Concept explainers

On December 31, 2018, Ditka Inc. had

Required:

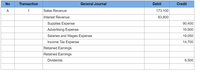

- Prepare the closing entries dated December 31, 2018.

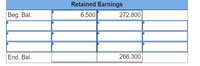

- Prepare T-account for the Retained Earnings account. Enter the beginning balance into the T-account,

post the closing entries , and then determine the ending balance.

Preparation of closing entries are part of accounting cycle in which all temporary accounts like all revenue and expenses account balance for the year is transferred to income summary and net balance is transferred to permanent account retained earnings.

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

- The following items were reported on Kevin Company's statement of comprehensive income for the year ended December 31, 2021: Legal and audit fees-P170,000; Rent expense-P240,000; Interest expense-P210,000; Loss on sale of equipment-P35,000. The office space is used equally by Kevin's sales and accounting departments. What amount of the above-listed items should be classified as general and administrative expenses? A P325,000 B) P500,000 P290,000 D) P410,000arrow_forwardHill Company uses accrual-based accounting. On Dec. 31, 2023, Company reported $50,000 Salaries and Wages Expense in the Income Statement and $3,000 Salaries and Wages Payable in the Balance Sheet. During 2023, the company paid $52,000 in salaries and wages. What was the balance in Salaries and Wages Payable at the start of the year? Example of Answer: 4000 (No comma, space, decimal point, or $ sign) Aarrow_forwardAllen Company's 2022 income statement reported total revenues, $890,000 and total expenses (including $44, 000 depreciation) of $760,000. The company's accounting records showed the following: accounts receivable - beginning balance, $54,000 and ending balance, $43, 600; accounts payable - beginning balance, $26,000 and ending balance, $31,600. Therefore, based only on this information, how much was the 2022 net cash provided by operating activities? Multiple Choice $190,000. $ 178,800. $125, 200. $169, 200arrow_forward

- On December 31, 2020, Ditka Inc. had Retained Earnings of $286, 800 before its closing entries were prepared and posted. During 2020, the company had service revenue of $187, 100 and interest revenue of $90,800. The company used supplies in the amount of $97,400, advertising expenses were $18,300, salaries and wages totaled $21,150, and income tax expense was calculated as $17,500. During the year, the company declared and paid dividends of $7,900. Required: Prepare the closing entries dated December 31, 2020. Prepare T-account for the Retained Earnings account. Enter the beginning balance into the T-account, post the closing entries, and then determine the ending balance. Record the entry for closing revenue and expense account. Record the entry for closing dividend account.arrow_forwardThe accounting records of Sandhill Inc. show the following data for 2020 (its fırst year of operations). 1. Life insurance expense on officers was $9,000. Equipment was acquired in early January for $321,000. Straight-line depreciation over a 5-year life is used, with no salvage value. For tax purposes, Sandhill used a 30% rate to calculate depreciation. 2. 3. Interest revenue on State of New York bonds totaled $3,800. Product warranties were estimated to be $51,600 in 2020. Actual repair and labor costs related to the warranties in 2020 were $10,100. The remainder is estimated to be paid evenly in 2021 and 2022. 4. 5. Gross profit on an accrual basis was $93,000. For tax purposes, $79,000 was recorded on the installment-sales method. 6. Fines incurred for pollution violations were $4,400. 7. Pretax financial income was $817,800. The tax rate is 30%.arrow_forwardPharoah Construction Company uses the percentage-of-completion method of accounting. In 2025, Pharoah began work under a contract with a contract price of $1,650,000. Other details follow: Costs incurred during the year Estimated costs to complete, as of December 31 Billings during the year Collections during the year (a) Your answer is incorrect. 2025 $1,093,400 446,600 933,400 260,000 2026 $1,510,000 -0- 1,650,000 1,650,000 What portion of the total contract price would be recognized as revenue in 2025? In 2026?arrow_forward

- Sandhill Industries collected $105,000 from customers in 2022. Of the amount collected, $25,700 was for services performed in 2021. In addition, Sandhill performed services worth $38,900 in 2022, which will not be collected until 2023. Sandhill Industries also paid $71,300 for expenses in 2022. Of the amount paid, $29,300 was for expenses incurred on account in 2021. In addition, Sandhill incurred $40.900 of expenses in 2022, which will not be paid until 2023. (a) Compute 2022 cash-basis net income. Cash-basis net income $ (b) Compute 2022 accrual-basis net income. Accrual-basis net income $ 33.700arrow_forwardVirginia Corp. has estimated that total depreciation expense for the year ending December 31, 2017 will amount to $1,280,000, total amortization expense for that period will be $420,000, and employee bonuses for the period will total $320,000. In Virginia’s interim income statement for the six months ended June 30, 2017, what is the total amount of expense relating to these three items that should be reported? $1,010,000 $0 $850,000 $505,000arrow_forwardBrady Corporation is preparing an income statement for year ended 12/31/20. During the final week of 2020, Brady earned revenues of $6,000 on account. It expects to collect the $6,000 on 1/10/21. Brady also incurred $1,500 of payroll costs which will be paid to employees on 1/15/21. Brady also paid cash of $500 for office cleaning services. No other transactions occurred in 2020. What is the net income of Brady Corporation if it uses cash basis accounting?arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education