FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Intermediate Accounting ll ch 16

5. On January 1, 2021, Ameen Company purchased major pieces of manufacturing equipment for a total of $48 million. Ameen uses straight-line

Required:

- Prepare the appropriate

journal entry to record Ameen’s 2024 income taxes. Assume an income tax rate of 25%. - What is Ameen’s 2024 net income?

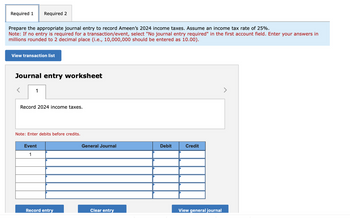

Transcribed Image Text:Required 1

Prepare the appropriate journal entry to record Ameen's 2024 income taxes. Assume an income tax rate of 25%.

Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in

millions rounded to 2 decimal place (i.e., 10,000,000 should be entered as 10.00).

Required 2

View transaction list

Journal entry worksheet

1

Record 2024 income taxes.

Note: Enter debits before credits.

Event

1

Record entry

General Journal

Clear entry

Debit

Credit

View general journal

Transcribed Image Text:Required 1 Required 2

What is Ameen's 2024 net income?

Note: Enter your answers in millions rounded to 2 decimal place (i.e., 10,000,000 should be entered as 10.00).

Net income

million

< Required 1

Required 2

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please explain proper steps by Step and Do Not Give Solution In Image Format ? And Fast Answering Please ?arrow_forwarddarrow_forwardQ3: Global Manufacturing Company purchased new equipment on April 29, 2020, at a cost of $80000. Useful life of this equipment was estimated at 4 years, with an estimated residual value of $5000. For income tax purpose, this equipment is classified as “5-years property”.Instructions: Compute the annual depreciation expense for each year until this equipment becomes fully depreciated under each of depreciation method listed below. i) Straight-line, with depreciation for fractional years rounded to the nearest whole month. ii) 200%- declining-balance, with the half-year convention.arrow_forward

- 7. Several years ago, Pentair purchased equipment for $23,500,000. Pentair uses straight-line depreciation for financial reporting and accelerated depreciation for tax purposes. At December 31, 2020, the carrying value of the equipment was $21,150,000 and its tax basis was $17,625,000. At December 31, 2021, the carrying value of the equipment was $18,800,000 and the tax basis was $12,925,000. There were no other temporary differences and no permanent differences. Pretax accounting income for the current year was $28,500,000. A tax rate of 25% applies to all years. Required:Prepare the journal entry to record Pentair's income tax expense for the current year. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)arrow_forward9arrow_forwardQuestion 4 On July 1, 2022, Pepperpot Company made a lump sum purchase of an office building, including the land and some fixtures, for cash of $550,000. The tax assessments for the past year reflected the following: Land, $48,000; Building, $168,000; and Fixtures, $24,000. Pepperpot believes they will use the building for another 20 years at which time they expect to sell it of $45,000. The fixtures only have a five year life and Pepperpot expects they will have a residual value of $2,000 when they are sold. Pepperpot depreciates their real estate holdings on a straight line basis. All fixtures are depreciated using declining balance method. a. b. c. Prepare the journal entry to record the acquisition. Show your work. Prepare any year end adjustments required. Show how the assets will be presented on the December 31, 2022 financial statements.arrow_forward

- B. If Flint prepares financial statements in accordance with ASPE, what is the recoverable amount of the equipment at November 30, 2023? Recoverable amount $arrow_forwardDepreciation as a Tax Shield The term tax shield refers to the amount of income tax saved by deducting depreciation for income tax purposes. Assume that Supreme Company is considering the purchase of an asset as of January 1, 2017. The cost of the asset with a five-year life and zero residual value is $123,300. The company will use the straight-line method of depreciation. Supreme's income for tax purposes before recording depreciation on the asset will be $46,900 per year for the next five years. The corporation is currently in the 30% tax bracket. Required: Calculate the amount of income tax that Supreme must pay each year if the asset is and is not purchased. 1. Amount of taxes paid if asset is not purchased is: $fill in the blank 1 2a. Amount of depreciation if asset is purchased is: $fill in the blank 2 b. Amount of taxes paid if asset is purchased is: $fill in the blank 3 3. What is the amount of the depreciation tax shield? $fill in the blank 4arrow_forward3arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education