FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:(b)

The parts of this question must be completed in order. This part will be available when you complete the part above.

(c)

The parts of this question must be completed in order. This part will be available when you complete the part above.

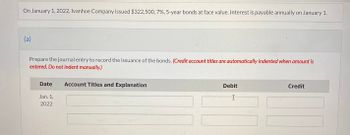

Transcribed Image Text:On January 1, 2022, Ivanhoe Company issued $322,500, 7%, 5-year bonds at face value. Interest is payable annually on January 1.

(a)

Prepare the journal entry to record the issuance of the bonds. (Credit account titles are automatically indented when amount is

entered. Do not indent manually.)

Date

Jan. 1,

2022

Account Titles and Explanation

Debit

I

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Wildhorse Co. issued $575,500 of 5-year, 5% bonds at 98 on January 1, 2020. The bonds pay interest annually.arrow_forwardOn January 1, 2020, Ehrlich Corporation issued 7%, 10-year bonds with a face amount of $800,000 at 97. Interest is payable annually on January 1. Instructions Prepare the following entries: record the issuance of the bonds on 1/1/20 first annual interest accrual on 12/31/20 amortization, assuming that the company uses straight-line amortization on 12/31/20 payment of interest on 1/1/21 What is the unamortized balance of the discount account at 1/1/21? What is the carrying value of the bond at 1/1/21?.arrow_forwardThe following section is taken from Crane's balance sheet at December 31, 2024. Current liabilities Interest payable Long-term liabilities Bonds payable (9%, due January 1, 2028) (a) (b) $41,000 Interest is payable annually on January 1. The bonds are callable on any annual interest date. (c) 510,000 Journalize the payment of the bond interest on January 1, 2025. Assume that on January 1, 2025, after paying interest, Crane calls bonds having a face value of $105,000. The call price is 105. Record the redemption of the bonds. Prepare the adjusting entry on December 31, 2025, to accrue the interest on the remaining bonds.arrow_forward

- On January 1, 2025, Entity D issued $1,000,000 of 7%, 5-year bonds at 98. The bonds pay interest annually on December 31 and Entity D amortizes any premium or discount using the straight-line method. What is the annual interest expense on the bonds? $66,000. $74,000. $4,000. $70,000.arrow_forwardSubject:: accountingarrow_forward1. On January 1, 2025, Waterway Company issued $408,000 of 9%, 10-year bonds at par. Interest is payable quarterly on April 1. July 1, October 1, and January 1. 2. On June 1, 2025, Wildhorse Company issued $360,000 of 11%, 10-year bonds dated January 1 at par plus accrued interest. Interest is payable semiannually on July 1 and January 1. For each of these two independent situations, prepare journal entries to record the following. (If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries.) a. The issuance of the bonds. b. The payment of interest on July 1. с The accrual of interest on December 31. Date Account Titles and Explanation Debit Credit 1. Waterway Company: 2. Wildhorse Company:arrow_forward

- On January 1st 2023, MSI Inc issues $500,000 4%, 6 year bonds at face value. Prepare the entry to record the issuance of the bonds.arrow_forwardMango Co. issued bonds payable on January 1, 2022. Each $1,000 bond is convertible to 10 shares of common stock after January 1, 2024. The bonds have a 5-year term, a stated rate of 8%, and pay interest annually on January 1. The bonds were issued at a premium of $25,274 which provides an effective interest rate of 6%. (Hint: Prepare an amortization table for the five-year term of the bonds. Note that 2023 is the second year in the term of the bonds.) Prepare the adjusting entry at Dec. 31 , 2023.arrow_forwardAggies Inc. issued bonds with a $450,000 face value, 8% interest rate, and a 4-year term on July 1, 2018, and received $510,000. Interest is payable semi-annually. The premium is amortized using the straight-line method. A. July 1, 2018: entry to record issuing the bonds B. Dec. 31, 2018: entry to record payment of interest to bondholders C. Dec. 31, 2018: entry to record amortization of premium Prepare journal entries for the above transactions. If an amount box does not require an entry, leave it blank. A. fill in the blank 2 fill in the blank 3 fill in the blank 5 fill in the blank 6 fill in the blank 8 fill in the blank 9 B. fill in the blank 11 fill in the blank 12 fill in the blank 14 fill in the blank 15 C.arrow_forward

- (d) What will be the total interest payments over the five-year life of the bonds? Total interest expense? Total interest payments Total interest expensearrow_forwardMarigold Corporation issued $660,000 of 6% bonds on May 1,2025 . The bonds were dated January 1,2025 , and mature January 1 , 2028 , with interest payable July 1 and January 1 . The bonds were issued at face value plus accrued interest. Prepare Marigold's journal entries for (a) the May 1 issuance, (b) the July 1 interest payment, and (c) the December 31 adjusting entry.arrow_forwardOn January 1, 2019, Grant Corporation issued $4,000,000, 10-year, 8% bonds at 102. Interest is payable semiannually on January 1 and July 1. The journal entry to record this transaction on January 1, 2019 includes a O credit to Premium on Bonds Payable 80,000 O debit to Cash for 4,000,000 O debit to Premium on Bonds Payable 80,000 O credit to Bonds Payable for 4,080,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education