FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Multiple Choice

Option A

Option B

Option C

Option D

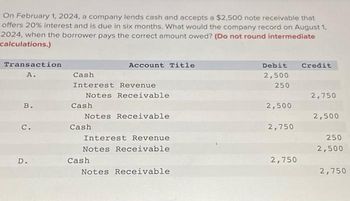

Transcribed Image Text:On February 1, 2024, a company lends cash and accepts a $2,500 note receivable that

offers 20% interest and is due in six months. What would the company record on August 1,

2024, when the borrower pays the correct amount owed? (Do not round intermediate

calculations.)

Transaction

A.

B.

c.

D.

Cash

Interest Revenue

Notes Receivable

Cash

Account Title

Notes Receivable

Cash

Interest Revenue

Notes Receivable

Cash

Notes Receivable

Debit Credit

2,500

250

2,500

2,750

2,750

2,750

2,500

250

2,500

2,750

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please help mearrow_forwardTaylor Bank lends Guarantee Company $111,942 on January 1. Guarantee Company signs a $111,942, 8%, 9-month, interest-bearing note. The entry made by Guarantee Company on January 1 to record the proceeds and issuance of the note is a. Cash 111,942 Notes Payable 111,942 b. Notes Payable 111,942 Interest Payable 3,359 Cash 111,942 Interest Expense 3,359 c. Cash 118,659 Interest Expense 6,717 Notes Payable 111,942 d. Interest Expense 6,717 Cash 105,225 Notes Payable 111,942arrow_forwardPaper Company receives a $6,000, 3-month, 6% promissory note from Dame Company in settlement of an open accounts receivable. What entry will Paper Company make upon receiving the note?arrow_forward

- C.S.Sunland Company had the following transactions involving notes payable. July 1, 2025 Nov. 1, 2025 Dec. 31, 2025 Feb. 1, 2026 Apr. 1, 2026 Borrows $55,950 from First National Bank by signing a 9-month, 8% note. Borrows $59,000 from Lyon County State Bank by signing a 3-month, 6% note. Prepares adjusting entries. Pays principal and interest to Lyon County State Bank. Pays principal and interest to First National Bank. Prepare journal entries for each of the transactions. (List all debit entries before credit entries. Credit accarrow_forwardharrow_forwardSheridan Company lends Marigold Company $48000 on January 1 and, accepts a 4-month, 3% promissory note in exchange. Sheridan Company prepares financial statements on January 31. What adjusting entry should be made before preparing the financial statements? Interest Receivable Interest Revenue Cash Interest Revenue Notes Receivable-Marigold Company Cash Interest Receivable Interest Revenue 480 120 48000 120 480 120 48000 120arrow_forward

- I NEED HELPING MAKING THE TABLE Novak Supply Co. has the following transactions related to notes receivable during the last 2 months of 2020. The company does not make entries to accrue interest except at December 31. Nov. 1 Loaned $27,000 cash to Manny Lopez on a 12-month, 10% note. Dec. 11 Sold goods to Ralph Kremer, Inc., receiving a $74,250, 90-day, 8% note. 16 Received a $95,400, 180 day, 8% note in exchange for Joe Fernetti’s outstanding accounts receivable. 31 Accrued interest revenue on all notes receivable.arrow_forwardAt December 1, 2021, Vaughn Company's accounts receivable balance was $1860. During December, Vaughn had credit revenues on account of $7080 and collected accounts receivable of $6070. At December 31, 2021, the accounts receivable balance is $850 credit. Ⓒ $850 debit Ⓒ $2870 debit. O $2870 credit.arrow_forwardAccounting for notes receivable and accruing interest Carley Realty loaned money and received the following notes during 2018. Determine the maturity date and maturity value of each note. Journalize the entries to establish each Note Receivable and to record collection of principal and interest at maturity. Include a single adjusting entry on December 31, 2018, the fiscal year-end, to record accrued interest revenue on any applicable note. Explanations are not required. Round to the nearest dollar.arrow_forward

- 4. AB company receives $10,000 for a 6 month, 8% note on 11/1/20. Prepare the journal entry for the receipt. Account Debit Credit 5. Prepare the journal entry to accrue interest on the above note at 12/31/20. Account Debit Credit 6. Prepare the entry to record payment of the above note in full on it's due date of 5/1/21. Account Debit Credit 7. AB Company purchases a truck in the amount of $15,000. Additional costs include sales tax of $1500, painting of $2500, license of $150 and a 1 year auto insurance policy of $1200. Complete the journal entry for the auto purchase. Account Debit Creditarrow_forwardAdmire County Bank agrees to lend Bonita Brick Company $609000 on January 1. Bonita Brick Company signs a $609000, 8%, 9- month note. What entry will Bonita Brick Company make to pay off the note and interest at maturity assuming that interest has been accrued to September 30? O O Notes Payable Cash Notes Payable Interest Payable Cash Interest Expense Notes Payable Cash Interest Payable Notes Payable Interest Expense Cash 645540 609000 36540 36540 609000 24360 609000 12180 645540 645540 645540 645540arrow_forwardC3.7arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education