FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

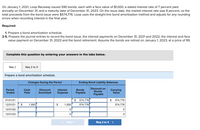

Transcribed Image Text:On January 1, 2021, Loop Raceway issued 590 bonds, each with a face value of $1,000, a stated interest rate of 7 percent paid

annually on December 31, and a maturity date of December 31, 2023. On the issue date, the market interest rate was 8 percent, so the

total proceeds from the bond issue were $574,776. Loop uses the straight-line bond amortization method and adjusts for any rounding

errors when recording interest in the final year.

Required:

1. Prepare a bond amortization schedule.

2-5. Prepare the journal entries to record the bond issue, the interest payments on December 31, 2021 and 2022, the interest and face

value payment on December 31, 2023 and the bond retirement. Assume the bonds are retired on January 1, 2023, at a price of 99.

Complete this question by entering your answers in the tabs below.

Req 1

Req 2 to 5

Prepare a bond amortization schedule.

Changes During the Period

Ending Bond Liability Balances

Discount

Amortized

Interest

Expense

Discount on

Bonds

Payable

Carrying

Value

Period

Cash

Bonds

Ended

Paid

Payable

01/01/21

$

574,776

$

574,776

12/31/21

$

1,000

$

1,000

574,776

574,776

12/31/22

12/31/23

< Req 1

Req 2 to 5 >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Claremont Inc. issued a $400,000 bond on January 1, 2020. The bond had a five-year life and an 8% stated rate of interest. The bond contract requires Claremont to pay semiannual dividends each June 30 and December 31. The market rate of interest on January 1, 2020 when Claremont issued the bond was 6%. Required: 1. Use Excel to determine the cash proceeds from the bond issue on January 1, 2020. 2. Use Excel to construct a bond amortization table for the five-year life of the bond. 3. Record the journal entries for the bond in 2020. 4. Report the effects of the bond on the 2020 income statement and cash flows statement and the balance sheet on December 31, 2020arrow_forwardOn January 1, 2021, Loop Raceway issued 500 bonds, each with a face value of $1,000, a stated interest rate of 7 percent paid annually on December 31, and a maturity date of December 31, 2023. On the issue date, the market interest rate was 8 percent, so the total proceeds from the bond issue were $487,099. Loop uses the straight-line bond amortization method and adjusts for any rounding errors when recording interest in the final year. Required: 1. Prepare a bond amortization schedule. 2-5. Prepare the journal entries to record the bond issue, the interest payments on December 31, 2021 and 2022, the interest and face value payment on December 31, 2023 and the bond retirement. Assume the bonds are retired early on January 1, 2023 instead of at their maturity date of 12/31/2023, record the entry to retire the bonds early assuming a price of 99.arrow_forwardTamarisk Ltd. issued a $1,076,000, 10-year bond dated January 1, 2023. The bond was sold at 98.8% interest was payable on the bond on January 1 and July 1 each year. The company's year-end was December 31, and Tamarisk followed ASPE, and chose to use the straight-line amortization method. Prepare the journal entries for the given dates. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Record journal entries in the order presented in the problem. List all debit entries before credit entries.) Date || | | Account Titles and Explanation Debit Credit ||arrow_forward

- Bonds with a stated interest rate of 9% and a face value totaling $610,000 were issued for $634 400 on January 1.2021 whe market interest rate was 8%. The company uses effective-interest bond amortization Required: Determine the carrying value of the bonds at December 31, 2022. (Round your answer to nearest whole dolar) Carrying Valuearrow_forwardOn January 1, 2023, Larkspur Corporation purchased a newly issued $1,500,000 bond. The bond matured on December 31, 2025, and paid interest at 6% every June 30 and December 31. The market interest rate was 8%. Larkspur's fiscal year-end is October 31, and the company had the intention and ability to hold the bond until its maturity date. The bond will be accounted using the amortized cost model. Calculate the price paid for the bond using a financial calculator or Excel functions. (Round answers to 2 decimal places, eg. 52.75.) the price paid for the bond is $ 1,421,367.95arrow_forwardOn June 30, 2021, the market interest rate is 5%. Champs Corporation issues $600,000 of 10%, 30-year bonds payable. The bonds pay interest on June 30 and December 31. The company amortizes bond premium using the effective-interest method. Read the requirements. Requirement 1. Use the PV function in Excel to calculate the issue price of the bonds. (Round your answer to the nearest whole dollar.) The issue price of the bonds is Requirements 1. 2. 3. Use the PV function in Excel to calculate the issue price of the bonds. Prepare a bond amortization table for the first four semiannual interest periods. Record the issuance of bonds payable on June 30, 2021; the payment of interest on December 31, 2021; and the payment of interest on June 30, 2022. Print Done Xarrow_forward

- Ellis Company issues 6.5%, five-year bonds dated January 1, 2021, with a $250,000 par value. The bonds pay interest on June 30 and December 31 and are issued at a price of $255,333. The annual market rate is 6% on the issue date. Required: 1. Compute the total bond interest expense over the bonds' life. 2. Prepare an effective interest amortization table for the bonds' life. 3. Prepare the journal entries to record the first two interest payments.arrow_forwardOn January 1, 2021, QuantumQuarry Co. issued a 5-year bond with a face value of $500,000. The bond pays interest semi-annually on July 1 and January 1. At the time of issuance, the market rate was 8% for similar bonds. Quantum Quarry's fiscal year ends on December 31, and it uses the effective-interest method to amortize bond discount or premium. Related to this bond, Quantum Quarry's records show the following on December 31, 2021. Bond Payable, 10%, carrying amount Interest Payable $533,664 25,000 3. On January 1, 2023, immediately after paying interest to bondholders QuantumQuarry redeemed 20% of the outstanding bond at 102. Show how the presentation of this transaction would be reported on: a. Statement of cash flows b. Income statement c. Balance Sheetarrow_forwardEllis Company issues 8.5 %, five - year bonds dated January 1, 2021, with a $540,000 par value. The bonds pay interest on June 30 and December 31 and are issued at a price of $550, 969. The annual market rate is 8.0% on the issue date. Required: Compute the total bond interest expense over the bonds' life. Prepare an effective interest amortization table for the bonds' life. Prepare the journal entries to record the first two interest payments.arrow_forward

- On January 1, 2018, Methodical Manufacturing issued 100 bonds, each with a face value of $1,000, a stated interest rate of 8 percent paid annually on December 31, and a maturity date of December 31, 2020. On the issue date, the market interest rate was 7.25 percent, so the total proceeds from the bond issue were $101,959. Methodical uses the effective-interest bond amortization method and adjusts for any rounding errors when recording interest in the final year. Prepare the journal entry to record the bond issue, interest payments on December 31, 2018 and 2019, interest and face value payment on December 31, 2020 and the bond retirement. Assume the bonds are retired on January 1, 2020, at a price of 102.arrow_forwardOn January 1, 2021, Solis Co. issued its 10% bonds in the face amount of P3,000,000, which mature on January 1, 2026. The bonds were issued for P3,405,000 to yield 8%, resulting in bond premium of P405,000. Solis uses the effective-interest method of amortizing bond premium. Interest is payable annually on December 31. At December 31, 2021, the carrying value of the bonds should be a.) P3,405,000 b.) P3,377,400 c.) P3,364,500 d.) P3,304,500arrow_forwardOn September 30, 2023, when the market interest rate is 9 percent, Score Ltd. issues $8,000,000 of 11-percent, 20-year bonds for $9,472,126. The bonds pay 30. Score Ltd, amortizes bond premium by the effective-interest method. Required 1. Prepare an amortization table for the first four semi-annual interest periods. Score amortizes a bond premium by the effective-interest method. 2. Record the issuance of the bonds on September 30, 2023, the accrual of interest on December 31, 2023, and the semi-annual interest payment on March 3 Requirement 1. Prepare an amortization table for the first four semi-annual interest periods. (Round your answers to the nearest whole dollar.) B: Interest Expense (4.5% of Preceding Bond Carrying Amount) A: Interest Payment Semi-annual Interest (5.5% of Maturity Period Values) Issue date. March 31, 2024 September 30, 2024 March 31, 2025 September 30, 2025 440,000 440,000 440,000 440,000 426,245 C: Premium Amortization (A-B) 13,755 D: Unamortized Premium…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education