FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

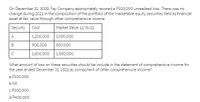

Transcribed Image Text:On December 31, 2020, Fay Company appropriately recored a P100,000 unrealized loss. There was no

change during 2021 in the composition of the portfolio of the marketable equity securities held as financial

asset at fair value through other comprehensive income.

Security

Cost

Market Value 12/31/21

A

1,200,000

1,300,000

В

900,000

500,000

1,600,000

1,500,000

What amount of loss on these securities should be include in the statement of comprehensive income for

the year ended December 31, 2021 as component of other comprehensive income?

a.P100,000

b.Nil

с Р300,000

d.P400,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Some of Cullumber Lake Limited's investment securities are classified as trading securities and some are classified as non- trading. The cost and fair value of each category at December 31, 2020, were as follows. Trading securities Nokn-trading securities Cost ¥96,500 ¥59,500 Fair Value ¥85,000 $64,000 Unrealized Gain (Loss) ¥(11,500 ) ¥4,500 At December 31, 2019, the Fair Value Adjustment-Trading account had a debit balance of ¥2,600, and the Fair Value Adjustment-Non-Trading account had a credit balance of ¥6,200. Prepare the required journal entries for each group of securities for December 31, 2020.arrow_forwardDO NOT GVIE SOUTION IN IMAGEarrow_forwardExercise 12-17 (Algo) Equity investments; fair value through net income [LO12-5] [The following information applies to the questions displayed below.] The accounting records of Jamaican Importers, Inc., at January 1, 2021, included the following: Assets: Investment in IBM common shares Less: Fair value adjustment No changes occurred during 2021 in the investment portfolio. Exercise 12-17 (Algo) Part 1 Required: 1. Prepare appropriate adjusting entry(s) at December 31, 2021, assuming the fair value of the IBM common shares was: $1,187,00 no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet < 1 $1,395,000 (150,000) $1,245,000 Record the fair value adjustment assuming the fair value of the IBM common shares was $1,187,000.arrow_forward

- On August 31, 2002, Rubics Company purchased the following equity securities and irrevocably elected to measure them at fair value through other comprehensive income: Fair Value Security Cost December 31, 2002 ₱ 96,000 ₱ 84,000 152,000 158,000 162,000 146,000 On December 31, 2002, Rubics reclassified its investment in security F from fair value through other comprehensive income to held for trading securities. What total amount of loss on reclassification should be included in Rubics' income statement for the year ended December 31, 2002? 0 b. 16,000 c. 22,000 d. 28,000arrow_forwardKk95.arrow_forwardUpvote will be given. Write the complete solutions legibly. The encircled letter is the correct answer. Solve it manually.arrow_forward

- Under the accumulated other comprehensive income in stockholders’ equity section of its December 31, year 2 balance sheet, what amount should Stone report? *arrow_forwardAt December 31, 2020, the available-for-sale debt portfolio for Crane, Inc. is as follows. Security A B C Total Previous fair value adjustment balance-Dr. Fair value adjustment- Dr. Cost $17,500 12,200 500 Fair Value $1,300 $15,000 23,400 25,700 $53,100 $54,900 14,200 Unrealized Gain (Loss) $(2,500 2,000 2,300 1,800 ) On January 20, 2021, Crane, Inc. sold security A for $15,100. The sale proceeds are net of brokerage fees. Crane, Inc. reports net income in 2020 of $118,000 and in 2021 of $143,000. Total holding gains (including any realized holding gain or loss) equal $49,000 in 2021. Prepare a statement of comprehensive income for 2020, starting with net income. Prepare a statement of comprehensive income for 2021, starting with net income. Please show underlying calculations (especially for reclassification adjustment for 2021). I correctly identified the statement of income for 2020, but am stuck on the one for 2021. Thank you!arrow_forwardLoreal-American Corporation purchased several marketable securities during 2021. At December 31, 2021, the company had the investments in bonds listed below. None was held at the last reporting date, December 31, 2020, and all are considered securities available-for-sale. Cost Fair Value Unrealized HoldingGain (Loss) Short term: Blair, Inc. $ 480,000 $ 405,000 $ (75,000 ) ANC Corporation 450,000 480,000 30,000 Totals $ 930,000 $ 885,000 $ (45,000 ) Long term: Drake Corporation $ 480,000 $ 560,000 $ 80,000 Aaron Industries 720,000 660,000 (60,000 ) Totals $ 1,200,000 $ 1,220,000 $ 20,000 Required:1. Prepare appropriate adjusting entry at December 31, 2021.2. What amount would be reported in the income statement at December 31, 2021, as a result of the adjusting entry?arrow_forward

- On December 31, 2024, Oriole Company purchased debt securities as trading securities. Pertinent data are as follows: Fair Value Security Cost At 12/31/25 A $128400 $114500 B 167500 182400 C 284400 258500 On December 31, 2025, Oriole transferred its investment in security Ċ from trading to available-for-sale because Oriole intends to retain security C as a long-term investment. What total amount of gain or loss on its securities should be reported in Oriole's income statement for the year ended December 31, 2025? O $24900 loss O $1000 gain O $25900 loss O $39800 lossarrow_forwardOn its December 31, 2020, balance sheet, Trump Company reported its investment in equity securities, which had cost $600,000, at fair value of $560, 000. At December 31, 2021, the fair value of the securities was $585, 000. What should Trump report on its 2021 income statement as a result of the increase in fair value of the investments in 2021? a. 50. b. Unrealized loss of $15,000. c. Realized gain of $25, 000. d. Unrealized gain of $25,000.arrow_forwardLoreal-American Corporation purchased several marketable securities during 2021. At December 31, 2021, the company had the investments in bonds listed below. None was held at the last reporting date, December 31, 2020, and all are considered securities available-for-sale. Unrealized Holding Gain (Loss) Cost Fair Value Short term: Blair, Inc. ANC Corporation $ 484,000 452,000 $ 403,000 484,000 $(81,000) 32,000 Totals $ 936,000 $ 887,000 $(49,000) Long term: Drake Corporation $ 484,000 718,000 $ 562,000 $ 78,000 (56,000) $ 22,000 Aaron Industries 662,000 Totals $1,202,000 $1,224,000 Required: 1. Prepare appropriate adjusting entries at December 31, 2021. 2. What amount would be reported in the income statement at December 31, 2021, as a result of the adjusting entry? Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required 1 Required 2 What amount would be reported in the income statement at December 31, 2021, as a result of…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education