FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

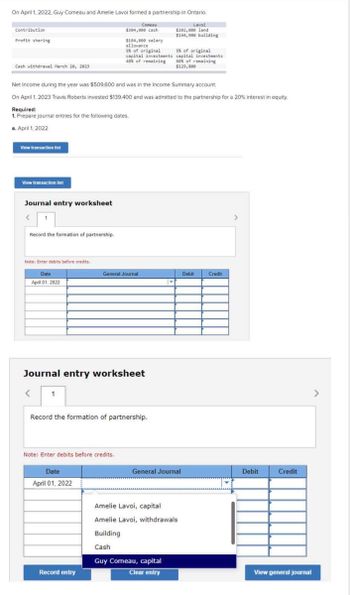

Transcribed Image Text:On April 1, 2022, Guy Comeau and Amelie Lavoi formed a partnership in Ontario.

Lavoi

Comeau

$304,000 cash

$202,000 land

$144,900 building

Contribution

Profit sharing

Cash withdrawal March 20, 2023

a.

Net Income during the year was $509,600 and was in the Income Summary account.

On April 1, 2023 Travis Roberts invested $139,400 and was admitted to the partnership for a 20% interest in equity.

Required:

1. Prepare journal entries for the following dates.

April 1, 2022

View transaction list

View transaction list

Journal entry worksheet

Record the formation of partnership.

Note: Enter debits before credits.

Date

April 01, 2022

<

1

$184,800 salary

allowance.

Journal entry worksheet

5% of original

capital investments

40% of remaining

Note: Enter debits before credits.

Date

April 01, 2022

General Journal

Record the formation of partnership.

Record entry

5% of original

capital investments

60% of remaining

$129,800

M

General Journal

Amelie Lavoi, capital

Amelie Lavoi, withdrawals

Building

Cash

Guy Comeau, capital

Clear entry

Debit

Credit

>

Debit

Credit

View general journal

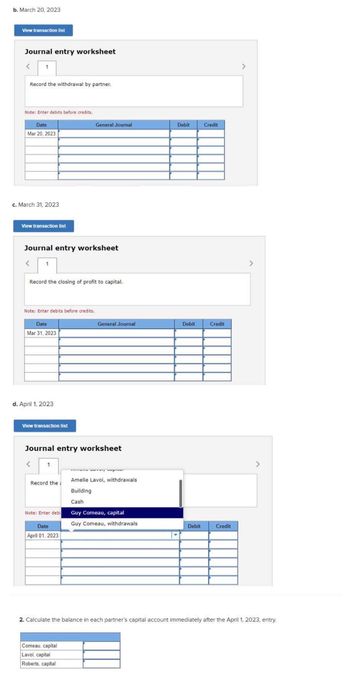

Transcribed Image Text:b. March 20, 2023

View transaction list

Journal entry worksheet

<

Record the withdrawal by partner.

Note: Enter debits before credits.

Date

Mar 20, 2023

c. March 31, 2023

View transaction list

Journal entry worksheet

Record the closing of profit to capital.

Note: Enter debits before credits.

Date

Mar 31, 2023

d. April 1, 2023

View transaction list

1

General Journal

Journal entry worksheet

<

Note: Enter debi

my wo

Record the Amelie Lavoi, withdrawals

Building

Cash

Date

April 01, 2023

General Journal

Comeau, capital

Lavoi, capital

Roberts, capital

Guy Comeau, capital

Guy Comeau, withdrawals

Debit

▾

Debit

Debit

Credit

Credit

Credit

>

>

2. Calculate the balance in each partner's capital account immediately after the April 1, 2023, entry.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Question #2: Toto profit 56,000 The ABCD Partnership has the following balance sheet at January 1, 2012, prior to the admission of new partner, Eden. Cash and current assets Land Building and equipment Total $ 39,000 234,000 130,000 $ 403,000 Liabilities Adams, capital Barnes, capital Cordas, capital Davis, capital Total $ 52,000 26,000 52,000 117,000 156,000 $ 403,000 Eden contributed $124,000 in cash to the business to receive a 20% interest in the partnership. Goodwill was to be recorded. The four original partners shared all profits and losses equally. After Eden made his investment, what were the individual capital balances?arrow_forwardplease do all u canarrow_forwardPlease Help Mearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education