FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

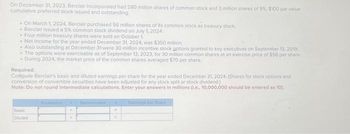

Transcribed Image Text:On December 31, 2023, Berciair Incorporated had 280 million shares of common stock and 3 million shares of 9%, $100 par value

cumulative preferred stock issued and outstanding

- On March 1, 2024, Berclair purchased 56 million shares of its common stock as treasury stock.

- Berclair issued a 5% common stock dividend on July 1, 2024,

- Four million treasury shares were sold on October 1.

- Net Income for the year ended December 31, 2024, was $350 million.

• Also outstanding at December 31-were 30 million incentive stock options granted to key executives on September 13, 2019.

- The options were exercisable as of September 13, 2023, for 30 million common shares at an exercise price of $56 per share.

- During 2024, the market price of the common shares averaged $70 per share.

Required:

Compute Berclair's basic and diluted earnings per share for the year ended December 31, 2024, (Shares for stock options and

conversion of convertible securities have been adjusted for any stock split or stock dividend.)

Note: Do not round intermediate calculations. Enter your answers in millions (l.e., 10,000,000 should be entered as 10).

Basic

Diluted

.

Denominator

Earnings per Share

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Similar questions

- On December 31, 2023, Berclair Incorporated had 400 million shares of common stock and 7 million shares of 9%, $100 par value cumulative preferred stock issued and outstanding. . On March 1, 2024, Berclair purchased 60 million shares of its common stock as treasury stock. • Berclair issued a 4% common stock dividend on July 1, 2024. • Four million treasury shares were sold on October 1. • Net income for the year ended December 31, 2024, was $350 million. . Also outstanding at December 31 were 30 million incentive stock options granted to key executives on September 13, 2019 • The options were exercisable as of September 13, 2023, for 30 million common shares at an exercise price of $35 per share. . During 2024, the market price of the common shares averaged $70 per share. • The options were exercised on September 1, 2024. Required: Compute Berclair's basic and diluted earnings per share for the year ended December 31, 2024. (Shares for stock options and conversion of convertible…arrow_forwardOn December 31, 2023, Ainsworth, Incorporated had 850 million shares of common stock outstanding. • Thirty four million shares of 6%, $100 par value cumulative, nonconvertible preferred stock were sold on January 2, 2024. On April 30, 2024, Ainsworth purchased 50 million shares of its common stock as treasury stock. • Twenty million treasury shares were sold on August 31. • Ainsworth issued a 4% common stock dividend on June 12, 2024. Required: 1. Compute Ainsworth's net loss per share for the year ended December 31, 2024. 2. Compute the per share amount of income or loss from continuing operations for the year ended December 31, 2024. 3. Prepare an EPS presentation that would be appropriate to appear on Ainsworth's 2024 and 2023 comparative income statements. Assume EPS was reported in 2023 as $0.70, based on net income (no discontinued operations) of $595 million and a weighted-average number of common shares of 850 million. • No cash dividends were declared in 2024. • For the year…arrow_forwardPlease Solve with Explanation and Do not Give image formatarrow_forward

- On December 31, 2023, Ainsworth, Incorporated had 760 million shares of common stock outstanding. B Twenty nine million shares of 6%, $100 par value cumulative, nonconvertible preferred stock were sold on January 2, 2024. ⚫ On April 30, 2024, Ainsworth purchased 30 million shares of its common stock as treasury stock. • Twelve million treasury shares were sold on August 31. B Ainsworth issued a 5% common stock dividend on June 12, 2024. ■ No cash dividends were declared in 2024. . For the year ended December 31, 2024, Ainsworth reported a net loss of $185 million, including an after-tax loss from discontinued operations of $490 million. Required: 1. Compute Ainsworth's net loss per share for the year ended December 31, 2024. 2. Compute the per share amount of income or loss from continuing operations for the year ended December 31, 2024. 3. Prepare an EPS presentation that would be appropriate to appear on Ainsworth's 2024 and 2023 comparative income statements. Assume EPS was reported…arrow_forwardSubject: acountingarrow_forwardVinubhaiarrow_forward

- On December 31, 2023, Berclair Incorporated had 520 million shares of common stock and 5 million shares of 9%, $100 par value cumulative preferred stock issued and outstanding. ⚫ On March 1, 2024, Berclair purchased 30 million shares of its common stock as treasury stock. • Berclair Issued a 5% common stock dividend on July 1, 2024. Five million treasury shares were sold on October 1. • Net Income for the year ended December 31, 2024, was $950 million. Required: Compute Berclair's earnings per share for the year ended December 31, 2024. Note: Do not round intermediate calculations. Enter your answers in millions (i.e., 10,000,000 should be entered as 10). Numerator Denominator■ Earnings per Sharearrow_forwardOn December 31, 2023, Berclair Incorporated had 540 million shares of common stock and 4 million shares of 9%, $100 par value cumulative preferred stock issued and outstanding. . On March 1, 2024, Berclair purchased 160 million shares of its common stock as treasury stock. • Berclair issued a 5% common stock dividend on July 1, 2024. • Four million treasury shares were sold on October 1. • Net income for the year ended December 31, 2024, was $1,000 million. • Also outstanding at December 31 were 30 million incentive stock options granted to key executives on September 13, 2019. • The options were exercisable as of September 13, 2023, for 30 million common shares at an exercise price of $56 per share. . During 2024, the market price of the common shares averaged $70 per share. Required: Compute Berclair's basic and diluted earnings per share for the year ended December 31, 2024. (Shares for stock options and conversion of convertible securities have been adjusted for any stock split or…arrow_forwardAshvinarrow_forward

- On December 31, 2023, Berclair Incorporated had 500 million shares of common stock and 3 million shares of 9%, $100 par value cumulative preferred stock issued and outstanding. • On March 1, 2024, Berclair purchased 24 million shares of its common stock as treasury stock. Berclair issued a 5% common stock dividend on July 1, 2024. • Four million treasury shares were sold on October 1. • Net income for the year ended December 31, 2024, was $800 million. The income tax rate is 25%. . • Also outstanding at December 31 were incentive stock options granted to key executives on September 13, 2019. • The options are exercisable as of September 13, 2023, for 30 million common shares at an exercise price of $56 per share. . During 2024, the market price of the common shares averaged $70 per share. • In 2020, $50.0 million of 8% bonds, convertible into 6 million common shares, were issued at face value. Required: Compute Berclair's basic and diluted earnings per share for the year ended December…arrow_forwardUramilabenarrow_forwardOn December 31, 2023, Berclair Incorporated had 250 million shares of common stock and 10 million shares of 9%, $100 par value cumulative preferred stock issued and outstanding. • On March 1, 2024, Berclair purchased 90 million shares of its common stock as treasury stock. Berclair issued a 4% common stock dividend on July 1, 2024. • Four million treasury shares were sold on October 1. • Net income for the year ended December 31, 2024, was $500 million. • Also outstanding at December 31 were 45 million incentive stock options granted to key executives on September 13, 2019. • The options were exercisable as of September 13, 2023, for 45 million common shares at an exercise price of $50 per share. • During 2024, the market price of the common shares averaged $75 per share. • The options were exercised on September 1, 2024. Required: Compute Berclair's basic and diluted earnings per share for the year ended December 31, 2024. (Shares for stock options and conversion of convertible…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education