FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

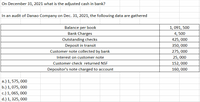

Transcribed Image Text:On December 31, 2021 what is the adjusted cash in bank?

In an audit of Danao Company on Dec. 31, 2021, the following data are gathered

Balance per book

1, 091, 500

Bank Charges

4, 500

Outstanding checks

425, 000

Deposit in transit

350, 000

Customer note collected by bank

275, 000

Interest on customer note

25, 000

152, 000

160, 000

Customer check returned NSF

Depositor's note charged to account

a.) 1, 575, 000

b.) 1, 075, 000

с.) 1, 065, 000

d.) 1, 325, 000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Full calculation and correct answers need plzzzarrow_forwardThe following information pertains to EXCELLENT Company as of December 31, 2020: Cash balance per bank statement P4,000,000 Checks outstanding (including certified check of P100,000) 500,000 Bank service charge shown in December bank statement 20,000 Error made by EXCELLENT in recording a check that cleared the bank in December (Cieck was drawn for P100,000 but recorded at P10,000) 90,000 Deposit in transit 1,300,000, What is the cash balance per ledger on December 31, 2020?arrow_forwardUsing the following information: The bank statement balance is $3,093. The cash account balance is $3,305. Outstanding checks amounted to $767. Deposits in transit are $815. The bank service charge is $155. A check for $40 for supplies was recorded as $31 in the ledger. Prepare a bank reconciliation for Miller Co. for August 31. Miller Co.Bank ReconciliationAugust 31 Cash balance according to bank statement $fill in the blank 1 Adjustments: $- Select - - Select - Total adjustments fill in the blank 6 Adjusted balance $fill in the blank 7 Cash balance according to company's records $fill in the blank 8 Adjustments: $- Select - - Select - Total adjustments fill in the blank 13 Adjusted balance $fill in the blank 14arrow_forward

- Need answer for this questionarrow_forwardRexrode Company's bank statement at January 31 showed an ending balance of $24,712.80. The unadjusted cash account balance for Rexrode is $21,245.75. The following data were gathered by Rexrode's accountant: Outstanding checks as of January 31: $4,895.44 ● NSF check from customer: $183.62 • Debit memo related to the returned deposit: $20.00 Credit memo for interest earned: $12.00 • Deposits in transit: $1,236.77 Required: a. Prepare a bank reconciliation for Rexrode Company at January 31. b. Indicate how each of the required adjusting entries impact the financial statements. . • Complete this question by entering your answers in the tabs below. Required A Required B Indicate how each of the required adjusting entries impact the financial statements. Note: Enter any decreases to account balances and cash outflows with a minus sign. Leave cells blank if no input is needed. Round your answers to 2 decimal places. Item Outstanding checks NSF check from a customer Debit memo related to the…arrow_forwardThe following information pertains to Candy company on December 31, 2019: Cash balance per bank statement P2,000,000 Checks outstanding (including certified check of P50,000) P 250,000 Customer note collected by bank for Candy P 75,000 NSF checks of customers returned by bank P 100,000 Bank service charge shown in December bank statement P 10,000 Error made by Candy in recording a check that cleared the bank In December (check was drawn in December for P50,000 But recorded at P5,000) P 45,000 Deposit in transit P 650,000 What is the cash balance per ledger on December 31, 2019?arrow_forward

- The accountant of ABC has collected the following information for the month of July 2019. ABC’s bank statement for July 2019 shows the following data: Balance on 1 July as per bank $29,500 Balance on 31 July as per bank $15,907.45 The cash balance as per company records as of July 31 is $11,589.45. Further review of the data reveals the following information: Errors: Check no115 for $1,226. The bank correctly paid the amount, but ABC recorded the check as $1,262. Outstanding checks on July 31, total $5,904 Deposits in transit on July 31 total $2,201.40 Bank statement shows: A. Debit-NSF check: $425.60 B. Debit-bank fee $30 C. Credit- collection of note receivable for $1,000 plus interest earned $50 and bank collection fee $15. Required:Prepare bank reconciliation on July 31, 2019.arrow_forwardBank reconciliation and entriesThe cash account for Coastal Bike Co. at October 1, 2019, indicated abalance of $5,140. During October, the total cash deposited was $39,175,and checks written totaled $40,520. The bank statement indicated abalance of $8,980 on October 31, 2019. Comparing the bank statement,the canceled checks, and the accompanying memos with the recordsrevealed the following reconciling items: A. Checks outstanding totaled $5,560.B. A deposit of $1,050 representing receipts of October 31 had beenmade too late to appear on the bank statement.C. The bank had collected for Coastal Bike Co. $2, 120 on a note leftfor collection. The face of the note was $2,000. D. A check for $370 returned with the statement had beenincorrectly charged by the bank as $730.E. A check for $310 returned with the statement had been recordedby Coastal Bike Co. as $130. The check was for the payment of anobligation to Rack Pro Co. on account. F. Bank service charges for October amounted to $25.G. A…arrow_forwardThe following information was available to reconcile A.C. Forrest Company's book cash balance with its bank statement as of June 30, 2020: The June 30 cash balance according to the accounting records was $14,630. Oustanding checks from May's bank reconciliation: Check # 229 $770 Check # 230 540 Below is a record of the cash receipts and cash payments for June: Cash Deposits Cash Payments Date Amount Check# Amount Jun 2 $3,600 231 $1,500 Jun 5 4,210 232 7,510 Jun 11 5,230 233 1,800 Jun 17 4,500 234 3,230 Jun 23 3,350 235 1,100 Jun 27 5,100 236 1,250 Jun 30 5,390 237 6,270 238 1,650 239 820 240 1,430 241 740 242 1,310 243 2,190 244 5,300 Continued…arrow_forward

- Bank reconciliation and entries The following information was available to reconcile Nelson Company's book cash balance with its bank statement as of September 30, 2021: The September 30 cash balance according to the accounting records was $21,870. Oustanding checks from August's bank reconciliation: Check # 356 $1,240 Check # 357 775 Check # 359 3,280 Check # 360 924 Below is a record of the cash receipts and cash payments for September: Cash Deposits Cash Payments Date Amount Check# Amount Sep 2 $8,359 361 $3,268 Sep 4 11,250 362 7,140 Sep 6 4,371 363 4,257 Sep 12 5,260 364 3,525 Sep 15 12,118 365 4,160 Sep 18 7,493 366 1,789 Sep 22 5,395 367 6,285 Sep 27…arrow_forwardHunter Company bank statement indicated a cash balance of $9,610, while the cash 11. chut ledger account on that date shows a balance of $7,430 in July 31. Outstanding checks totaled $2,417. A $500 check mailed to the bank for deposit had not reached the bank at the statement date. The bank returned a customer's NSF check for $225 received as payment of an account receivable. 2016092 FAT 2019302296 The bank statement showed $30 interest earned on 201504 20130022 2019002295 the bank balance for the month of July. 7090022 2019002295 20120arrow_forwardABC Company reported that the cash account per ledger had a balance at December 31, 2021 of P4,415.000 which consisted of the following: Petty Cash fund Undeposited receipts including a postdated customer check for P70,000 Cash in Allied Bank, per bank statement, with a check for P40,000 still outstanding Bond sinking fund Vouchers paid out of collections, not yet recorded IOUS signed by employees, taken from collections 24,000 1,220,000 2,245,000 850,000 43,000 33,000 4.415.000 What amount should be reported as cash in the December 31, 2021 statement of financial position?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education