FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

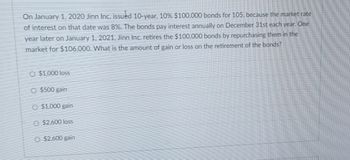

Transcribed Image Text:On January 1, 2020 Jinn Inc. issued 10-year, 10% $100,000 bonds for 105. because the market rate

of interest on that date was 8%. The bonds pay interest annually on December 31st each year. One

year later on January 1, 2021, Jinn Inc. retires the $100,000 bonds by repurchasing them in the

market for $106,000. What is the amount of gain or loss on the retirement of the bonds?

O $1,000 loss

O $500 gain

O $1.000 gain

O $2,600 loss

O $2,600 gain

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On January 1, 2022, Gorski Corp. purchased $1,000,000, 10% bonds for $1,040,000. These bonds were to mature on January 1, 2032, but were redeemable at 101 any time after December 31, 2025. Interest was payable semiannually on July 1 and January 1. On July 1, 2027, Gorski sold all of the bonds. Bond premium was amortized on a straight-line basis. Gorski’s gain or loss in 2027 was: Select one: a. $30,000 loss b. $12,000 loss c. $10,000 gain d. $8,000 loss e. $12,000 gainarrow_forwardOn January 2, 2020, Tamarisk Corporation issued $1,000,000 of 10% bonds at 96 due December 31, 2029. Interest on the bonds is payable annually each December 31. The discount on the bonds is also being amortized on a straight-line basis over the 10 years. (Straight-line is not materially different in effect from the preferable "interest method.") The bonds are callable at 101 (i.e., at 101% of face value), and on January 2, 2025, Tamarisk called $600,000 face value of the bonds and redeemed them. Ignoring income taxes, compute the amount of loss, if any, to be recognized by Tamarisk as a result of retiring the $600,000 of bonds in 2025. (Round answer to O decimal places, e.g. 38,548.) Loss on redemption $ Prepare the journal entry to record the redemption. (Round answers to O decimal places, e.g. 38,548. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent…arrow_forwardOn January 1, 2020, Vaughn Corporation issued $5,480,000 of 10% bonds at 101 due December 31, 2029. Vaughn paid $75,000 in bond issue costs when the bonds were issue to the market. These will be amortized over the life of the bond. The premium on the bonds is also being amortized on a straight-line basis over the 10 years. (Straight-line is not materially different in effect from the preferable "interest method".) The bonds are callable at 105 (i.e., at 105% of face amount), and on January 2, 2025, Vaughn called one-half of the bonds and retired them. Ignoring income taxes, compute the amount of loss, if any, to be recognized by Vaughn as a result of retiring the $2,740,000 of bonds in 2025. Loss on redemption $ Prepare the journal entry to record the retirement. (If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before…arrow_forward

- On January 2, 2020, Stellar Corporation issued $1,850,000 of 10% bonds at 96 due December 31, 2029. Interest on the bonds is payable annually each December 31. The discount on the bonds is also being amortized on a straight-line basis over the 10 years. (Straight-line is not materially different in effect from the preferable "interest method.") The bonds are callable at 101 (i.e., at 101% of face value), and on January 2, 2025, Stellar called $1,110,000 face value of the bonds and redeemed them. Ignoring income taxes, compute the amount of loss, if any, to be recognized by Stellar as a result of retiring the $1,110,000 of bonds in 2025. (Round answer to O decimal places, e.g. 38,548.) Loss on redemption $ Prepare the journal entry to record the redemption. (Round answers to O decimal places, e.g. 38,548. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when the amount is entered. Do not…arrow_forwardPresented below are two independent situations: a) On December 31, 2021, Legault Corporation had $1,000,000, 8% bonds payable issued. The bonds pay interest on January 1 and June 1 of each year, and mature on January 1, 2021. On January 2, 2022, Legault redeemed 60% of these bonds at 101. The amortized cost of the entire bond issue on the retirement date was $1,026,000. The interest payment due on January 1, 2022, has been made and recorded. b) Antonio Inc. redeemed $500,000 of its bonds at 98 on December 31, 2021. The amortized cost of the bonds on the retirement date was $497,500. The bonds pay semi-annual interest and the interest payment due on December 31, 2021, has been made and recorded. Instructions For each of the independent situations, prepare the journal entry to record the retirement of the bondsarrow_forwardOn January 1, 2021, Shay Company issues $300,000 of 10%, 15-year bonds. The bonds sell for $293,250. Six years later, on January 1, 2027, Shay retires these bonds by buying them on the open market for $315,750. All interest is accounted for and paid through December 31, 2026, the day before the purchase. The straight-line method is used to amortize any bond discount. 1. What is the amount of the discount on the bonds at issuance?2. How much amortization of the discount is recorded on the bonds for the entire period from January 1, 2021, through December 31, 2026?3. What is the carrying (book) value of the bonds as of the close of business on December 31, 2026?4. Prepare the journal entry to record the bond retirement.arrow_forward

- Blossom Electric sold $3,800,000, 8%, 10-year bonds on January 1, 2022. The bonds were dated January 1 and pay interest annually on January 1. Blossom Electric uses the straight-line method to amortize bond premium or discount. The bonds were sold at 103. (a)arrow_forwardOn June 30, 2020, Kikiam Inc. had outstanding 8%, P3,000,000 face amount, 15-year bonds maturing on June 30, 2027. Interest is payable on June 30 and December 31. The unamortized balances of bond discount as of June 30, 2020 is P105,000. Kikiam re-acquired all its bonds at 94 on June 30, 2020 and retired them. Ignoring income taxes, how much is the gain should Kikiam report on this early extinguishment of debt? A. 45,000 B. 75,000 C. 180,000 D. 105,000arrow_forwardThe December 31, 2021 balance sheet of Metlock Co. included the following items: 7.5% bonds payable due December 31, 2029 $2,880,000 Unamortized discount on bonds payable 115,200 The bonds were issued on December 31, 2019 at 95, with interest payable on June 30 and December 31. (Use straight-line amortization.)On April 1, 2020, Wolfe retired $576,000 of these bonds at 101 plus accrued interest.Prepare journal entries to record the above retirement.arrow_forward

- On December 31, 2020, the liability section of Martin Luther Company's statement of financial position included 10% bonds payable of P10,000,000 and unamortized premium on bonds payable of P180,000. Further verification revealed that these bonds were issued on December 31, 2018 and will become due on December 31, 2028. Interest at 12% is payable every December 31. On April 1, 2021, Martin Luther retired P4,000,000 of these bonds at 97 plus accrued interest. How much was the gain or (loss) on the retirement of bonds on April 1, 2021? Enclosed in parenthesis in case of loss.arrow_forward1. On January 1,2020, Kooky Corporation issued a 5-year, 10%, 1,000 of the P 5,000 face value bonds with a yield of 12%. The bonds is payable after five years and interests is payable annually starting December 31,2020. Assuming 1/4 of the bonds were retired at 102 on December 31,2022 after payment of periodic interest, how much is the gain or loss on retirement of the bonds? (For present value factors, do not round off) 2. The following are the balances of the liability accounts of IKARIS Company as of December 31,2021: Accounts payable - P 1,000,000(recognized for purchase of inventories, including a debit balance in the suppliers account of P 150,000) The following are not yet reflected in the balance of accounts payable above: - Upon receipt of the goods on January 1,2022 costing P 175,000, the accounting staff of IKARIS Company recorded the purchase in the accounts. It was determined that the goods were shipped Shipping point on December 31,2021. -Goods with invoice cost of…arrow_forwardOn January 2, 2020, Headland Corporation issued $1,450,000 of 10% bonds at 97 due December 31, 2029. Interest on the bonds is payable annually each December 31. The discount on the bonds is also being amortized on a straight-line basis over the 10 years. (Straight-line is not materially different in effect from the preferable "interest method.") The bonds are callable at 102 (i.e., at 102% of face value), and on January 2, 2025, Headland called $870,000 face value of the bonds and redeemed them. Ignoring income taxes, compute the amount of loss, if any, to be recognized by Headland as a result of retiring the $870,000 of bonds in 2025. (Round answer to O decimal places, e.g. 38,548.) Loss on redemption $ 43,500 Prepare the journal entry to record the redemption. (Round answers to O decimal places, e.g. 38,548. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when the amount is entered. Do not…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education