FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

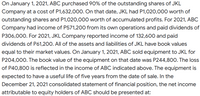

Transcribed Image Text:On January 1, 2021, ABC purchased 90% of the outstanding shares of JKL

Company at a cost of P1,632,000. On that date, JKL had P1,020,000 worth of

outstanding shares and P1,020,000 worth of accumulated profits. For 2021, ABC

Company had income of P571,200 from its own operations and paid dividends of

P306,000. For 2021, JKL Company reported income of 132,600 and paid

dividends of P61,200. All of the assets and liabilities of JKL have book values

equal to their market values. On January 1, 2021, ABC sold equipment to JKL for

P204,000. The book value of the equipment on that date was P244,800. The loss

of P40,800 is reflected in the income of ABC indicated above. The equipment is

expected to have a useful life of five years from the date of sale. In the

December 21, 2021 consolidated statement of financial position, the net income

attributable to equity holders of ABC should be presented at:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On January 1, 2021, Alamar Corporation acquired a 36 percent interest in Burks, Inc., for $198,000. On that date, Burks’s balance sheet disclosed net assets with both a fair and book value of $353,000. During 2021, Burks reported net income of $84,000 and declared and paid cash dividends of $24,000. Alamar sold inventory costing $27,000 to Burks during 2021 for $35,000. Burks used all of this merchandise in its operations during 2021. Prepare all of Alamar’s 2021 journal entries to apply the equity method to this investment. 4. Record the collection of dividend from investee.arrow_forwardB.On January 1, 2021, LASER LTD. acquired 70% of outstanding ordinary shares of JUSTICE INC. at a price of P210,000. On the same date, the net assets of JUSTICE INC. were reported at P260,000. On January 1, 2021, LASER LTD. reported retained earnings of P2,000,000 while JUSTICE INC. reported retained earnings of P200,000. All the assets and liabilities of JUSTICE INC. are fairly valued except machinery, which is undervalued by P80,000 and inventory which is overvalued by P10,000. The said machinery has remaining useful life of five years while 40% of the said inventory remained unsold at the end of 2021. For the year ended December 31, 2021, LASER LTD. reported net income of P1,000,000 and declared dividends of P200,000 in the separate financial statements while JUSTICE INC. reported net income of P150,000 and declared dividends of P20,000 in the separate financial statements. LASER LTD. accounted the investment in JUSTICE INC. using cost method in the separate financial statements.…arrow_forwardOn January 1, 2021 ABC purchased 80% of the outstanding shares of DEF at a cost of $960,000. On that date, DEF had $600,000 worth of outstanding shares and $60,000 worth of accumulated profits. For 2021, ABC had income of $336,000 from its own operations and paid dividends of $180,000. For 2021, DEF reported income of $64,000 and paid dividends of $36,000. All of the assets and liabilities of DEF have book values equal to their market value. On January 1, 2021, ABC sold equipment to DEF for $120,000. The book value of the equipment on that was $144,000. The loss of $24,000 is reflected in the net income of indicated above. The equipment is expected to have a useful life of five years from the date of the sale. In the December 31, 2021 consolidated statement of financial position, the non- controlling interest in net assets of Subsidiary should be presented at O 284,400 O 240,000 O 245,600 O 255,600arrow_forward

- On January 1, 2021, Alamar Corporation acquired a 36 percent interest in Burks, Inc., for $198,000. On that date, Burks’s balance sheet disclosed net assets with both a fair and book value of $353,000. During 2021, Burks reported net income of $84,000 and declared and paid cash dividends of $24,000. Alamar sold inventory costing $27,000 to Burks during 2021 for $35,000. Burks used all of this merchandise in its operations during 2021. Prepare all of Alamar’s 2021 journal entries to apply the equity method to this investment 1. Record the acquisition of a 36 percent interest in Burksarrow_forwardOn May 31, 2021, Oriole Company paid $3,675,000 to acquire all of the common stock of Pharoah Corporation, which became a division of Oriole. Pharoah reported the following balance sheet at the time of the acquisition: Current assets $ 945,000 Current liabilities $ 630,000 Noncurrent assets 2,835,000 Long-term liabilities 525,000 Stockholder's equity 2,625,000 Total assets $3,780,000 Total liabilities and stockholder's equity $3,780,000 It was determined at the date of the purchase that the fair value of the identifiable net assets of Pharoah was $3,255,000. At December 31, 2021, Pharoah reports the following balance sheet information: Current assets $ 840,000 Noncurrent assets (including goodwill recognized in purchase) 2,520,000 Current liabilities (735,000 ) Long-term liabilities (525,000 ) Net assets $2,100,000 It is determined that the fair value of the Pharoah division is $2,310,000.…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education