FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

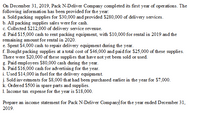

Transcribed Image Text:On December 31, 2019, Pack N-Deliver Company completed its first year of operations. The

following informati on has been provided for the year:

a. Sold packing supplies for $30,000 and provided $280,000 of delivery services.

b. All packing supplies sales were for cash.

c. Collected $212,000 of delivery service revenue.

d. Paid S15,000 cash to rent packing equipment, with S10,000 for rental in 2019 and the

remaining amount for rental in 2020.

e. Spent $4,000 cash to repair delivery equipment during the year.

f. Bought packing supplies at a total cost of $46,000 and paid for $25,000 of these supplies.

There were $20,000 of these supplies that have not yet been sold or used.

g. Paid employees $80,000 cash during the year.

h. Paid $16,000 cash for advertising for the year.

i. Used $14,000 in fuel for the delivery equipment.

j. Sold investments for $8,000 that had been purchased earlier in the year for $7,000.

k. Ordered $500 in spare parts and supplies.

1. Income tax expense for the year is $18,000.

Prepare an income statement for Pack N-Deliver Company for the year ended December 31,

2019.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- table belom shows the financial statements of a fan components supplier company that started it's operation in 1st January 2021.Calculate the profit and loss statement for the year ended December 2021.arrow_forwardDuring August, 2020, Sheffield’s Supply Store generated net sales of $60100. The company’s expenses were as follows: cost of goods sold of $35000 and operating expenses of $4500. The company also had rent revenue of $1000 and a loss on the sale of a delivery truck of $1700. Sheffield’s operating income for the month of August 2020 is $20600.$21600.$19900.$25100.arrow_forwardMarigold Consulting uses the cash basis of accounting and a fiscal year ending December 31. Beginning on September 1, 2021, Marigold performs services for Bramble International at a rate of $3900 per month. On February 12, 2022, Bramble pays Marigold $19500 in full for all services rendered from September 1, 2021 to January 31, 2022. Marigold understated revenues by ________ on its 2021 income statement. $15600 $19500 $3900 $11700arrow_forward

- Olivia Smith is the owner of an unincorporated business that does landscaping. The business began operations on January 2, 2019 and has a December 31 year end. The 2019 and 2020 results for the business can be described as follows: 2019 During its first year, the business had sales of delivered merchandise and services totaling $185,000. OF this total $65,000 had not been collected on December 31, 2019. Olivia anticipates that #5,000 of these sales will be uncollectible. In addition to these sales of delivered merchandise and services, she received $23,000 in advances for merchandise to be delivered in 2020. Olivia purchased a large supply of landscaping materials from the trustee of a bankrupt landscaping business at a very good price. Since she is unlikely to use them in the next few years, she has arranged to sell these materials for $50,000. These materials have a cost of $40,000, resulting in a total gross profit of $10,000. Because of the size of this sale, she has agreed to…arrow_forwardBrady Corporation is preparing an income statement for year ended 12/31/20. During the final week of 2020, Brady earned revenues of $6,000 on account. It expects to collect the $6,000 on 1/10/21. Brady also incurred $1,500 of payroll costs which will be paid to employees on 1/15/21. Brady also paid cash of $500 for office cleaning services. No other transactions occurred in 2020. What is the net income of Brady Corporation if it uses cash basis accounting?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education