Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

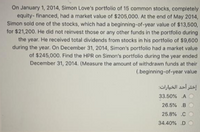

Transcribed Image Text:On January 1, 2014, Simon Love's portfolio of 15 common stocks, completely

equity- financed, had a market value of $205,000. At the end of May 2014,

Simon sold one of the stocks, which had a beginning-of-year value of $13,500,

for $21,200. He did not reinvest those or any other funds in the portfolio during

the year. He received total dividends from stocks in his portfolio of $9,600

during the year. On December 31, 2014, Simon's portfolio had a market value

of $245,000. Find the HPR on Simon's portfolio during the year ended

December 31, 2014. (Measure the amount of withdrawn funds at their

(.beginning-of-year value

إختر أحد الخبارات

33.50% A

26.5% B

25.8% .CO

34.40% D

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The D asenso corp issued 5000 shares of common stock at 100.00 per share. Of this, Eugene owns 500 shares which he acquired at 100 per share. In December, 2013 the corporation declared and paid 25% stock dividend payable in preferred stock. Eugene sold all his stock dividend shares at 120 per share on February 10, 2014. Required: a. Compute the gain or loss on sale of stock dividend shares, assuming that at the time of payment of the stock dividend, the fair market value of the shares of stock are: Common: 110 per share Preferred: 110 per share b. Compute the capital gain due on said salearrow_forwardJune Inc. issued 9,000 nonqualified stock options valued at $27,000 (in total--$3 each). Each option entitles the holder to purchase one share of stock at $5 per share. The options vest over three years - one-third in 2016 (the year of issue), one-third in 2017, and one-third in 2018. Three thousand options are exercised in 2017 at a time when the stock price of the stock is $9. What is the 2017 book-tax difference associated with the stock options (assume ASC 718 applies to the options)? $3,000 favorable $1,500 unfavorable $6,000 favorable $4,500 favorable |arrow_forwardOn January 1, 2020, Simon Love's portfolio of 15 common stocks had a market value of $256,000. At the end of May 2020, Simon sold one of the stocks, which had a beginning-of-year value of $26,600, for $31,800. He did not reinvest those or any other funds in the portfolio during the year. He received total dividends from stocks in his portfolio of $11,700 during the year. On December 31, 2020, Simon's portfolio had a market value of $245,000. Find the HPR on Simon's portfolio during the year ended December 31, 2020. (Measure the amount of withdrawn funds at their beginning-of-year value.) C Simon's portfolio HPR during the year ended December 31, 2020, is%. (Round to two decimal places.)arrow_forward

- Suzy Q buys stock on 1/1/2011 for ____________ per share, paying annual dividends of $27. On 12/31/2011, she sells the stock for $350. Her annual rate of return is -5.75%.arrow_forwardJohn invested $12,000 in the stock of Hyper Cyber. Eight years later, Hyper Cyber's shares reached $125,000, but John held onto the shares in the belief that their price would double in the next five years. Unfortunately, Hyper Cyber did not double. Rather the market value of John's shares today is $4,000. If the shares were sold today and the proceeds invested in another investment, they would likely earn 5% per annum. Which of the following tems and values is correct? a. $250,000 is the opportunity cost b. $12,000 is the sunk cost C. $2,000 is the opportunity cost d. $125,000 is the opportunity cost of selling the shares todayarrow_forwardOn January 1, 2020, Simon Love's portfolio of 15 common stocks had a market value of $263,000 At the end of May 2020, Simon sold one of the stocks, which had a beginning-of-year value of $26,400, for $31,000. He did not reinvest those or any other funds in the portfolio during the year. He received total dividends from stocks in his portfolio of $12,100 during the year. On December 31, 2020, Simon's portfolio had a market value of $246,000. Find the HPR on Simon's portfolio during the year ended December 31, 2020. (Measure the amount of withdrawn funds at their beginning-of-year value.) Simon's portfolio HPR during the year ended December 31, 2020, is %. (Round to two decimal places.)arrow_forward

- Subject:- accountingarrow_forwardIn 2016 (year 0), Jessee exercised a stock option by paying $100 per share for 225 shares of ABC stock. The market price at date of exercise was $312 per share. In 2023, Jessee sold the 225 shares for $480 per share. Assuming that Jessee is in the 35 percent tax bracket, has a 15 percent capital gains rate, and uses a 6 percent discount rate, compute the 2016 NPV of the cash flows from the exercise and sale if: (Use Appendix A). Required: a. The stock option was nonqualified. b. The stock option was an ISO. Complete this question by entering your answers in the tabs below. Required A Required B Compute the 2016 NPV of the cash flows from the exercise and sale if the stock option was nonqualified. Note: Round your intermediate calculations to the nearest whole dollar amount. NPVarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education