry to record the sale of these bonds on June 1, 2022. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Account Titles and Explanation Debit Creditarrow_forwardThe balance sheet for Ivanhoe Consulting reports the following information on July 1, 2020. Long-term liabilities Bonds payable $4,500,000 Less: Discount on bonds payable 315,000 $4,185,000 Ivanhoe decides to redeem these bonds at 101 after paying annual interest.Prepare the journal entry to record the redemption on July 1, 2020. what is the account title or explanation? what is debit or credited?arrow_forward

- On the first day of the fiscal year, a company issues a $980,000, 8%, 5-year bond that pays semiannual interest of $39,200 ($980,000 × 8% × 1/2), receiving cash of $884,177. Required: Journalize the entry to record the issuance of the bonds. Refer to the Chart of Accounts for exact wording of account titles. Chart Of Accounts CHART OF ACCOUNTS General Ledger ASSETS 110 Cash 111 Petty Cash 112 Accounts Receivable 113 Allowance for Doubtful Accounts 114 Notes Receivable 115 Interest Receivable 121 Merchandise Inventory 122 Supplies 131 Prepaid Insurance 140 Land 151 Building 152 Accumulated Depreciation-Building 153 Equipment 154 Accumulated Depreciation-Equipment LIABILITIES 210 Accounts Payable 221 Salaries Payable 231 Sales Tax Payable 241 Notes Payable 242 Interest Payable 251 Bonds Payable 252 Discount on Bonds Payable 253 Premium on Bonds Payable EQUITY 310…arrow_forwardLegacy issues $740,000 of 7.5%, four-year bonds dated January 1, 2021, that pay interest semiannually on June 30 and December 31. They are issued at $680,186 when the market rate is 10%. 4. Prepare the journal entries to record the first two interest payments.arrow_forwardHawar Company issued $400,000 of bonds on January 1, 2020. Required: Prepare the journal entry to record the redemption of the bonds before maturity at 97. Assume the balance in Premium on Bonds Payable is $4,000. For the toolbar presS ALT+F10 (PC) or ALT+EN+F10 (Mac)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education