FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

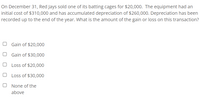

Transcribed Image Text:On December 31, Red Jays sold one of its batting cages for $20,000. The equipment had an

initial cost of $310,000 and has accumulated depreciation of $260,000. Depreciation has been

recorded up to the end of the year. What is the amount of the gain or loss on this transaction?

Gain of $20,000

Gain of $30,000

Loss of $20,000

Loss of $30,000

None of the

above

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Need help with this questionarrow_forwardProblem 5-3A (Algo) The following salaried employees of Mountain Stone Brewery in Fort Collins, Colorado, are paid semimonthly. Some employees have union dues or garnishments deducted from their pay. You do not need to complete the number of hours. Required: Calculate their net pay using the percentage method for manual payroll systems with Forms W-4 from 2020 or later in Appendix C to determine federal income tax. Assume box 2 is not checked for any employee. Include Colorado income tax of 4.40 percent of taxable pay. No employee has exceeded the maximum FICA limit. Note: Round your intermediate calculations and final answers to 2 decimal places. Employee S. Bergstrom C. Pare L. Van der Hooven S. Lightfoot Filing Status, Dependents MJ-0 MJ-2 (<17) S-1 (Other) MJ-0 $ Pay Union Dues per Period 1,750 3,600 $ 3,325 $ $ $ $ 2,950 Garnishment per Period 120 240 $ $ 50 75 100 Net Payarrow_forwardRequired Information (The following information applies to the questions displayed below] On January 1, Mitzu Company pays a lump-sum amount of $2,600,000 for land, Building 1, Building 2, and Land Improvements 1. Building 1 has no value and will be demolished. Building 2 will be an office and is appraised at $644,000, with a useful life of 20 years and a $60,000 salvage value. Land Improvements 1 is valued at $420,000 and is expected to last another 12 years with no salvage value. The land is valued at $1,736,000. The company also incurs the following additional costs. Cost to demolish Building 1 Cost of additional land grading Cost to construct Building 3, having a useful life of 25 years and a $392,000 salvage value Cost of new Land Improvements 2, having a 20-year useful life and no salvage value $ 328,400 175,400 2,202,000 164,000 3. Using the straight-line method, prepare the December 31 adjusting entries to record depreciation for the first year these assets were in use. View…arrow_forward

- The Bomb Pop Corporation sold ice cream equipment for $18,500. The equipment was originally purchased for $40,000, and depreciation through the date of sale totaled $25,000. 1. What was the gain or loss on the sale of the equipment? on salearrow_forwardAn apartment building was acquired in 2013. The depreciation taken on the building was $181,700, and the building was sold for a $54,510 gain. What is the maximum amount of 25% gain? Xarrow_forwardZorzi Corporation purchased a Machine on January 1, 2017 for S80,000. The machinery is estimated to have a salvage value of $8,000 after a useful life of 8 years. Compute the 2017 depreciation expense using the straight-line method assuming the machine was purchased on September 1, 2017 O s9.000 O s7000 O55,000 O S3.000arrow_forward

- Nonearrow_forwardIn 1980, Artima Corporation purchased an office building for $400,000 for use in its business. The building is sold during the current year for $550,000. Total depreciation allowed for the building was $390,000; straight-line would have been $360,000. As result of the sale, how much Sec. 1231 gain will Artima Corporation report? O A. $150,000 B. $510,000 C. $398,000 D. $540,000arrow_forward11. Gingerbread Corp had been depreciating a delivery truck for 3 years when it decided to sell the truck. The historical cost of the delivery truck was $40,000 with an estimated salvage value of $5,000 and a useful life of 7 years. The company had recorded $7,000 of depreciation expense every year for three years. The company sold the truck for $21,000. What is the gain or loss recorded on the sale of the truck. a.Loss of $4,000 b.Gain of $2,000 c.Gain of $4,000 d.Loss of $2,000arrow_forward

- Hahaaarrow_forwardIn year 0, Canon purchased a machine to use in its business for $56,000. In year 3, Canon sold the machine for $42,000. Between the date of the purchase and the date of the sale, Canon depreciated the machine by $32,000. (Loss amounts should be indicated by a minus sign. Leave no answer blank. Enter zero if applicable.) a. What are the amount and character of the gain or loss Canon will recognize on the sale, assuming that it is a partnership? Total Gain/Loss Recognized Character of Recognized Gain/Loss Ordinary Gain/Loss 1231 gain/Lossarrow_forwardA firm purchased an asset with a 5-year life for $80,000, andit cost $5,000 for shipping and $10,000 for installation. Accordingto the current tax laws the initial depreciation value of the assetis a. $95,000 b. $90,000 c. $85,000 d. $80,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education