FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

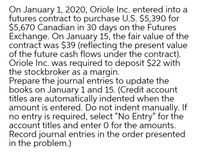

Transcribed Image Text:On January 1, 2020, Oriole Inc. entered into a

futures contract to purchase U.S. $5,390 for

$5,670 Canadian in 30 days on the Futures

Exchange. On January 15, the fair value of the

contract was $39 (reflecting the present value

of the future cash flows under the contract).

Oriole Inc. was required to deposit $22 with

the stockbroker as a margin.

Prepare the journal entries to update the

books on January 1 and 15. (Credit account

titles are automatically indented when the

amount is entered. Do not indent manually. If

no entry is required, select "No Entry" for the

account titles and enter 0 for the amounts.

Record journal entries in the order presented

in the problem.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On 1 January 2019, Azzurri Berhad sold a stock item with a cost of RM50,000 to Mancini Berhad. The terms of the sale include a five-yearly instalment of RM15,000, each payable at the end of every year. The cash selling price of the stock is RM60,000. An effective interest rate of 7.931% should be used in any calculations With reference to relevant Malaysian Financial Reporting Standards (MFRS), prepare the respective journal entries for the years ended 31 December 2019 and 31 December 2020arrow_forwardOn June 1, Maxwell Corporation (a U.S.-based company) sold goods to a foreign customer at a price of 1,110,000 pesos and will receive payment in three months on September 1. On June 1, Maxwell acquired an option to sell 1,110,000 pesos in three months at a strike price of $0.076. The time value of the option is excluded from the assessment of hedge effectiveness, and the change in time value is recognized in net income over the life of the option. Relevant exchange rates and option premia for the peso are as follows: Date June 1 June 30 September 1 Maxwell must close its books and prepare its second-quarter financial statements on June 30. a-1. Assuming that Maxwell designates the foreign currency option as a cash flow hedge of a foreign currency receivable, prepare journal entries for the export sale and related hedge in U.S. dollars. a-2. What is the impact on net income over the two accounting periods? b-1. Assuming that Maxwell designates the foreign currency option as a fair value…arrow_forwardOn October 1, 2024, Wildhorse Corporation ordered some equipment from a supplier for 322,000 euros. Delivery and payment are to occur on November 15, 2024. The spot rates on October 1 and November 15, 2024, are $1.20 and $1.30, respectively. (a) - Your answer is partially correct. Assume that Wildhorse entered into a forward contract on October 1, 2024, to hedge the firm commitment. The forward rates for euros for November 15 delivery were October 1 November 15 $1.23 $1.30 Furthermore, assume the equipment was purchased and paid for on November 15. Prepare all journal entries needed to record and settle the hedge and to record the purchase of the equipment. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.)arrow_forward

- Icebreaker Company (a U.S.-based company) sells parts to a foreign customer on December 1, 2020, with payment of 16,000 dinars to be received on March 1, 2021. Icebreaker enters into a forward contract on December 1, 2020, to sell 16,000 dinars on March 1, 2021. The forward points on the forward contract are excluded in assessing hedge effectiveness and are amortized to net income using a straight-line method on a monthly basis. Relevant exchange rates for the dinar on various dates are as follows: Date Spot Rate Forward Rate(to March 1, 2021) December 1, 2020 $ 3.40 $ 3.475 December 31, 2020 3.50 3.600 March 1, 2021 3.65 N/A Icebreaker must close its books and prepare financial statements at December 31. a-1. Assuming that Icebreaker designates the forward contract as a cash flow hedge of a foreign currency receivable, prepare journal entries for the sale and foreign currency forward contract in U.S. dollars. a-2. What is the impact on…arrow_forwardOn January 1, 2021, Glanville Company sold goods to Otter Corporation. Otter signed an installment note requiring payment of $21,500 annually for five years. The first payment was made on January 1, 2021. The prevailing rate of interest for this type of note at date of issuance was 10%. Glanville should record sales revenue in January 2021 of: (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Multiple Choice $107,500 $81,502 $89,652 None of these answer choices are correct.arrow_forwardRequired Information On January 1, 2024, Avalanche Corporation borrowed $102,000 from First Bank by issuing a two-year, 8% fixed-rate note with annual interest payments. The principal of the note is due on December 31, 2025. • Avalanche wanted to hedge against declines in general interest rates, so it also entered into a two-year SOFR-based interest rate swap agreement on January 1, 2024, and designates it as a fair value hedge. Because the swap is entered at market rates, the fair value of the swap is zero at inception. • The agreement called for the company to receive fixed interest at the current SOFR swap rate of 5% and pay floating interest tied to SOFR. This arrangement results in an effective variable rate on the note of SOFR + 3%. • The contract specifies that the floating rate resets each year on June 30 and December 31 for the net settlement that is due the following period. In other words, the net cash settlement is calculated using beginning-of-period rates. The SOFR rates…arrow_forward

- On January 1, 2021, Labtech Circuits borrowed $300,000 from First Bank by issuing a three-year, 6% note, payable on December 31, 2023. Labtech wanted to hedge the risk that general interest rates will decline, causing the fair value of its debt to increase. Therefore, Labtech entered into a three-year interest rate swap agreement on January 1, 2021, and designated the swap as a fair value hedge. The agreement called for the company to receive payment based on an 8% fixed interest rate on a notional amount of $300,000 and to pay interest based on a floating interest rate tied to LIBOR. The contract called for cash settlement of the net interest amount on December 31 of each year. Floating (LIBOR) settlement rates were 8% at inception and 9%, 7%, and 7% at the end of 2021, 2022, and 2023, respectively. The fair values of the swap are quotes obtained from a derivatives dealer. These quotes and the fair values of the note are as follows: January 1 December 31 2021 2021 2022 2023…arrow_forwardi need the answer quicklyarrow_forwardOn June 1, Maxwell Corporation (a U.S.-based company) sold goods to a foreign customer at a price of 1,170,000 pesos and will receive payment in three months on September 1. On June 1, Maxwell acquired an option to sell 1,170,000 pesos in three months at a strike price of $0.082. The time value of the option is excluded from the assessment of hedge effectiveness, and the change in time value is recognized in net income over the life of the option. Relevant exchange rates and option premia for the peso are as follows: Put Option Premium Spot Date for September 1 Rate (strike price $0.082) June 1 S 0.082 June 30 0.081 September 1 0.080 $ 0.0045 0.0032 N/A Maxwell must close its books and prepare its second-quarter financial statements on June 30. a-1. Assuming that Maxwell designates the foreign currency option as a cash flow hedge of a foreign currency receivable, prepare journal entries for the export sale and related hedge in U.S. dollars. a-2. What is the impact on net income over…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education