FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

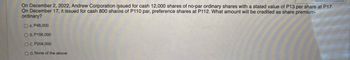

Transcribed Image Text:On December 2, 2022, Andrew Corporation issued for cash 12,000 shares of no-par ordinary shares with a stated value of P13 per share at P17.

On December 17, it issued for cash 800 shades of P110 par, preference shares at P112. What amount will be credited as share premium-

ordinary?

O A P48,000

O B. P156,000

C. P204,000

D. None of the above

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- (a) Your answer is correct. Determine the weighted-average number of shares outstanding as of December 31, 2026. (b) The weighted-average number of shares outstanding eTextbook and Media X Your answer is incorrect. Earnings per share 1751425 Assume that Ivanhoe Corp. earned net income of $3,500,000 during 2026. In addition, it had 101,000 shares of 9%, $100 par nonconvertible, noncumulative preferred stock outstanding for the entire year. Because of liquidity considerations, however, the company did not declare and pay a preferred dividend in 2026. Compute earnings per share for 2026, using the weighted-average number of shares determined in part (a). (Round answer to 2 decimal places, e.g. 2.55.) 34.66 Attempts: 1 of 3 usedarrow_forwardU the common shares is $165 each and market price of the preferred is $230 each. (Round to nearest dollar.) b. Prepare the journal entry for the issuance when only the market price of the common stock is known and it is $170 per share. E14.6 (LO 1, 2) (Stock Issuances and Repurchase) Lindsey Hunter Corporation is authorized to issue 50,000 shares of $5 par value common stock. During 2025, Lindsey Hunter took part in the following selected transactions. a. Issued 5,000 shares of stock at $45 per share, less costs related to the issuance of the stock totaling $7,000. b. Issued 1,000 shares of stock for land appraised at $50,000. The stock was actively traded on a national stock exchange at approximately $46 per share on the date of issuance. c. Purchased 500 shares of treasury stock at $43 per share. The treasury shares purchased were issued in 2021 at $40 per share. d. Retired the treasury shares purchased in part (c). Instructions Prepare the journal entries to record these…arrow_forward3. How much is the TOTAL subscribed share capital (assuming subscriptions receivable is collectible on January 5, 2022)? 4. How much is the TOTAL share premium?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education