FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Iniciar ses

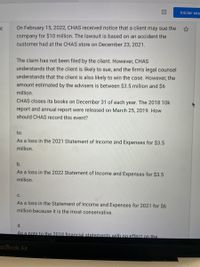

On February 15, 2022, CHAS received notice that a client may sue the ☆

company for $10 million. The lawsuit is based on an accident the

customer had at the CHAS store on December 23, 2021.

The claim has not been filed by the client. However, CHAS

understands that the client is likely to sue, and the firm's legal counsel

understands that the client is also likely to win the case. However, the

amount estimated by the advisers is between $3.5 million and $6

million.

CHAS closes its books on December 31 of each year. The 2018 10k

report and annual report were released on March 25, 2019. How

should CHAS record this event?

to.

As a loss in the 2021 Statement of Income and Expenses for $3.5

million.

b.

As a loss in the 2022 Statement of Income and Expenses for $3.5

million.

С.

As a loss in the Statement of Income and Expenses for 2021 for $6

million because it is the most conservative.

d.

As a note to the 2018 financial statements with no effect on the

acBook Air

Transcribed Image Text:to.

As a loss in the 2021 Statement of Income and Expenses for $3.5

million.

b.

As a loss in the 2022 Statement of Income and Expenses for $3.5

million.

C.

As a loss in the Statement of Income and Expenses for 2021 for $6

million because it is the most conservative.

d.

As a note to the 2018 financial statements with no effect on the

financial statements because the lawsuit has not yet been filed.

MacBook Air

DII

DD

F7

F8

F9

F10

F11

F1

*

8.

%3D

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- In 2014 Jack suffered bodily injury while at work. In 2016, Jack won a workers' compensation claim and prevailed in an injury lawsuit, both in connection with the 2014 injury. Jack received the following in 2016 as settlement: Punitive damages $150,000 Workers' compensation $50,000 Personal physical injury damages $25,000 Compensation for emotional distress caused by the physical injury $15,000 What amount of the settlement should be excluded from Jack's 2016 gross income? $25,000 $165,000 $90,000 $75,000arrow_forwardNifty Cleaners Inc., a CCPC that uses a December 31 taxation year, began carrying on the business of providing cleaning services to residential properties. All of the shares were owned by Samuel Spade and, in addition, he was actively involved in managing the business. Samuel Spade, whose previous occupation was as a lawyer at a major Toronto law firm, showed little aptitude for running a business. In 2019, the business had a loss of $123,000 and a further business loss of $87,000 in 2020. When the business began, Nifty Cleaners Inc. had purchased land on which the intention was to expand the business with a second location once the first location became successful. As success did not appear to be on the horizon, Nifty Cleaners Inc. sold the land in 2020 realizing a capital loss of $192,000 which became a 2020 net capital loss of $96,000. In early 2021, Samuel Spade decided to sell the company. Consolidated Enterprises, a large public company agreed to buy all of his shares, and, on…arrow_forwardQuince owns a used-car lot where Ray works as a salesperson. Quince tells Ray not to make any warranties for the cars. To make a sale to Sylvia, however, Ray adds a 50,000-mile warranty. Later, Sylvia sues Quince for breach of warranty. Quince may hold Ray liable for any damages he must pay to Sylvia under which remedy: a. indemnification b. avoidance c. constructive trust d. accountingarrow_forward

- Linda Sue Carr worked for a large food brokerage firm. In January of this year she was terminated. After a court battle Linda Sue was reinstated in her job and received from the firm in November $7,500 in punitive damages. Must Linda Sue include the $7,500 in punitive damages in her 2023 gross income?arrow_forwardClark Inc plans to sell 9000 lawn chairs during May, 9700 in June, and 7000 during July. The company keeps 15% of the next month's sales as ending inventory. How many units should Clark produce during June? 10105 9295 Not enough information to determine 10750arrow_forwardOn April 13th 2022: K.C. is sued for cheating its customers by adding ice to cold beverages, thereby reducing the amount of precious liquid contained in the cups. By the time lawsuit occurs, the lawsuit loss is not probable and can not be estimated. On May 18th 2022: K.C. is sued for a week-long insomnia its customer sustained after the customer consumed K.C. signature expresso – The Death Wish. By the time K.C. is served, the lawsuit loss is probable and can be reasonable estimated between $ 90,000 to $ 100,000. On January 28th 2023 (before 2022 financial report is issued): new evidence related to ICE CUBE lawsuit surfaced. K.C.’s ice cube is on average 50% larger than industry standard! Thus, K.C. determines the lawsuit is probable and can be reasonable estimated at $ 15,500. With respect to each of the above events, Should K.C. recognize any gain/loss in its 2022 financial report? If so, what is the correct journal entry (entries) Whether and how should K.C. disclose the…arrow_forward

- Superior Skateboard Company, located in Ontario, is preparing adjusting entries at December 31, 2023. An analysis reveals the following: During December, Superior sold 6, 600 skateboards that carry a 60 - day warranty. The skateboard sales totalled $391,000. The company expects 7% of the skateboards will need repair under warranty and it estimates that the average repair cost per unit will be $39. A disgruntled employee is suing the company. Legal advisers believe that it is probable that Superior will have to pay damages, the amount of which cannot be reasonably estimated. Superior needs to record previously unrecorded cash sales of $2, 110,000 (cost of sales 60%) plus applicable HST. Superior recognizes that $ 96,000 of $161,000 received in advance for skateboards has now been earned. Required: Prepare any required adjusting entries at December 31, 2023, for each of the above. (If no entry is required for a transaction/event, select "No journal entry required" in the first account…arrow_forwardOn 15 January, 20X8, the company settled and paid a personal injury claim of a former employee as the result of an accident that occurred in March 20X0. The company had not previously recorded a liability for the claim? is this an adjusting or non-adjusting event?arrow_forward28. Kindly answer below:arrow_forward

- Haresharrow_forwardcorcese Inc. is involved in a lawsuit at December 31, 2020. (a) Prepare the December 31 entry assuming it is probable that Scorcese will be liable for $900,000 as a result of this suit. (b) Prepare the December 31 entry, if any, assuming it is not probable that Scorcese will be liable for any payment as a result of this suit.arrow_forwardsheet of pap 1. This is not one of the five major accounts. A. interest B. income C. liability D. owner's equity 2. These are the resources owned by the owners. A. assets B. liabilities C. revenLIes D. expenseSarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education