FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

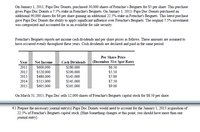

Transcribed Image Text:On Jamuary 1, 2011, Papa Doc Donuts, purchased 30,000 shares of Frenchie's Beignets for $5 per share. This purchase

gives Papa Doc Donuts a 7.5% stake in Frenchie's Beignets. On January 1, 2013, Papa Doc Donuts purchased an

additional 90,000 shares for $6 per share gaining an additional 22.5% stake in Frenchie's Beignets. This latest purchase

gave Papa Doc Donuts the ability to apply significant influence over Frenchie's Beignets. The original 7.5% investment

was categorized and accounted for as an available for sale security.

Frenchie's Beignets reports net income cash đividends and per share prices as follows. These amounts are assumed to

have occurred evenly throughout these years. Cash dividends are declared and paid in the same period.

Per Share Price

Cash Dividends

$180,000

(December 31st Spot Rate)

$6.50

Year

Net Income

2011

S600,000

$190,000

$145,000

$145,000

$165,000

$5.50

$7.00

$7.50

$9.00

2012

$520,000

$480,000

$515,000

$605,000

2013

2014

2015

On March 31, 2015, Papa Doc sells 12,000 shares of Frenchie's Beignets capital stock for $8.50 per share.

4.) Prepare the necessary journal entry(s) Papa Doc Donuts would need to account for the January 1, 2013 acquisition of

22.5% of Frenchie's Beignets capital stock. {Hint-Something changes at this point, you should have more than one

joumal entry}

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Acker Company bought 100% of Howell Company on 1/1/X1 for $1,440,000 and began applying the equity method. The book value of Howell's equity on that date was $1,440,000. In year X1, Howell reported net income of $100,000 and paid $40,000 in dividends. During year X1, Howell sold 1,000 units of inventory to Acker for $20,000 that had cost $10,000. On 12/31/X1, 400 of the units remained in Acker's inventory. How much investment income should Acker report in year X1arrow_forwardNeed answer the questionarrow_forwardMunabhaiarrow_forward

- See Imagearrow_forwardSituation 1: Novak Cosmetics acquired 10% of the 193,000 shares of common stock of Martinez Fashion at a total cost of $14 per share on March 18, 2025. On June 30, Martinez declared and paid $67,500 cash dividends to all stockholders. On December 31, Martinez reported net income of $118,700 for the year. At December 31, the market price of Martinez Fashion was $15 per share. Situation 2: Splish, Inc. obtained significant influence over Seles Corporation by buying 40% of Seles's 30,700 outstanding shares of common stock at a total cost of $8 per share on January 1, 2025. On June 15, Seles declared and paid cash dividends of $38,300 to all stockholders. On December 31, Seles reported a net income of $84,200 for the year. Prepare all necessary journal entries in 2025 for both situations. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account…arrow_forwardSee Imagearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education