FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

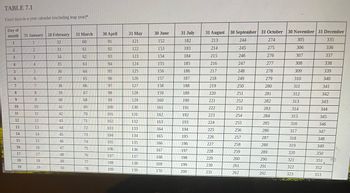

Transcribed Image Text:TABLE 7.1

Exact days-in-a-year calendar (excluding leap year)*

Day of

month

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

31 January 28 February

1

32

2

33

3

34

4

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

31 March

60

61

62

انتا

63

64

65

66

67

68

69

70

71

72

73

74

75

76

7.7

78

30 April

91

92

93

94

95

96

97

98

99

100

101

102

103

104

105

106

107

108

109

31 May

121

122

123

124

125

126

127

128

129

130

131

132

133

134

135

136

137

138

139

30 June

152

153

154

155

156

157

158

159

160

161

162

163

164

165

166

167

168

169

170

31 July

182

183

184

185

186

187

188

189

190

191

192

193

194

195

196

197

198

199

200

31 August 30 September 31 October 30 November 31 December

213

244

274

305

214

245

275

306

215

246

276

307

216

247

277

308

217

248

278

309

218

249

279

310

219

250

280

311

220

251

281

312

221

252

282

313

253

283

314

254

284

315

285

316

286

317

287

318

288

319

289

320

290

321

291

322

292

323

222

223

224

225

226

227

228

229

230

231

255

256

257

258

259

260

261

262

335

336

337

338

339

340

341

342

343

344

353

345

346

347

348

349

350

351

352

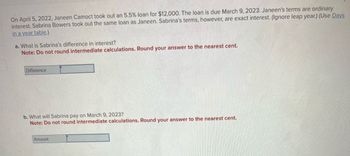

Transcribed Image Text:On April 5, 2022, Janeen Camoct took out an 5.5% loan for $12,000. The loan is due March 9, 2023. Janeen's terms are ordinary

interest. Sabrina Bowers took out the same loan as Janeen. Sabrina's terms, however, are exact interest. (Ignore leap year.) (Use Days

in a year table.)

a. What is Sabrina's difference in interest?

Note: Do not round intermediate calculations. Round your answer to the nearest cent.

Difference

b. What will Sabrina pay on March 9, 2023?

Note: Do not round intermediate calculations. Round your answer to the nearest cent.

Amount

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Dave borrowed $730 on January 1, 2019. The bank charged him a $4.00 service charge and interest was $54.40. If Dave paid the $730 in 12 equal monthly payments, what was the APR? (Enter your answer as a percent rounded to 1 decimal place.) Annual percentage rate %arrow_forward9. Jason bought a home in Arlington, Texas, for $127,000. He put down 25% and obtained a mortgage for 30 years at 6%. a. What is Jason’s monthly payment? (Do not round intermediate calculations. Round your answer to the nearest cent.) Monthly payment $ b. What is the total interest cost of the loan? (Use the amortization worksheet on the financial calculator.) Total interest cost $arrow_forwardplease help answerarrow_forward

- George borrowed $1,500 from Sally on April 13, 2018. George repaid the loan on September 20, 2018, and paid interest of $60. What annual simple rate of interest did George pay? (round to two decimals)arrow_forwardIf Inez is charged an interest of $357.76 on a loan of $18946 for 2 months, calculate the rate of interest charged on the loan. (Calculate to two decimals and enter without the percent sign, eg 1.23% = 1.23 or 12.34% = 12.34) Answer:arrow_forwardFinancial contracts involving investments, mortgages, loans, and so on are based on either a fixed or a variable interest rate. Assume that fixed interest rates are used throughout this question. Zoe deposited $900 in a savings account at her bank. Her account will earn an annual simple interest rate of 7%. If she makes no additional deposits or withdrawals, how much money will she have in her account in 13 years? O $967.41 $2,168.86 O $163.00 O $1,719.00 Now, assume that Zoe's savings institution modifies the terms of her account and agrees to pay 7% in compound interest on her $900 balance. All other things being equal, how much money will Zoe have in her account in 13 years? O $1,719.00 O $963.00 O $2,168.86 O $151.82arrow_forward

- Required Informatlon [The following information applies to the questions displayed below.] Javier and Anita Sanchez purchased a home on January 1 of year 1 for $1,000,000 by paying $200,000 down and borrowing the remaining $800,000 with a 6 percent loan secured by the home. The Sanchezes made interest-only payments on the loan in years 1 and 2. (Leave no answer blank. Enter zero if applicable.) c. Assume year 1 is 2020 and by the beginning of year 4, the Sanchezes have pald down the principal amount of the loan to $500,000. In year 4, they borrow an additional $100,000 through a loan secured by the home in order to finish their basement. The new loan carries a 7 percent interest rate and is termed a "home equity loan" by the lender. What amount of interest can the Sanchezes deduct on the $100,000 loan? Maximum deductible interest expensearrow_forwardLinda borrowed money from a bank to buy a fishing boat. She took out a personal, amortized loan for $13,500, at an interest rate of 4.35%, with monthly payments for a term of 4 years. For each part, do not round any intermediate computations and round your final answers to the nearest cent. If necessary, refer to the list of financial formulas. (a) Find Linda's monthly payment. S (b) If Linda pays the monthly payment each month for the full term, find her total amount to repay the loan. s (c) If Linda pays the monthly payment each month for the full term, find the total amount of interest she will pay. $0 X ?arrow_forwardOn September 12, Jody Jansen went to Sunshine Bank to borrow $2,300 at 9% interest. Jody plans to repay the loan on January 27, Assume the loan is on ordinary interest. (Use Days in a year table) a. What interest will Jody owe on January 27? Note: Do not round intermediate calculations. Round your answer to the nearest cent. Interest b. What is the total amount Jody must repay at maturity? Note: Do not round intermediate calculations. Round your answer to the nearest cent. Maturity valuearrow_forward

- Arianna borrowed $6700. Over the course of 4 years, Arianna ended up paying $1340 in interest. What was the simple interest rate of the loan? Record your answer as a percentage. Do not inlcude the % symbol in your answer. 11%arrow_forwardLonnie lends Burt $15,000 in 2009. Burt repaid Lonnie $150 in real interest for the 1-year loan. Inflation that year was 1.5%. What nominal interest rate did Lonnie charge Burt?arrow_forwardJason and Matthew borrowed $38.400 on a 7-month, 5% note from Gem State Bank to open their business, Blossom's Coffee House The money was borrowed on June 1, 2025, and the note matures January 1, 2026. (a) ✓ Your answer is correct. Prepare the entry to record the receipt of the funds from the loan. (List all debit entries before credit entries, Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts) Date ne 1, 2025 Account Titles and Explanation (b) Question 5 of 12 Cash Date Notes Payable eTextbook and Medial Prepare the entry to accrue the interest on June 30, (List all debit entries before credit entries. Credit account titles are automatically Indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter O for the amounts) Account Titles and Explanation Debit 38400 Credit Debit…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education