FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

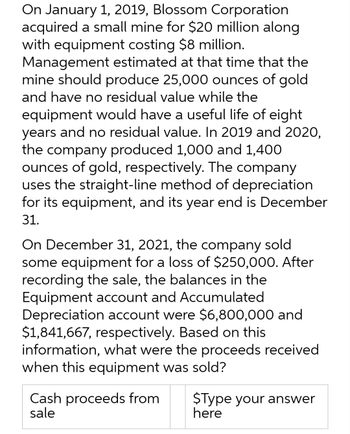

Transcribed Image Text:On January 1, 2019, Blossom Corporation

acquired a small mine for $20 million along

with equipment costing $8 million.

Management estimated at that time that the

mine should produce 25,000 ounces of gold

and have no residual value while the

equipment would have a useful life of eight

years and no residual value. In 2019 and 2020,

the company produced 1,000 and 1,400

ounces of gold, respectively. The company

uses the straight-line method of depreciation

for its equipment, and its year end is December

31.

On December 31, 2021, the company sold

some equipment for a loss of $250,000. After

recording the sale, the balances in the

Equipment account and Accumulated

Depreciation account were $6,800,000 and

$1,841,667, respectively. Based on this

information, what were the proceeds received

when this equipment was sold?

Cash proceeds from

sale

$Type your answer

here

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- In January, 2020, Swifty Corporation purchased a mineral mine for $4800000 with removable ore estimated by geological surveys at 2500000 tons. The property has an estimated value of $310000 after the ore has been extracted. The company incurred $1600000 of development costs preparing the mine for production. During 2020, 600000 tons were removed and 450000 tons were sold. What is the amount of depletion that Swifty should expense for 2020?arrow_forwardOn June 1, 2021, ABC Company purchased rights to a mine for P30,000,000, of which, P3,000,000 was allocable to the land. Estimated reserves were 2,250,000 tons. ABC expected to extract and sell 37,500 tons per month. ABC purchased mining equipment on September 30, 2021 for P12,000,000. The mining equipment had a useful life of nine years. However, after all the resource is removed, the equipment will be of no use and will be sold for P750,000. ANSWER THE QUESTION: What is the depletion for 2021?arrow_forward

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education